Over the course of thousands of years Gold bullion has been seen as a symbol of wealth and a sense of security. Even to this day, investors and collectors all around still visualize Gold in that way as it continues to be a sought-after asset. However, the Gold market varies from one country to another in their own respective ways. They are influenced by cultural, economic and regulatory factors that shape the demand for the precious metal.

Canada and United States: A Safe Haven Market

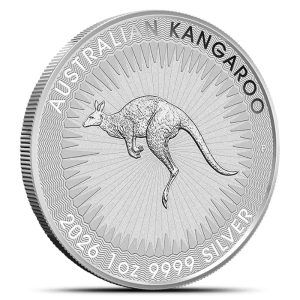

In Canada and the United States, people tend to invest in Gold as a means of hedging their wealth against inflation and other economic uncertainties. It is viewed as a safe haven asset that investors flock to for shelter. In the North American Gold market, precious metals are traded regularly, making it one of the most liquid markets in the world. Some of the most popular Gold coins among investors include the Canadian Gold Maple and the American Gold Eagle coins. Moreover, as the North American market is regulated and characterized for its transparency, it is an attractive option for investors who are seeking for a stable environment to invest in this asset class.

India: Cultural and Festive Demand

In India, the Gold market is hugely influenced by their rich cultural and religious traditions. Gold is used as an integral part of weddings, festivals and religious ceremonies in India, it is seen as more than just an investment. A major price and demand driver for Gold in India is during the Diwali festival and wedding season. In Indian culture these are auspicious times to buy and also gift Gold to loved ones. Typically the most common form of Gold purchased would jewellery, however Gold coins and Gold bars are also really popular options. Essentially, Indian investors always prefer to purchase physical Gold over other forms such as ETFs and paper gold.

China: Rising Consumer and Investment Demand

China has grown to becoming the both the largest producer and consumer of Gold in the world. Both investors and the Chinese federal reserve have been stockpiling on Gold for investment purposes. They see the value in Gold being a tangible and safe haven asset class, which has lead them to having massive holdings in the yellow metal. Moreover, in Chinese culture, Gold is often gifted during the Chinese Lunar New Year. It is a significant time of year for Gold purchases and there tends to be a huge demand.

Switzerland: The Global Gold Hub

Switzerland is renowned for its discretion, stability, and expertise in precious metals. It is a global hub for gold refining, with a substantial portion of the world’s gold passing through Swiss refineries. Swiss investors have a long-standing tradition of holding a portion of their wealth in gold, reflecting the country’s history of financial security and privacy.

Understanding Global Gold Markets

The global gold market is filled with different elements and influencers that can drive demand and pricing depending on where you are situated. In this blog we only spoke about 3 different markets, North American, Indian and Chinese. There are so many differences between these three and there are many more differences in the Gold market in other countries too. While the allure for Gold is universal, the path to acquiring and growing your portfolio may vary from country to country. As the global economy evolves, so will the dynamics of the gold market. By staying informed about these international trends and their impacts on Gold demand and price, investors can make more informed decisions when diversifying their investment portfolios with gold bullion.

Hi,

Hi,