If you tune in to the news, you’ll notice that a lot of the loudest voices only show up after a price move has occurred. The smart money, however, often accumulates quietly. Smart Money Doesn’t Wait for Headlines Institutional investors, as well as central banks, often start accumulating long before the price is trending on…

Category: Buying Gold

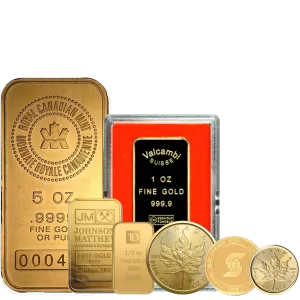

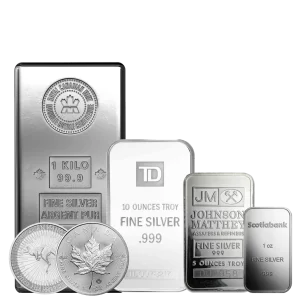

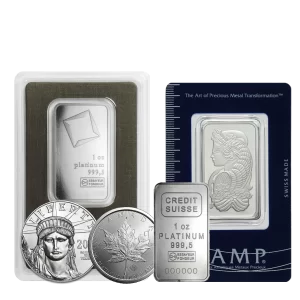

Buying Gold and Silver in Canada: What New Investors Need to Know

As a novice investor, buying gold and silver can be quite daunting at first. The prices are always fluctuating, the premium varies, and the sellers are definitely not the same. The good news is that once you are aware of the basic information, investing in physical precious metals is quite simple and accessible. Physical vs….

The Real Meaning of a Recession for Gold and Silver Investors

The term recession may be intimidating. Typically associated with it are stock sell-offs and economic uncertainty. However, for an investor who already has gold and silver in their portfolio, a recession may be just a topic for conversation. Rather than emphasizing growth, periods of decline bring focus to stability – and this is where precious…

How Inflation Quietly Erodes Cash – And How Bullion Helps

It’s not something that happens with much fanfare. There isn’t a blaring alert or a news headline about your money losing value. It’s more of a presence, a slight increase here, a slight increase there, until suddenly your wallet isn’t going as far as it used to. What people do not understand is that money…

Are Precious Metals Entering a New Supercycle?

Some assets periodically reach a point where there is a favorable alignment of long-term demand, global conditions, and behavior of investors. These phases are sometimes known as “supercycles,” which refer to periods of rising prices over many years, as opposed to months. Recently, a common question that many investors have been asking is whether gold…

Hi,

Hi,