When looking at your average silver investor they most often deal with individual pieces 100 troy ounces or smaller, while governments, banks, companies, and other larger entities trade in 5000 troy ounce bricks that get traded on the COMEX. Similar on the gold side, but on a much smaller scale, your average investor likely deals with individual pieces 1 troy ounce or smaller, with some larger purchasers getting into your 10 troy ounce, kilogram, or even 100 troy ounce gold bars; mind you a 100 troy ounce gold bar at current melt value is $251,178 USD ($338,763.77 CAD). Not a small chunk of change by any means. Using the same comparison to silver above, governments, banks, and other large institutional buyers of gold bullion most often deal with 400 troy ounce bars of gold. That said, at time of writing, gold is sitting at $2512.70 USD/oz, which for the first time in history values one 400 troy ounce gold bar being traded on the global market at $1,005,080 USD. A truly staggering milestone.

There is no reason why gold bullion could not continue to set more impressive highs especially as talks of rate cuts intensified over the weekend at the Jackson Hole Symposium where bankers and economic officials from across the world gather to discuss critical monetary policy. Federal Reserve Chair, Jerome Powell, made more assertive statements that fueled a deeper belief by market participants that at least a 25-bps or even a 50-bps rate cut was incoming. This pushed both silver and gold higher moving into the weekend as looser monetary policy is often a strong accelerant for bullion. Jerome Powell stated in paraphrase that he was confident inflation was on a pathway back down to 2%. However, both silver and gold’s performance through the first 2/3rds of the year offer a very different perspective as in an environment where inflation truly was coming down, silver and gold as non-yielding assets would lose some of their lustre. This being because if fiat currency was not losing value at such a rapid pace, the chance of silver and gold making strong pushes higher becomes far less likely as other assets with higher yields become more attractive.

Looking deeper into gold’s defiance of what Jerome Powell is trying to convince market participants is happening, you will see that gold has made SEVEN brand new all-time highs since the beginning of April. That is almost 2 new all-time highs reached each month. And this is supposedly happening during a time with lower inflation? Seems highly unlikely. To add more support to our theory that inflation is in fact NOT coming closer to 2%, we turn our attention to global gold reserves. In an article written by Global Market Investor written on May 25th, 2024, just prior to most of these new all-time highs in gold, they stated, “Official world gold reserves reached 1,170 MILLION fine troy ounces, the highest level since the 1970s. They are now higher than just before US President Richard Nixon broke the US Dollar’s link to gold in 1971.” There are a few things to consider here:

- This article is from the end of May 2024. Since then, central banks have continued to add to their stockpiles meaning official gold reserves are now well above the mark set in the early 1970s.

- Countries have now stockpiled more gold than when gold was still widely accepted in the public as money during a time when we are now told in the public that gold is a barbarous relic with no real-world use.

- Countries have stockpiled more gold during a time when over 75% of all countries are working on a Central Bank Digital Currencies for citizen use.

- Countries have stockpiled continuously during a time we are told high inflation was temporary and would be kept under control.

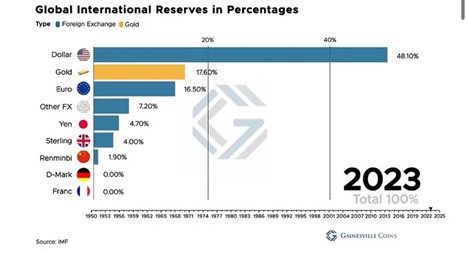

- Countries now hold more gold bullion in foreign reserve accounts than they do the Euro, making gold the #2 reserve asset in the world behind the United States Dollar. Which, we have actively been covering how quickly countries are looking to ditch the dollar, so it is no reach to say that gold will one day (sooner than most think) take over reign as the world #1 reserve asset.

The fact that countries are accumulating gold at a pace unseen since a time it was almost considered sacrilege to own no gold as a government or empire, speaks volumes.

To finish off, we want to highlight silver, as it is still our firm belief that SILVER will be the strongest bullion horse in the race on a percentage gains basis. Consider this, throughout the entire year, while it really has been incredibly quiet on mainstream media outlets regarding gold’s all-time high streak, it has been dead silent when it comes to silver. And one may ask, “why talk about silver when it is nearly 70% below its’ 1980 all-time high?” And in response, we would immediately refer to why percentage gains are so important. With gold breaking all-time highs, it catches people’s attention and holds it as it continues to climb. All the while, silver remains comparatively unloved. However, even with gold making 7 new all-time highs since April of this year, and silver not making a single one, silver is still outpacing gold on a percentage gains basis in 2024. Since January 1st, 2024, gold has increased 21.89%. Silver during the same time has increased 25.24%. Going back to March of 2020 when the world shutdown, gold is up 59.67%, while silver has amassed an increase of 113.66%. Highlighting why we have been encouraging our clients to take a hard look at silver. It is set up to continue to outpace gold on a percentage gains basis, even if it never is more valuable per ounce. Even if you are the largest lover of gold and do not necessarily enjoy silver, something we would suggest you consider is the following:

If you want gold, buy silver. If silver continues to outpace gold and the gold/silver ratio continues to move in favour of silver, let’s hypothetically say silver and gold go to a 20:1 ratio at the end of this run down from their current 85:1 ratio. At that point, you could swap your silver for 4x more gold than you would have had buying gold straight up at current ratios. Breakdown shown below:

10 ounces of gold purchased today at an 85:1 gold/silver ratio leaves you with 10 ounces of gold at a 20:1 gold/silver ratio.

For the same cost of 10 ounces of gold, you could purchase 837.57 ounces of silver. If silver outpaces gold and brings the gold/silver ratio down to 20:1 similar to the example above, you could now trade your silver bullion in for 41.88 ounces of gold. Leaving you with 31.88 ounces more than you would have if you initially had purchased gold instead of silver.

Hi,

Hi,