Going back to March of 2023, we began to see the fallout in the banking sector caused by the reckless monetary policies that were put in place during lockdowns. This started when Silicon Valley Bank collapsed, followed by Silvergate Bank, then Signature Bank, First Republic Bank, and finally the giant Credit Suisse. This caused massive overhauls to be taken within the banking system that ultimately just acted as a band-aid, rather than disinfecting the wound, it was just patched over. Well, it was clear to many who were following this situation that the band-aid fix of expanding the Federal Deposit Insurance Corporation (FDIC) deposit insurance from $250,000 per depositor to an unlimited cap would not work, and that the cut would ultimately become infected and begin to spread. This was clear for a couple reasons, but the most glaring would be that these banks had taken on so much risk due to how easy it was to get their hands on cheap cash while interest rates were held near zero, that it was inevitable for them to fail once interest rates were raised. However, the solution to Silicon Valley Bank failing was simply to just print more dollars, and patch over the issue, guaranteeing all deposits as if the failure never happened in the first place. How a fair system would operate would be to allow bad debts to fail, which would clean up the financial system due to risk being pulled out of the system. Rather, they kicked the can down the road as big bankers in conjunction with government regulators usually do. And what occurred? The infection spread, and 4 more banks failed as a result.

Turning our attention to the present, we now have a 6th bank failure with this bank having over $66 million worth of assets on its book; that bank being Citizens Bank located in Iowa. The reason for its failure was the over $15 million worth of hidden loan losses on its book. Which may seem like a major loss, until you consider that Moody’s (Credit Rating Agency) has estimated the total unrealized losses on banks books within the United States to be over $650 million. $650 million!! If banks were forced to sell the assets they are currently holding at a loss to cover citizen deposits as they rush to remove their money from the bank while they still can, the entire system would fail. Unless, the government approves a massive bailout which would throw the West into another inflationary tailspin, which means, the only true protection citizens have for their wealth is holding silver and gold like many major world central banks are currently doing. These metals protect you against inflation, as well as, protect your wealth from being sucked into a black hole caused when a bank fails.

With all that said, many perceived the rapid failure of major banks that was seen as THE MAIN problem, and now that these banks have failed and we have gone about our daily lives, the situation must be over, right? Wrong. In reality, bank failures do not happen over night as it may seem. Banks do not go from perfect health to their deathbed in a moment, rather the writing is on the wall for many months, until ultimately the pot boils over and collapse becomes evident to citizens. The same can be said for an overall financial system breakdown – today, the writing is already on the wall, warning calls are spreading about the risks we face, yet the system keeps chugging forward… but for how long?

Looking back at both the 1998 and 2008 financial system collapses, you can see clear evidence that large systemic failures occur slowly at first, then all at once. The 1998 crisis that was seen, reached a peak on Sept 28th, 1998, when Long-Term Capital Management was rescued from failure. The world was hours away from every stock and bond exchange being shutdown. What is often not spoken about is that this crisis began in June of 1997 when the Thai Baht was devalued and massive capital rushed out of Asia and Russia at the time. It took 15 months to go from crisis, to full blown existential threat.

Similarly, in 2008, we saw the peak of the collapse occur on Sept 15th, 2008, when Lehman Brothers filed for bankruptcy. However, again, the crisis began in the spring of 2007 when HSBC announced their mortgage losses were far higher than expected. Then through the summer of 2007, we saw Bear Stearns, Freddie Mac, and Fannie Mae fail before reaching Lehman Brothers. From there, the collapse of Lehman Brothers also pulled down AIG, General Electric, and General Motors on March 9th, 2009. Meaning this crisis started in March of 2007, and reached threat levels in 24 months.

This gives us an average duration for the 1998 and 2008 financial crises of about 20 months. It has only been 8 months since Silicon Valley Bank collapsed, signalling there is far more chaos to come.

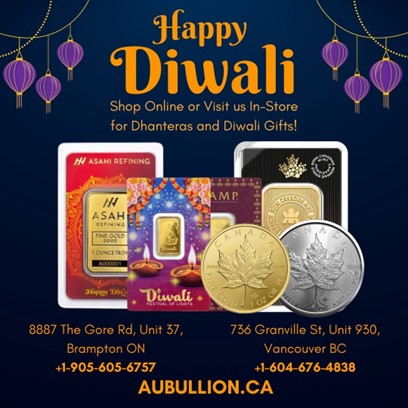

Through this chaos, China and other BRICS+ nations have stayed consistent. Stacking physical gold and silver along with other tangible commodities that bring their nation REAL WEALTH. All the while, Western and European nations battle with excessive debt, and intangible wealth. It was reported that again in October, China’s central bank added another 23 tonnes of gold to their reserves, adding gold for the 12th straight month! If you can also see the writing on the wall becoming more obvious, the best thing to do would be to prepare your finances before any major collapse takes place, as once it does, you will have millions of citizens chasing after real wealth in the forms of gold and silver, where as right now, it is still widely available as barely anyone outside of the financial sector takes notice of gold and other precious metals. Below we have incredible offers going for Diwali that end on November 11th, 2023. If you want to take advantage before offers end, follow the link below to secure your wealth.

Hi,

Hi,