It has long been highlighted through our weekly newsletters that our current fiat based financial system that sees all world fiat currencies tied to the United States Dollar which acts as the world reserve currency is nearing its end. This being known more commonly as the Petrodollar System due to the United States Dollar being the ONLY currency accepted by Saudi Arabia for their oil, a deal struck by Henry Kissinger in 1974. We emphasized this point by outlining that modern financial systems average a lifespan of about 30-50 years before a new system needs to be introduced with our current system being on year 53, well overdue for an overhaul. Unfortunately, these introductions lack gentleness and ease, and often come in the form of a birth through chaos.

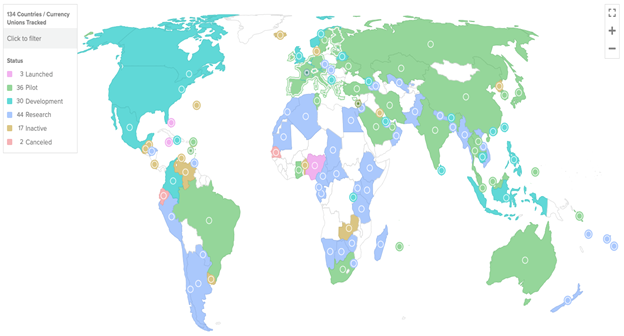

Looking at how world finance is shaping up at present, we see very few paths than can be taken, if any, that lead to a smooth transition into our next system that will most likely blend a digital system with one built upon physical assets such as silver and gold. We believe this to be true based on 70% of all countries in the world having in some fashion began developing a Central Bank Digital Currency (CBDC). The map below speaks for itself, the world is shifting toward having citizens use digital, trackable, currencies that are void of any form of financial privacy. Only the white portions of the map have not started researching a CBDC for their country, which stands at 61 countries. Of the 134 remaining, only 2 projects have been cancelled.

All the while, central banks continue to buy RECORD amounts of gold and silver. According to the 2024 Central Bank Gold Reserves Survey, with a total of 70 responses, 29% of central banks intend to increase their gold holdings in the next 12 months, the highest level observed since the survey began in 2018. A gold rush has not only begun but is going to increase in pace.

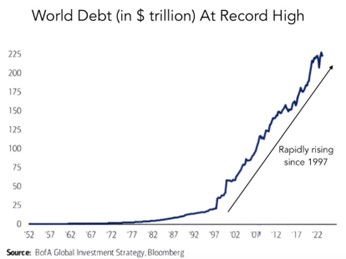

Looking at where we stand today, it has become OFFICIAL that the current Petrodollar System has come to an end. It is no longer conspiracy that Saudi Arabi will begin accepting payment in forms other than United States Dollars which will DRASTICALLY impact the demand for dollars, sending much of the shipped inflation back home to the West. It was announced late last week that Saudi Arabia will not be renewing the 50-year Petrodollar Deal struck in 1974 by Henry Kissinger as mentioned earlier. With United States interest payments on their national debt reaching above $1 TRILLION per year, if demand for United States Dollars drop, and there is no longer a need to hold U.S. debt in such high quantities, which is increasingly going sour, this would cause a massive drop in the value of the United States Dollar and likely would end its reign as the World Reserve Currency. This would inevitably cause global financial panic because if the World Reserve Currency’s value is called into question, what would that mean for the others? Of course, the logical, and correct answer, is that they all have NO VALUE. Fiat by definition means the value is derived by trust and confidence in the issuer of the currency and at rates currency is currently being created and savings destroyed by world governments, many are right to call into question that trust and confidence in our issuers of paper money. Again, this is where we see CBDCs coming into play. Once confidence is lost in paper money due to financial collapse due to reckless printing and spending, again, through chaos, a new form of money will be born. Digital currencies will be sold to the public on transparency and efficiency of the blockchain they run on, again, while those in the know prior were collecting real money, silver and gold while it was cheap. During the collapse of fiat currency, as we have seen, silver and gold absorb the loss in purchasing power, and so a full system transition would, as we have stated previously, likely cause a revaluation of gold and silver many multiples higher to cover the massive debts central banks will have making both metals unaffordable for the average citizen. This is where the term ‘unobtanium’ comes from that you may see in some precious metal forums. Just look at this insane chart regarding world debt levels:

The world is $225 TRILLION in debt. In a system where each dollar is created with interest, debt can NEVER be paid off, or all money would cease to exist. The only asset with precedence to erase this massive debt due to revaluation is silver and gold. Making the holders of each metal very wealthy, which will not be very many people on a percentage basis.

Below you will find a timeline of our financial systems so you can better understand how we arrived where we are today.

Birth of Modern Financialization (1870-1914)

This was when global financialization began. The world went from circulating physical bullion coins to what was known as the Gold Bullion Standard, and 1870 marked really the first-time paper money was used in place of silver and gold but was redeemable in each metal if the holder wanted. Silver and gold are money, paper money is the claim check or receipt on real money. Like with any paper money, it gets abused and over printed. The Panic of 1907 was the beginning of the end. This system ended up lasting 44 years.

Federal Reserve Act (1914-1944)

After the Federal Reserve Act was passed in December of 1913 just before Christmas, this began the spread of the federal reserve note and the dominance it began to see around the world as the United States funded both sides of both World Wars until ultimately joining in each for the Allies. However, after the World Wars ended, the world needed a new system as economies had been largely destroyed outside of the United States. This system lasted 30 years.

Bretton Woods – The Gold Standard (1944-1971)

Due to the United States Dollar being so freely circulated and each country having much in reserve, the Bretton Woods System was implemented. All world fiat currencies would be tied to the United States Dollar which would be tied to gold. However, after the United States abused this power and began printing far more USDs than they had in reserve, Charles de Gaulle of France called them out, and the system effectively was axed as all countries began trading in dollars for their gold rapidly. This system lasted a mere 27 years.

Full Fiat – Petrodollar System (1971-2024)

Once President Nixon removed the United States Dollar’s tie to gold, a brand-new system was instantly created. All fiat currencies would still be tied to the United States Dollar, but the dollar would now be tied to NOTHING. No real value pegged the system, and it is why debt and inflation have begun to ravage each country in the world. This system lasted 53 years.

A new system is rapidly approaching, and those that usually create it, the bankers, are buying silver and gold like their lives depend on it. To close out, remember, through the above chaos of financial transition silver has risen over 2000%, while gold is up over 11,000%. They were there for those in the past as things became chaotic, and they will be there for those today as this financial transition ramps up.

Hi,

Hi,