When thinking of the global banking elite, many would consider them one big club. While central bankers like the Federal Reserve, Bank of Canada, and the European Central Bank (ECB) ultimately have the power to determine their country’s monetary policy that other banking institutions like investment banks, retail banks, credit unions, commercial banks, etc. must operate within, they are still tightly tied at the hip. Historically, it is those policies that allow these other institutions to become mega banks with so much power like Bank of America, JP Morgan, World Bank, HSBC, and others. However, going back about a month, you started to see bankers not at the central bank level begin to call out central banks due to their reckless policies putting so much pressure on the global economy pushing the world closer and closer to a major recession at best, and a deep depression at worst. This was likely spurred on by the fact that large banks in the United States began to collapse and other European banks began to hang on by a thread due to such immense interest rate hikes to combat raging inflation that was caused by central banks pushing countries to go so deep into debt during lockdowns; debt that is now drowning the world.

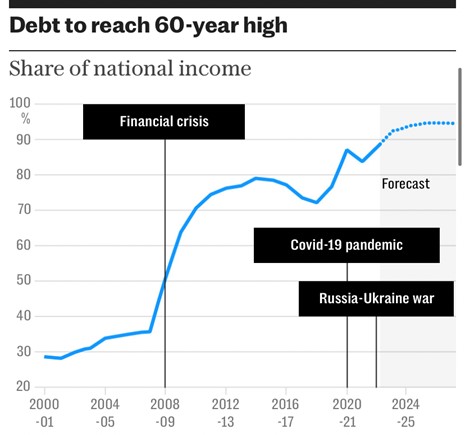

Where we really saw these investment and commercial bankers begin to speak out against their central bank counterparts was at the Future Investment Initiative Summit in Riyadh, Saudi Arabia this week. Jamie Dimon, CEO of JP Morgan, started off by saying, “Fiscal spending (which is the use of government revenue collection and expenditures to influence a country’s economy) is more than it’s ever been in peacetime and there’s this omnipotent feeling that central banks and governments can manage through all this stuff [but] I am cautious about what will happen next year.” Dimon went on to compare today’s situation to that of the 1970s, which we have covered extensively through our newsletters warning that what we are seeing today is similar to the 1970s but on steroids due to the immense increase in global debt. Below you can see what Dimon was referring to as debt in the United States begins to creep up on 90% of the nation’s TOTAL INCOME.

If the United States is said to be the wealthiest country on earth, this paints a glaring picture. If the United States is verging on complete bankruptcy, it can only be imaged how other countries are faring. Noel Quinn, chief executive of HSBC, then added, “[due to fiscal deficits (spending more than counties have)] When a [collapse] comes, it will come fast and I think there are a number of economies in the world where there could be a tipping point and it will hit hard” this coming because of such reckless borrowing during the 2020 lockdowns and beyond. Ayhan Kose, the World Bank’s deputy chief economist, went on to say that smaller emerging economies were likely already in a “silent debt crisis” due to governments being crushed by debt making it impossible for them to fund public services. This is also forcing a mass exodus of people out of being able to provide for their families into a spiral of debt where it is nearly impossible to make ends meet. Kose also stated that this debt binge since 2010 after the Great Financial Crisis of 2008 has been the fastest, most broad, and largest the world has ever seen, going on to say that previous debt waves have all led to financial crisis. To top things off, the International Monetary Fund chipped in warning that the United States and China have put public debt on course to be the size of the ENTIRE world economy by the end of the decade.

It is becoming glaringly obvious that as bankers begin to turn on each other, they are no longer one big happy club as they can see the writing on the wall – that being, an epic collapse in economies around the world is coming, which will fundamentally change the way citizens of every nation will operate.

When considering the inevitability of all world fiat currency crashing, and again, we are calling it an inevitability because if you continue to print more and more of something into existence, the value of what is being printed will continue to plummet until it is completely worthless. Then you get Argentina, where you see billions of pesos on the sidewalk, with no one even flinching to pick them up. The best way to ensure that your wealth is protected through a scenario like this and that you will have value to spend in your family’s time of need is to protect yourself the very same way these banks giving the warnings are protecting themselves. That is with physical gold and silver. Let us remind you again, central banks have been buying record amounts of gold since 2010, while countries like India continue to stockpile gold and silver together. And look at that date, 2010. Earlier in the newsletter, Mr. Kose of the World Bank stated that this debt binge began in 2010, the very same year central banks and governments began buying as much gold and silver as they could get their hands on. Almost as if they have been preparing for this day nearly 15 years in advance.

It is clear that as people continue to struggle to make ends meet, silver and gold are doing their job, as those who bought these precious metals ahead of time have had valued stored that they are now able to use to get what they need to get by. It was reported in Chicago by a large jeweller in the area, that the amount of citizens now selling gold to make ends meet has skyrocketed as the fiat currency they previously had saved has evaporated in purchasing power.

If you are looking to get out ahead of any calamity that may be brought on the nations of the world due to reckless spending and printing of currency by governments and central banks, physical silver and gold have always held their purchasing power and protected their holder in times of crisis. This is confirmed by looking far into the past to evaluate silver and gold prices during times where world economies faltered. Below you will find the world’s most secure silver and gold bullion coin – the 1 Oz Silver and Gold Canadian Maples. Due to the radial lines and a micro-engraved laser mark, you can be sure these coins will be recognized all over the world.

2023 1 Oz Silver Canadian Maple Tubes

Random Year 1 Oz Gold Canadian Maple

Hi,

Hi,