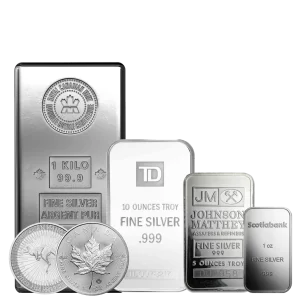

Imagine waking up to find that an everyday metal like silver is suddenly making headlines for skyrocketing prices and vanishing stockpiles. In the past week alone, silver has surged dramatically, especially in key markets like the U.S. and China. This isn’t just trader talk; it’s a signal of bigger shifts in supply, demand, and global…

Category: Newsletter

Silver’s Breaking Point: Premiums Explode, Volatility Soars, Dollars Fade

Imagine standing at the edge of a deep mine shaft, the metallic scent of freshly broken rock in the air. Below, machines tear out veins of real silver – tangible wealth humans have prized for centuries that it is then sold for a hefty price. Up top, trading screens show a different reality: paper prices…

Silver’s Breaking Point: The East Hoards While the West Bleeds Dry

Silver isn’t just a precious metal – it is the quiet powerhouse fueling the modern world. From solar panels and electric vehicles to smartphones and advanced defense systems, industrial demand is surging at an unprecedented pace. Yet mine production struggles to keep up, creating a fundamental imbalance that’s now playing out dramatically across the globe’s…

World’s Largest Mints Halt Silver Sales

In the ever-shifting landscape of global finance, where digital assets flicker and fade, one timeless commodity is commanding unprecedented attention: silver. As we step into 2026, the precious metals market is not just buzzing — it’s roaring. Record-breaking demand is straining supplies at the world’s top mints, while savvy nations and investors scoop up physical…

Silver & Gold: Tale of the Two Largest Assets in the World

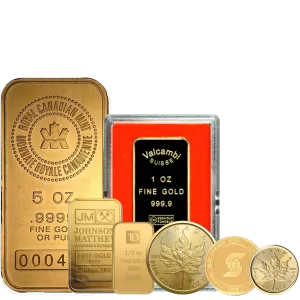

In the first week of 2026, precious metals didn’t just rise — they stormed the global stage. Silver’s explosive surge briefly claimed second place among the world’s largest asset list, gold solidified its dominance over the United States Dollar, and central banks continued their relentless accumulation. Meanwhile, all major precious metals — gold, silver, platinum,…

Hi,

Hi,