Prior to jumping into our main topic for today’s newsletter of silver forming the largest Cup & Handle in history and what that means for this precious metal as an asset, we want to give an update on what was covered in our previous newsletters. If you haven’t already read them, we implore you to do so to give this next story more context as we cover just how extensive these bullion shortages have become.

On Wednesday, February 12th, 2025, South Korea’s Mint, The Korea Minting and Security Printing Corp. stated that sales of gold bullion would be halted effective immediately! Something unprecedented when it comes to a country’s main mint. The reason is sending further shockwaves through the world as these shortages or delivery delays on bullion is becoming more commonplace. It was stated by the Korean Mint that they are facing problems sourcing gold bullion and is therefore having issues managing surging demand being seen within the country. While the report states the mint indicated they would resume sales as soon as possible, no date was specified. With gold making all-time highs each week, demand continues to grow rapidly, and because of that sourcing bullion will only become more difficult. Hence our previous newsletter covering silver and gold premiums going through the roof.

That said, even with premiums rising there is still a very large buyer(s) that do not appear to be price sensitive to premiums as over 30,000,000 troy ounces of gold bullion have been physically delivered in the United States to start the year. Some in the industry are hypothesizing it was either the Federal Reserve or the United States Treasury that made this massive purchase, if not both. While we are unsure who is purchasing all this gold bullion and demanding physical delivery, one thing we can be certain of is, demand in the United States has soared as fears of Trump Tariffs continue to lurk with unseen consequences for the global economy. Thus, giving countries every reason in the world to turn to silver and gold, the longest standing safe havens.

Newly Reported Gold Purchases in January 2025

Poland added another 3 tonnes to its gold reserves in January, bringing its total reserve to 451 tonnes. 97% more than was held just 2 years ago in January of 2023.

Uzbekistan added another 8 tonnes, bringing its gold reserves to 391 tonnes.

Czech Republic added 2 tonnes of gold, totalling 53 tonnes in reserve. This is 63% higher than January of 2024.

The Cup & Handle Formation

Turning our attention to our main topic of today’s newsletter, we want to focus on something that has gone largely unnoticed by the wider bullion community. We have only ever seen it spoken about by a few industry experts, but its importance is so great we felt it deserved a breakdown for our readers.

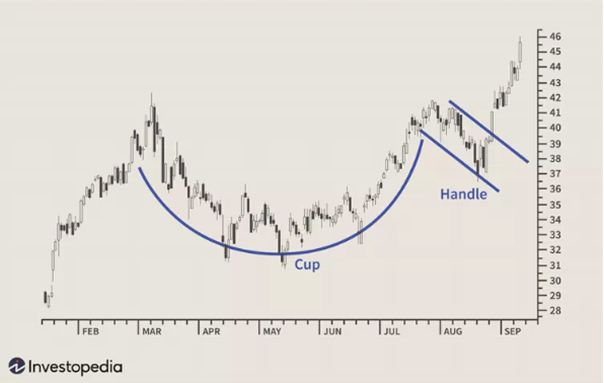

The Cup & Handle formation when looking at an assets price chart has long been known as one of the most bullish formations an asset can form. In short, a cup and handle formation is formed when an asset makes a high, pulls back a significant amount, then retests near the previous high to form the cup, only to pull back again to form the handle of the formation. If the asset can break through the highs made to form the cup, the sky is the limit for where the asset will top out next. Below is a visual so you can get a better idea of what we are describing:

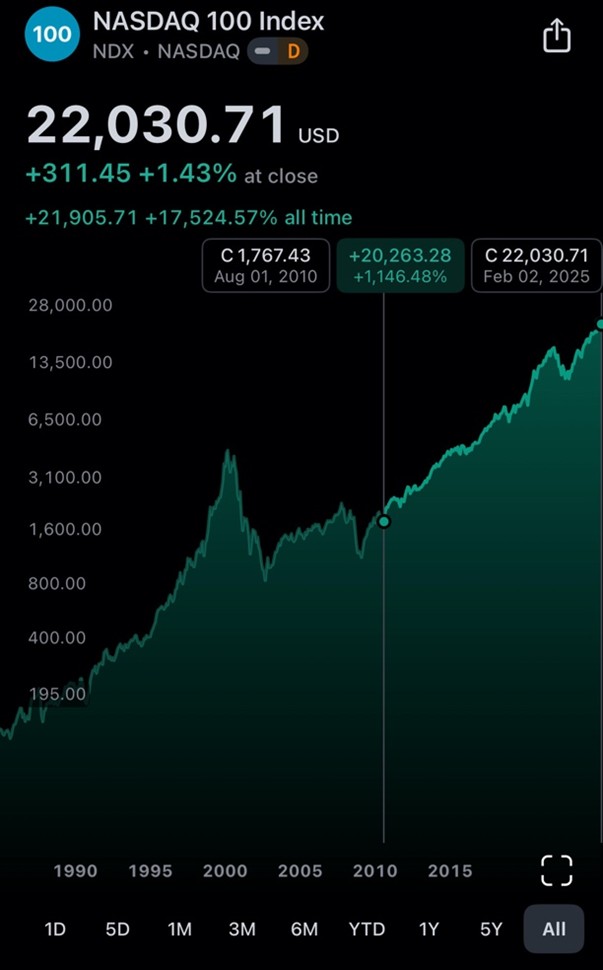

One major Cup & Handle example in recent history was the NASDAQ. It made a high prior to the 2008 Great Financial Crisis, saw a significant pull back during the crisis, made a near-high in 2010 coming out of the crisis to be followed up with a smaller pull back to form the handle. See below:

As you can see above, once the NASDAQ broke out of this formation it marched to new all-time high after new all-time high. What is important to note is that the ‘cup’ portion of the formation only lasted about 2 years, with the handle lasting about 6 months. Then, after 2 ½ years, the NASDAQ has since broken out to the tune of 1146.48% to-date.

When looking at silver, the Cup & Handle it has formed has been shaped and sculpted since 1980, a staggering 45-year, near perfect, Cup & Handle. You can see it visually below:

It is difficult to make out in the chart above, but the resistance line for the ‘cup’ sits right near $50 USD/oz, the high made in 1980 and again in 2011. Due to this formation and the increased demand for silver across the world, silver has become a pressure cooker just waiting to explode higher. Which, explains why we are beginning to see pre-market moves as we did this morning (Friday, February 14th, 2025):

It cannot and should not be understated that silver is the only commodity in the world not to surpass highs in 1980 and because of this has formed the largest Cup & Handle in modern history. As it currently stands, silver is crucial to society and because of that is deemed a critical mineral while simultaneously being the most undervalued asset on earth. This provides huge potential for gains for those that have the foresight to purchase silver bullion prior to it making its breakout move past the cup’s resistance.

“Better three hours too soon than a minute too late” – William Shakespeare

Hi,

Hi,