In today’s issue of Au Bullion’s newsletter, we’ll explore four critical developments: the stark underperformance of Bitcoin compared to gold and silver through February; Indonesia’s ground-breaking launch of its first bullion banks under President Prabowo; Wyoming’s historic $10 million USD gold and silver reserve; and the overvaluation of stocks, underscoring the growing case for safe haven assets. Let’s dive in.

Bitcoin, Silver, and Gold: A February Reality Check

As of February 28, 2025, Bitcoin’s performance has been a cautionary tale for investors chasing high-risk assets. Down 17.34% this month, the lead cryptocurrency has shed significant value, dropping from its December 2024 peak near $108,000 to around $84,000 at time of writing. Once touted as “digital gold,” Bitcoin’s steep decline reflects its ties to speculative risk rather than stability, with volatility spiking amid profit-taking and macroeconomic uncertainty following its post-election rally. Analysts in financial markets now question its reliability as a store of value, especially as traditional safe haven assets shine brighter.

In contrast, silver has posted a modest but resilient gain of 3.05% in February, trading around $31-$32 USD/oz. Buoyed by steady industrial demand—particularly from solar and electric vehicle sectors—and its role as a monetary hedge, silver proves its dual-purpose strength. Gold, the ultimate safe haven, has climbed 3.8%, currently trading at $2,846 USD/oz, just shy of the all-time high set last week when gold was being sold for over $2900 USD/oz. Central bank buying, and persistent geopolitical tensions have reinforced gold and silver’s appeal, offering a stark contrast to Bitcoin’s rollercoaster ride.

The lesson? Bitcoin’s February flop highlights its speculative nature, while gold and silver reaffirm their status as anchors in turbulent times. Investors betting on digital disruption may be rethinking their positions as traditional metals hold firm promising the protection they are advertised to provide.

Indonesia’s Bullion Banks: President Prabowo’s Golden Vision

On February 26, 2025, Indonesian President Prabowo Subianto launched the nation’s first two bullion banks, operated by Pegadaian (a subsidiary of Bank Rakyat Indonesia) and Bank Syariah Indonesia. These institutions will provide gold deposit, financing, trading, and custody services. A bold move for a country that ranks among the world’s top gold producers, with output now at 160 metric tons annually up from 100 metric tons just a few years ago. President Prabowo’s goal is clear: keep more gold within Indonesia’s borders and strengthen its financial sovereignty.

By incentivizing citizens and businesses to deposit gold rather than hoard it, these banks aim to bolster national reserves and reduce dependence on foreign currencies. President Prabowo called it “a step toward economic independence,” reflecting a global shift toward de-dollarization. For a gold-rich nation tired of exporting its wealth in raw gold only to buy it back when refined, this could redefine the regional bullion market—and inspire copycats elsewhere.

Wyoming’s $10 Million Gold and Silver Reserve: A Historic Precedent

Meanwhile, Wyoming has made waves by establishing a $10 million USD gold and silver reserve, the first U.S. state to back its treasury with precious metals. It should be noted that the $10 million USD mark is a minimum the reserve must hold, it is not a cap, meaning Wyoming can fill its precious metals reserves with as much bullion value as they see fit. Announced earlier this month, the reserve—held in physical bullion—serves as a hedge against inflation and federal fiscal instability, with the U.S. dollar having lost 85% of its purchasing power since 1970 and closer to 99% since the inception of the Federal Reserve in 1913. Gold’s 3.8% rise and silver’s 3.05% uptick in February only validate the move.

Advocates see this as a blueprint for other states, with Wyoming betting on the continued appreciation of precious metals amid economic headwinds. While $10 million USD is a small fraction of the state’s budget, it’s a symbolic jab at fiat fragility—and a practical play as distrust in centralized systems grows. Could this spark a broader trend among U.S. states? Time will tell, but this move certainly aligns with a growing number of states that have made gold and silver legal tender.

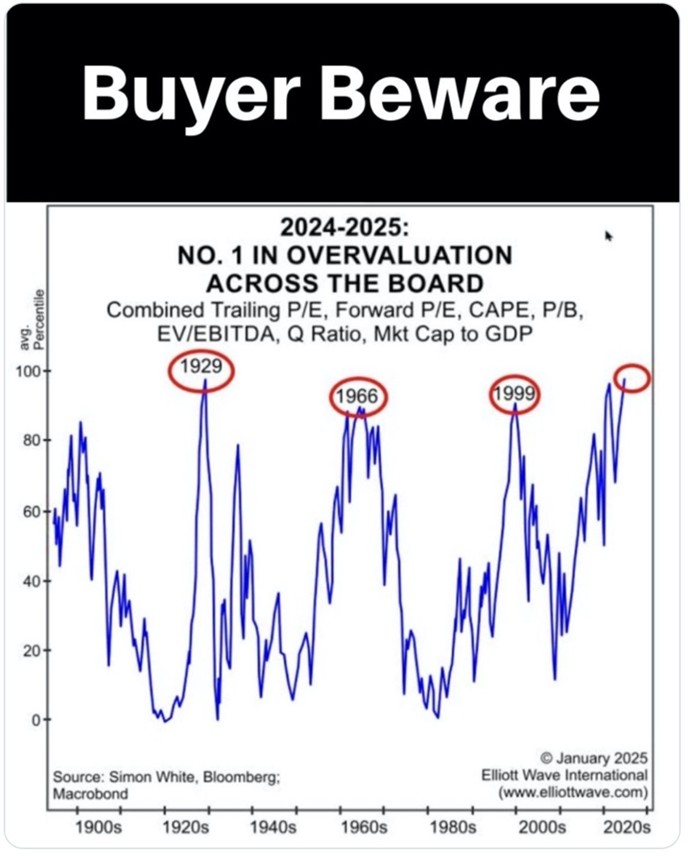

Stocks at Historic Highs: The Safe Haven Imperative

U.S. stocks, particularly the S&P 500, remain at nosebleed valuations as of February 2025, with a cyclically adjusted price-to-earnings (CAPE) ratio exceeding 35—double its long-term average of 17. This echoes pre-2008 and pre-2000 levels, both of which preceded sharp corrections. Fueled by low rates, post-pandemic stimulus, and tech euphoria, equities have decoupled from fundamentals, leaving them vulnerable to a reckoning.

Geopolitical risks, Trump’s tariff rhetoric, and a $36.5 trillion U.S. national debt amplify the unease. Bitcoin’s 17.34% plunge this month mirrors this risk-on fragility, moving in lockstep with speculative excess rather than offering refuge. Gold and silver, up 3.8% and 3.05% respectively, shine as counterweights. Gold’s negative correlation with stocks (-0.4 during the 2023 banking crisis) and silver’s industrial resilience make them vital hedges.

History backs this up: gold soared over 140% during the 2008 crash and silver spiked nearly 400% while stocks cratered 37%. Silver, with analysts eyeing $35-$40 USD/oz this year, blends safety with upside. Bitcoin, meanwhile, amplifies risk, not relief. In an overvalued market, safe havens aren’t just prudent—they’re paramount.

February 2025 has laid bare the fault lines in financial markets. Bitcoin’s 17.34% drop exposes its speculative roots, while gold’s 3.8% and silver’s 3.05% gains underscore their enduring value in tough times. Indonesia and Wyoming are doubling down on precious metals, signaling a shift toward tangible wealth, and overvalued stocks highlight the urgency of diversification. Safe haven assets aren’t just a luxury—they’re a lifeline.

Hi,

Hi,