To say it has been a hectic year across all global markets would be a massive understatement. Not only have we seen global inflation reach multi-decade highs, ravishing not only emerging nations with weaker currencies, but developed nations mainly out in Europe, as well. That said, we also have inversely seen interest rate hikes made by central banks around the world at a record pace. The Federal Reserve leading the charge raising interest rates to 4.25% in less than 1 year. This has caused mass turbulence and uncertainty in the markets unseen since 2008 or more recently the crash caused by the 2020 lockdowns.

The reason for this is because talk on inflation has been tough, real tough. This, early on, caused the overarching public to buy into the fact that inflation was in fact transitory and not here to stay. The truth, as most of us now know at this point, is with inflation still ABOVE interest rates, central banks are still way behind and no where close to stopping the rise of inflation. This discrepancy has caused mass investor confusion, as many are unsure whether to trust what they see, or to trust what they are being told by the experts that continuously get it wrong. For us, as believers in tangible assets, we like to empower ourselves and go off what we are seeing in reality, not what we are being told without any evidence to back it up.

And what are we seeing exactly?

We are seeing gold performing as it should during a time of high inflation and uncertainty.

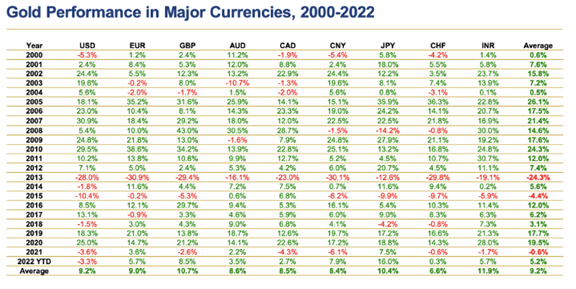

While most investors are glued to asset prices denominated in the USD due to it being the current world reserve currency, that tunnel vision is causing people to miss the larger picture. Again, it is worth mentioning, that the USDs run to a two-decade high is not REAL strength, it is relative strength. Due to all currencies being tied to the USD, when the Federal Reserve rapidly increased interest rates, other world currencies plunged in value, making it appear in reality like the USD was becoming stronger. In reality, it is still horribly weak, and inflating at nearly 10%. How can an asset that lost pretty well a 10th of its value in one year be considered strong? That answer is simple, because if it was admitted the USD is not strong, the following chart would not show USD denominated gold gains/losses in the red.

In fact, what you can see for 2022 is that while gold was championed as being weak against inflation – when averaged against all major currencies, gold is actually up 5.2% on the year. In currencies that lost value the quickest; you are seeing gold respond the hardest. The Euro, British Pound, Chinese Yuan, Japanese Yen, and Indian Rupee, all performed above the golden gains average. When looking at these countries, what is also interesting to consider is that Europe has been teetering on a SEVERE energy crisis, sending the Euro below parity with the USD for the first time in 20 years, heightening the urgency for gold in that area of the world. The same can be said in China and Japan as these two countries race to drop assets denominated in USDs, as well as India that just imported well over 200 million ounces of physical silver, as well as 3.4 trillion rupees ($41 billion USD) worth of gold, an increase of over 35% from last year!

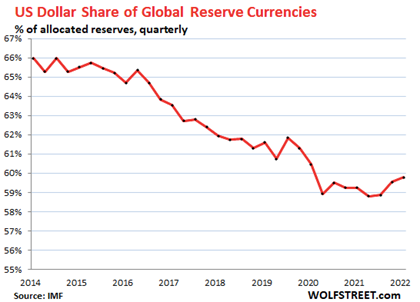

The chart below also highlights the severe decline in USD holdings by countries around the world. Showing clearly that as countries move into silver and gold, they are simultaneously moving out of USDs, potentially signalling a change of guard regarding world reserve currency status. A change that may not go from one fiat currency to another, but rather from a fiat reserve with no real value, to a physical reserve of gold and silver that has held value for over 5000 years.

When looking at 2019-2020, the world faced a “shock and awe” type disaster that caught everyone by surprise, and during that time, USD asset holdings across all countries dropped 5.32% in a flash, with the average year over year change usually not surpassing a single percentage point. If this trend continues at the same or at any increased pace, by 2032, a new asset very well may take the USDs place.

With many major banks and economists also predicting economic turbulence carrying into 2023, it begs the question how long countries will continue to hold an asset that is rapidly loosing purchasing power? Especially, when looking at assets like silver and gold that have been reacting positively to entrenched inflation and overall economic uncertainty across the world. It is worth mentioning that since the year 2000, we have seen 3 economic collapses (2000, 2008, 2020) , and during that 22-year period, gold has averaged a return of 9.2% per year. If chaos continues, and it likely will, gold will act as a buoy, keeping you afloat. And you do not need to take our word for it, central banks appear to agree as it is worth reminding you that central banks bought gold at a pace unseen since 1967 when the USD was backed by the very metal.

As for which specific buoy to invest in, we do not think you can go wrong with the classic 1 oz Gold Bar out of the Royal Canadian Mint. It is not only paired with some of the lower premiums for 1 oz gold products, but it comes out of one of the world’s most reputable mints.

Hi,

Hi,