It has been no hidden secret that over the past couple years since rapid inflation begun in Canada that citizens have been struggling to keep afloat. It did not help matters that as soon as we saw record inflation, we also saw a record pace of interest rate hikes by the Bank of Canada that started a secondary squeeze on the bank accounts of Canadians. Not only was the cost of everyday goods increasing at an incredible pace, now any citizen that held any form of debt, started seeing their monthly interest payments skyrocket – leaving very little wiggle room for those looking to save their wealth for the future. This left majority of citizens in a pinch, as they either had very little to no savings at all, forcing them deep into debt to afford the lifestyle they had become accustomed to or for those that did have savings they were hoping to keep for a future purchase, retirement, or to simply pass down through the family, this group of citizens has been forced to begin to tap into their savings simply to get by in the present.

To shine light on just how bad it has become for the Canadian consumer, it was reported last week that Canadians through the second quarter of 2023, have racked up a whopping 107.4 billion dollars CAD in credit card debt. Taking children out of the equation as it is not common to see those under-18 years of age with a personal credit card, the adult population of Canada sits around 30,602,317 given that the population at the beginning of the year was estimated at 38,781,291 people with those under 18 making up 21.09% of that number. From there, MasterCard and Visa reported that around 41% of credit card holders in Canada carry a balance month-to-month, with 59% paying their bill down fully. This would suggest that 41% of 30,602,317 people who likely hold a credit card of some kind, are taking on the burden of 107.4 billion dollars of credit card debt alone as this is not including mortgage payments/rent payments, grocery bills, gas bills, etc. Breaking this down a little further, that would mean that if all else were equal, 12,546,950 Canadians on average are facing credit card debt to the tune of $8559.85 a month, in addition to all other monthly expenses they may have. It is no wonder, why you are hearing more and more people speak out about how they can no longer afford to live how they did a mere 3 years ago.

On the American side of the border, they are facing a similar problem, and citizens are holding a similar amount of credit card debt that continues to weigh them down. Earlier in the year it was reported that the United States credit card debt swelled to over one trillion dollars for the first time ever – which sounds far worse, but in reality is similar to Canada’s 107.4 billion dollar bill given the American population is nearly 10x larger than Canada. However, on the American side, it was reported that credit card companies are racking up losses due to delinquent payments from citizens at the fastest pace in 30 years, not including the Great Financial Crisis of 2008. At this point, it would be hard to avoid acknowledging how many similarities we are seeing between present day and the 2008 Great Financial Crisis when looking at global and domestic economies.

In previous newsletters, we had warned that it would be nearly impossible for central banks to get ahead of inflation and stay ahead without severely impacting their economies with rapid rate hikes. To be fair, central banks were able to slow down the pace of inflation, and even brining it down a few percentage points, however, the pain of inflation was then replaced with the pain of skyrocketing interest payments, and now – inflation is preparing for a second run. This past CPI report showed that Canadian inflation rose 0.7% month-over-month returning to 4%, double the goal of the Bank of Canada. This, of course, has not surprised many who keep an eye on the economy as once the Bank of Canada was forced to stop raising interest rates due to pushing the economy quickly toward a massive recession, the door for inflation was swung back open and it has once again began to climb.

Across the pond, Russia has been a glaring example of why silver and gold are incredibly useful assets to hold when financial burdens approach. When the war in Ukraine started, sanctions coming from Western and European nations forced Russia to settle many of their transactions by selling from their gold reserves, without a precious metal reserve, Russia would have been left handicapped. Now looking to 2023, Russia has been able to return their gold reserves back to the level they had it at pre-war due to deals made with Middle Eastern and BRICS+ nations that saw Russia selling oil at peak cost, circumventing G7 oil price caps. What this shows is not only how useful precious metals are during times of financial struggle due to them holding their value over long periods of time, but also the importance of holding gold and silver PRIOR to entering any sort of financial difficulty.

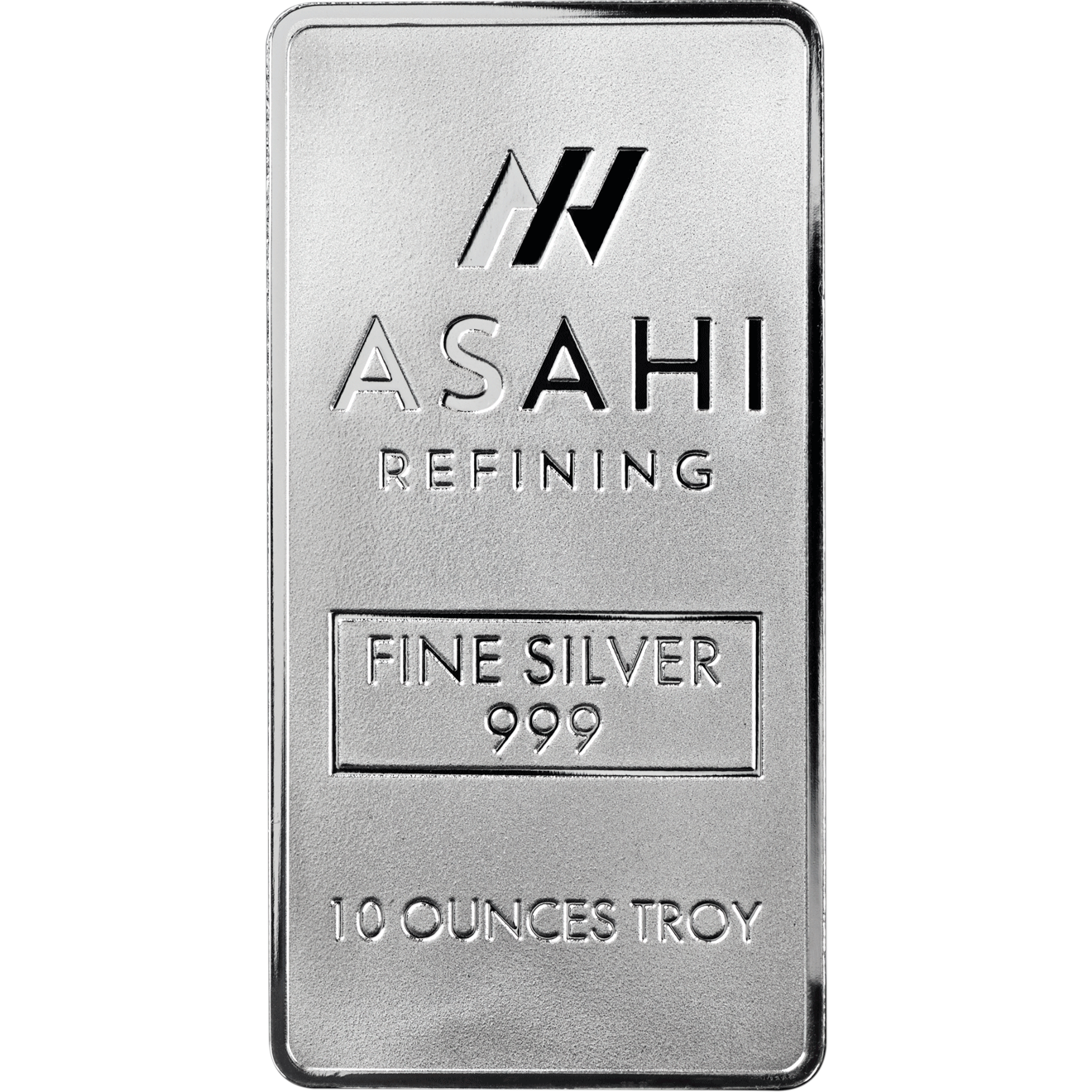

If you are someone that has been fortunate enough to set aside savings for a rainy day, there is no better time to convert a portion of those savings into physical precious metals to ensure your savings hold its value when you ultimately go to use them. The IMF reported last week that 93% of global central banks are now exploring a Central Bank Digital Currency to aid in the de-dollarization drive. It is clear that paper fiat currencies that have been printed beyond belief are quickly being recognized as being completely without value. Yet, at the same time, and it is worth reiterating, central banks have been buying precious metals for their reserves at a record pace. If citizens want to put themselves in a position to flourish during this currency transition, it would be highly beneficial to position themselves similarly to how those making the banking rules are – and that is being flush with silver and gold.

1 Oz Silver Donald J. Trump Rounds

1/10th Oz Gold Canadian Maples

Hi,

Hi,