The global economy is always in motion, and with ongoing trade tensions, investors are left questioning how tariffs influence investment. A question that arises is whether gold is a safer and more profitable investment than stocks during periods of high tariffs. As trade restrictions intensify and economic uncertainty mounts, gold is considered by many investors to be a hedge against volatility. But is it really the better investment than stocks? Let’s find out.

Understanding Tariffs and the Investment Impact

Tariffs are taxes imposed by the government on imported goods to encourage domestic manufacturing and protect domestic industries. While they can be helpful to domestic businesses, tariffs can also lead to higher cost, supply chain interruption, and inflation.

Investors in the stock market are commonly impacted by tariffs. Companies that are reliant on global supply networks or export commodities will be hit with lower profits. Trade wars between big economies such as the U.S. and China will create economic uncertainty that will cause stock prices to move sharply.

Gold versus Stocks: Which One Performs Better?

- Gold As Safe-Haven Asset

Traditionally, gold has been considered a safe-haven asset that holds its purchasing power during times of uncertainty. Previously, if stock markets collapse due to economic uncertainty, gold appreciates. This is because investors shift to gold as a store of value to safeguard themselves from devaluation of the currency and inflationary pressure created by tariffs.

- Stocks and Market Volatility

Stocks are also highly impacted by trade policies. Tariffs can create supply chain disruptions, increased production expenses, and lower corporate profits. Such factors can lead to stock market declines, making stocks a riskier investment under such situations.

But not all stocks are affected the same. Some sectors such as domestic manufacturing and tech can be benefited by tariffs but some such as international exporters and consumer goods can be harmed.

- Purchasing Power and Inflation

Tariffs are inflationary because the higher import prices are then imposed on consumers. Inflation tends to decrease the purchasing power of fiat currencies, making gold an attractive hedge. Unlike shares that are susceptible to earnings decline and reduced dividends, gold tends to preserve its value and often appreciates during times of inflation.

Which Investment Is Right for You?

The decision between gold and stocks depends on several factors, including your risk tolerance, investment horizon, and market conditions. Here are some key considerations:

If stability and protection from economic uncertainty are sought, Gold is the best option, protecting one from inflation and market volatility.

If your top concern is growth potential, Stocks are still an option for greater returns in the long term, especially within sectors that can survive or benefit from tariffs.

A Balanced Approach: Diversify. Investing in gold and stocks will enable one to balance risks with potential gains from the stock market.

Closing Thoughts

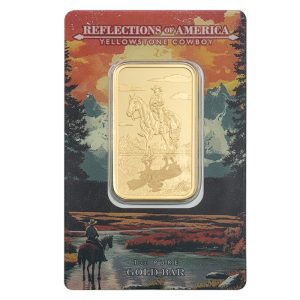

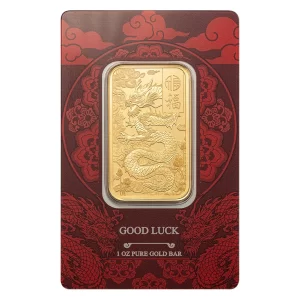

Tariffs bring uncertainty to the stock market, which makes gold an attractive investment option for cautious investors. Gold provides stability, but stocks retain the hope for future appreciation. The best strategy is often a diversified investment that contains both gold and stocks to experience the highs and lows of the market but safeguard your wealth. If the aim is to invest in gold to hedge the uncertainty of the economy, AU Bullion provides gold bars and coins that are competitively priced to help you invest wisely. Explore AU Bullion’s gold product lineup today and protect your wealth from market volatility.

Hi,

Hi,