Late last week, a prominent bank in China, Jiangxi Bank, filed for bankruptcy and collapsed. As expected, this caused Chinese citizens with deposits at that bank to rush to their nearest branch in the hopes of pulling out as much of their wealth as possible. Of course, our reader’s here at Au Bullion are well aware due to our past newsletters that once a bank has failed, you are already far too late to secure any of your wealth as any deposit you put in a bank makes you a creditor of that bank. Essentially, you are investing in the bank itself, and your investment doesn’t just sit there, it is taken and reinvested in the form of loans, buying bonds, etc. If the bank fails, your investment is lost.

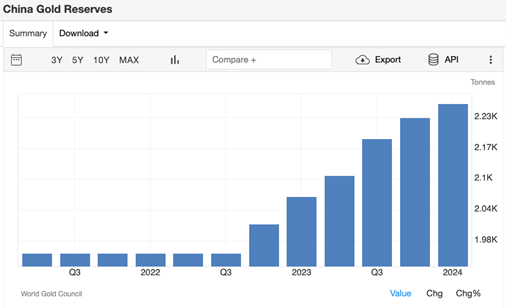

We also had touched on how astute Chinese citizens were as they have long seen the writing on the wall with the terrible collapse of their property market putting immense pressure on financial institutions in the country, and around the world. Due to this, you have not only seen massive amounts of gold being purchased by the People’s Bank of China, who purchased gold for 18 straight months dating back to 2022, but you are also seeing massive wealth allocation in gold by citizens in the form of gold coins, bars, and the ever-popular gold beans. For those in China that did not have the foresight to secure wealth in physical gold or silver ahead of time, the collapsing of a bank is the rudest of monetary awakenings a person can go through as once your wealth is lost during a financial collapse it is very difficult to get any of it back.

Related to the situation above, it was also reported by The Economist that in the middle of last week, Chinese citizens woke up to find that 40 banks had simply vanished and were no longer in existence. Now, they did not just disappear entirely, as the 40 failing institutions were absorbed into larger ones, which is a common procedure. If a small bank has bad loans piling up and their net positive assets no longer can offset the difference leading to the banks ultimate collapse, often a larger bank with enough profits to offset the sour assets of the bank it is absorbing will come in to “save the day” as they still want to secure the net positive assets and continue to grow. Of course, as bank failures pick up in pace, that is when this common place procedure becomes more worrisome as the amount of bad assets grows rapidly. To that, it was also noted that over 3600 banking institutions are threatening China’s economy – representing a massive 13% of their entire banking system. Even worse, the situation in China appears to be far more dire than the common practice of a large healthy bank absorbing a small unhealthy bank as it was also reported that the larger banks absorbing the collapsing banks were recently created for the sole purpose of ABSORBING THE BAD BANKS. Think about this, rather than letting a bank fail or having them absorbed by a pre-existing bank with good assets on its book, they are pooling all the failing banks bad assets into larger and larger groups creating a FAR LARGER problem that will need to be dealt with sometime in the future. When that will be is anyone’s guess, but as global debt rises at record speed, geopolitical and citizen tensions increasing in intensity almost daily – it wouldn’t be far-fetched to think it would be sooner than later, and again, maybe why China (and many other countries) went on RECORD SETTING gold buying sprees. An unprecedented number of gold tonnes were purchased in a very short amount of time. Begs the question, “why?”.

Turning our attention to other parts of the world, you do not need to look too hard to find more proofs that countries are beginning to value gold’s place as a means to secure themselves financially and to weather the economic storm that is building strength each passing day. Our first story is out of Zimbabwe, who in April of 2024 released the Zimbabwe Gold (ZiG) which is backed by over 2.5 tonnes of physical gold to combat inflation that had exceeded 550% in 2020. Due to this gold backing, the ZiG has placed constraints on how much currency can be created allowing the ZiG to quickly returned inflation down near 50%, which, while still high is a dramatic improvement in a rapid amount of time and has caused a widespread acceptance of this new gold-backed currency. With this acceptance growing, Zimbabwe is confident international integration of its new currency will be seamless, and we would tend to agree. With BRICS+ nations stockpiling physical gold and silver, with Saudi Arabia now accepting physical gold for their oil, with tensions rising and economies failing – gold and silver are going to become increasingly more popular.

From there, we have Nigeria. Nigeria is the top oil producing country in all of commodity rich Africa and they too are facing an inflation rate problem over 34% that is destroying the value of citizen savings and their standard of living along with it. It was recently reported that they too have turned their attention to gold as they believe increasing the physical gold reserves of the country would not only help combat inflation, but also provide significant protection should things in the country get financially worse. Which is partially correct, as without using gold as money itself, the inflation will continue to get worse, but it will provide the government who owns the physical gold immense protections as gold will appreciate as their currency depreciates. As we speak, lawmakers within Nigeria are discussing raising gold reserves from a measly 4% of foreign reserves to a massive 30%. This will take significant physical gold purchases to achieve, but Nigeria has no reason to believe this strategy will fail as gold has been used in such a capacity successfully for centuries.

Our final report out of Africa came from Uganda. Currently, Uganda is a country that has ZERO, not even one single ounce of gold in its foreign reserves. However, after watching the success with the ZiG in Zimbabwe, and hearing of Nigeria’s plan to increase its gold reserves, Uganda has decided to also explore the idea of buying all domestic production of gold to not only “protect themselves from international financial risk” as the Bank of Uganda put it, but to also “support local artisanal and small-scale miners as this has a positive spill-over impact on other sectors of the economy.” Again, physical gold bullion is being used to solve problems created by valueless paper fiat currency as it is inevitable that as time passes, fiat currencies value will return closer and closer to zero as gold and silver will rise in comparison to those currencies due to their ability to absorb lost purchasing power and preserve wealth.

Hi,

Hi,