The financial services industry originated in Switzerland, and the collapse of Credit Suisse shocked the entire world. A significant Swiss 167-year-old bank.

What is Credit Suisse and What Happened with Their Business?

The second-largest bank in Switzerland, it is renowned for offering wealth management, private banking services, investment banking, asset management, and securities.

The value of Credit Suisse shares has decreased by more than 75% in the last 12 months. The largest stakeholder in Credit Suisse, Saudi National Bank, declared it was unable to offer any more financial support. The company has experienced financial issues for the past two to three years. Credit Suisse claims. In 2022, customers withdrew $133 billion, primarily in the final three months.

The Credit Suisse’s Challenges

- Credit Suisse’s stock may lose all its value, even if UBS is acquired.

- The stakeholders still don’t seem convinced, despite Credit Suisse’s major strategic makeover, to restore stability and profitability.

- The job markets have also been shaken by the unexpected bankruptcy of Credit Suisse. Recently this year, the bank has already eliminated 4,000 positions. Employees at Credit Suisse are experiencing anxiety.

- Bloomberg News reported that current Credit Suisse employees have been emailing and calling recruiters and competing institutions all around the world.

What Points to Credit Suisse?

Credit Suisse is among the top 30 banks in terms of systemic importance. Its probable collapse would be harmful to the world economy since it could start a bigger financial crisis because there is global connectivity. Credit Suisse has numerous international subsidiaries. So, the commercial prospects for the providers of IT services could be hampered by a financial sector crisis.

The most probable situation is that central banks will continue to be cautious and will offer liquidity to support the banking industry during this crisis.

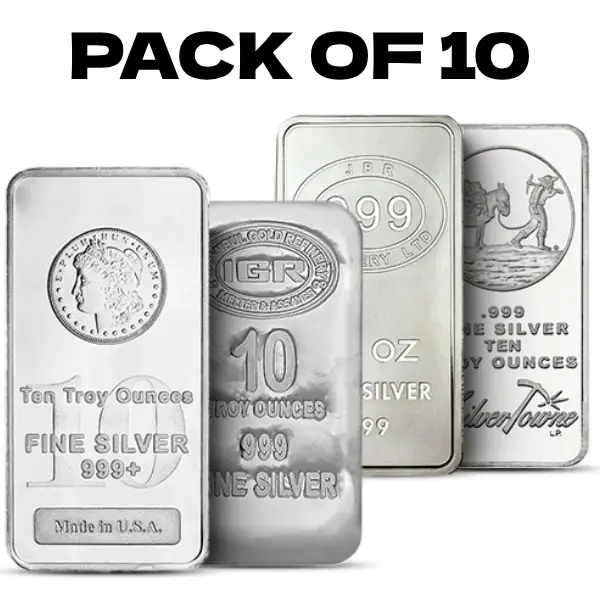

Precious metals is a best investment for high returns. Invest in gold / invest in silver at best rates from Au bullion.

Hi,

Hi,