Market crashes can be very stressful, especially for investors. At such critical times, the stock market is in turmoil, and news is filled with negative reports. This is the time when most people want to panic and make decisions based on emotions. However, people who own physical gold tend to remain calm even in such…

Category: Gold Bullion Market

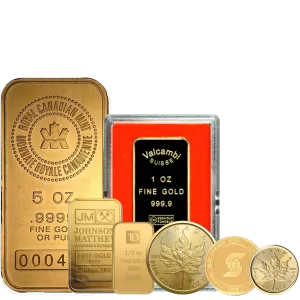

Why Canadians Are Choosing Bullion Over Savings Account

Traditionally, savings accounts have been considered a safe haven for saving money. However, with the current economic environment, Canadians are increasingly turning to bullion as a means to save their money. Bullion is a physical asset consisting of gold and silver coins. It is a more viable option for saving money compared to a savings…

Tax Rules on Buying and Selling Bullion in Canada Explained

If you are planning to invest in bullion in Canada, it is as important to understand the tax rules as it is to choose the right bullion for your investment. Even though bullion can help you secure your wealth in the long run, you might still have your doubts about the tax rules when you…

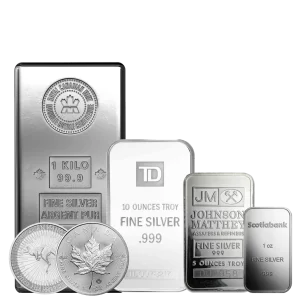

Is It a Good Idea to Sell Silver Now With Prices at All-Time Highs?

With silver prices reaching record highs, there is one pertinent question that comes to mind. The question is: Is it the right time to sell? For some, the answer is not clear. It is not black and white. It all depends on your objectives and who you want to sell it to. Why So Many…

Silver Prices at Record Levels: Is This a Breakout or Just Normal

In the case of silver, which has also been making headlines once again – and this time, it’s definitely no small market movement. Prices have moved into record highs, and this has caught the eye of some investors who may have considered the metal to be “the slower metal” in comparison to gold. The burning…

Hi,

Hi,