With 30-year bonds surging in many of the most vital economies in the world, we wanted to take the time this week to dive into the complex and pressing issue of sovereign debt crises, what they are, what causes them, and what nations and citizens can do to protect themselves when they occur. As nations grapple with mounting debts that are becoming more and more difficult to pay back, understanding how these crises unfold, the role of bond yields, and the stabilizing power of precious metals like gold and silver is more critical than ever. Just think about this: the United States has by far the largest military in the world and for the 2025 fiscal year they have a defence budget of $895 billion USD that the government can spend on their military. In 2025, the payments the United States must make to its creditors to service their national debt that is quickly approaching $37 TRILLION USD is a mind-blowing $952 billion USD – over $50 billion USD more than the United States will spend on their military this year. To further paint how serious this issue is becoming, the United States typically earns about $4-5 trillion USD per year in revenue meaning 20-25% of all profits flow directly into servicing their debt. Something that is entirely unsustainable. The scary part, they are not the only ones.

What is a Sovereign Debt Crisis?

A sovereign debt crisis occurs when a government struggles or fails to meet its debt obligations (otherwise known as failing to service their debt, as mentioned above), such as repaying loans or interest to creditors, often leading to what is known as a default. This can destabilize a nation’s economy as banks often begin failing due to banks historically being major buyers of government bonds, this leads to bank runs that begins to erode public confidence in their national currency as it is quickly devalued. This can further trigger ripple effects across global markets because of how interconnected the world economy is. As one nation begins to fail and take on heavy losses, other nations that hold their debt also begin to fail. Then nations that hold the debt of those newly failing nations begin to struggle and the cycle quickly becomes vicious. Companies that also hold bonds will begin to lose value as well causing stock losses for both companies and citizens alike that have invested in that failing company. Historical examples include Greece’s crisis in the early 2010s and Argentina’s defaults in 2001 and 2020.

These crises typically arise from a combination of factors:

- Excessive Borrowing or Currency Creation: Governments borrow to fund budget deficits, infrastructure repair, or social programs. Over time, unchecked borrowing can lead to unsustainable debt levels, which is exactly what we are seeing today.

- Economic Shocks: Recessions are often a result of sovereign debt crises which lead to shrinking tax revenues required to service their current debt and increase spending needs, straining budget even further.

The Role of Bond Yields

Government bonds are the primary tool for borrowing, and bond yields—the interest rate paid to bondholders or creditors of a specific government—play a pivotal role in sovereign debt dynamics. Yields reflect the perceived risk of lending to a government. Here’s how bonds factor into a crisis:

- Rising Yields, Rising Costs: When investors doubt a government’s ability to repay, they demand higher yields to compensate for the risk. Higher yields increase borrowing costs, exacerbating budget deficits, making it a very difficult cycle to break for any one nation. Once doubt creeps in, it is hard to return to a state of confidence. For example, during Greece’s crisis, 10-year bond yields soared above 20%, signaling deep market distrust in the nation’s government health.

- Vicious Cycle: As yields rise, governments may borrow more to cover interest payments, further increasing debt. This can spiral into a loss of market access if yields become prohibitively high. This also leads to a complete bottoming out of the failing nation’s currency usually leading to a period of hyperinflation.

- Market Signals: Spiking yields often precede a crisis, as they reflect waning investor confidence. Conversely, central banks may intervene to suppress yields (e.g., through quantitative easing), but this can also devalue currency and fuel inflation making these crises lose-lose situations.

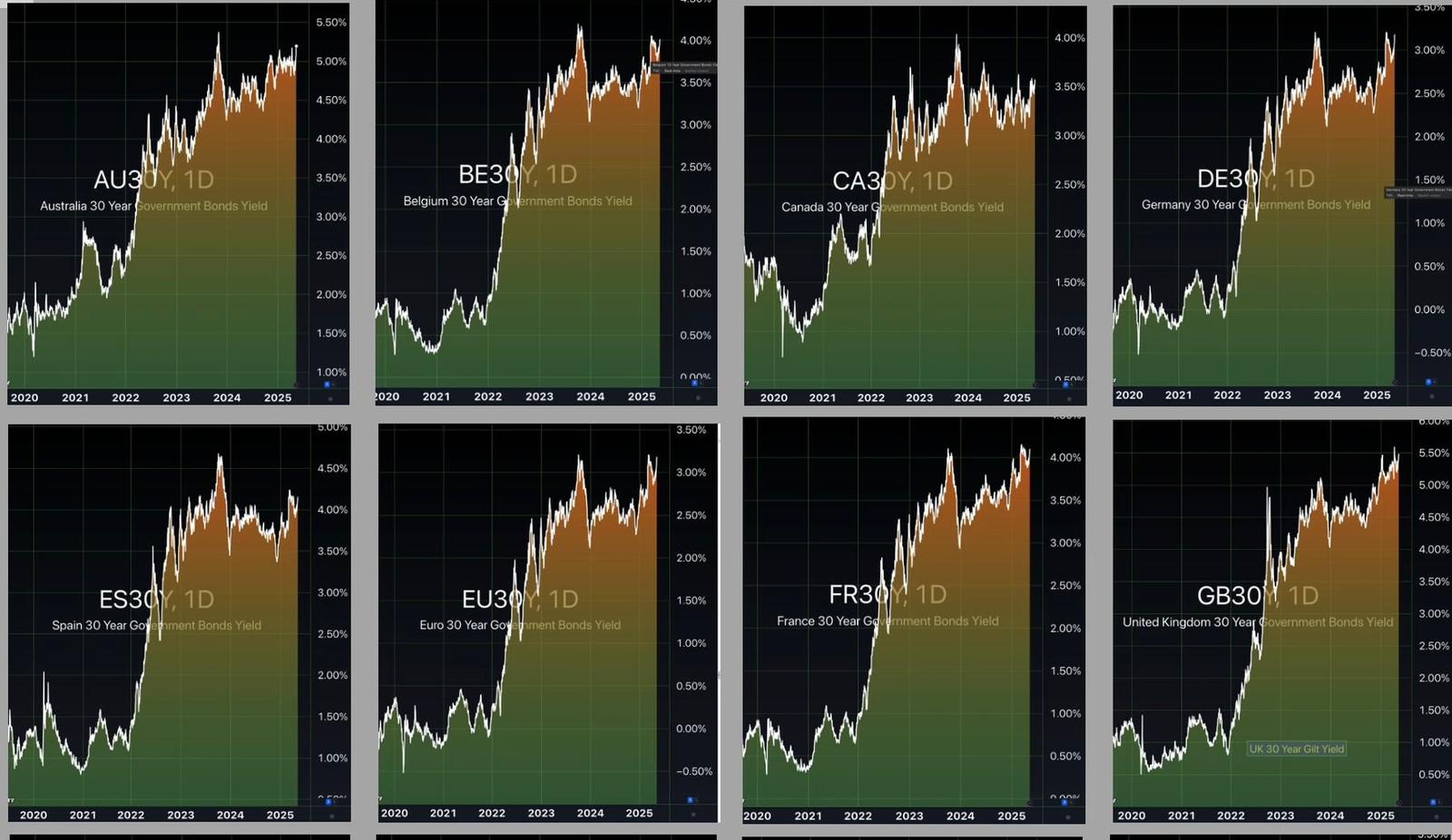

Bond yields are thus both a symptom and a driver of sovereign debt crises, amplifying financial strain when confidence falters. To emphasize our statement that the world is on the verge of multiple sovereign debt crises, look at 30-year bond yields below for the world’s largest economies and apply what you have learned above to gain a deeper understanding of the severity of the situation:

LISTED ABOVE IN ORDER

(Australia, Belgium, Canada, Germany, Spain, Europe, France, United Kingdom, Italy, Japan, Netherlands, United States)

Gold and Silver: Safe Havens in a Crisis

Amid a sovereign debt crisis, gold and silver emerge as vital assets for nations and citizens alike. These precious metals have unique properties that make them critical during economic turmoil, which is further highlighted by how much gold and silver countries have been buying in recent years. It is becoming clear they are planning to soon rely on the world’s longest standing form of money to weather the storm.

- Store of Value: Unlike fiat currencies, which always lose value through over-creation, gold and silver have intrinsic value and a long history as reliable stores of wealth. During crises, central banks, and investors flock to them to preserve capital losses.

- Hedge Against Currency Devaluation: Sovereign debt crises often lead to currency depreciation, especially if governments print money to cover their debts. This allows them to pay their debt, but those receiving the payment often need to get rid of the currency quickly as it is almost worthless due to the over printing. Gold and silver are often where these currencies are put to retain value when currencies falter, protecting national reserves. For instance, during Venezuela’s hyperinflation crisis, gold became a critical asset for those seeking stability as their national currency the Venezuelan Bolivar littered sidewalks, completely valueless.

- Liquidity and Global Acceptance: Gold and silver are universally recognized and easily traded with any country in the world, providing liquidity when financial markets seize up. Central banks, like those in BRICS+, have increased gold reserves to diversify away from volatile fiat currencies like the U.S. dollar.

- Stabilizing National Wealth: Nations with significant gold and silver reserves can use them to restore confidence, backstop currencies by returning to a gold or silver standard or use them to settle international debts. In extreme cases, these precious metals can serve as a foundation for currency revaluation and/or economic recovery.

Why Gold and Silver Matter to Nations

For a nation, holding gold and silver is akin to an economic insurance policy, policies that are seemingly becoming far more popular in recent times. During a sovereign debt crisis, these metals can:

- Bolster central bank reserves as they increase in value, enhancing credibility with international creditors.

- Provide a hedge against inflation and currency risks, preserving purchasing power for those that own them.

- Serve as a strategic asset to navigate geopolitical tensions or sanctions, as seen in Russia’s pivot to gold after 2014 sanctions that saw much of their foreign reserves frozen, highlighting the long-time saying “if you don’t hold it, you don’t own it” – gold and silver held in your own possession is the strongest defence against economic uncertainty.

Looking Ahead

Sovereign debt crises are a stark reminder of the fragility of unchecked borrowing and economic mismanagement. As bond yields signal trouble and markets waver, gold and silver stand as timeless anchors of stability. While they have seen recent price pull backs, on the year, both metals have posted solid gains. For nations and individuals, prioritizing these assets can provide a lifeline in turbulent times.

Stay informed and consider how precious metals fit into your financial strategy. Until next time, stay resilient.

Hi,

Hi,