If you were to go up to a random person on the street in whichever city you are currently reading this in and asked them how well gold was performing as an asset this year, we would venture to guess that very few people would have any idea of the answer. Which is not unsurprising given how little mainstream media attention gold has received this year. Without your ‘for you’ pages on social media platforms being tailored to show you precious metal news or searching for those sources yourself, you would be hard done by to come across any information organically. Of course, if you flip the demographic of the above and ask those involved with precious metals in some form or another the very same question, we would assume the answer from that group would be that gold has performed pretty well. However, we also believe that most of those that follow gold intimately may not know that gold hasn’t performed this well over a single year outside of 2007 and 1979, and outside of those two years, this is the best year for gold bullion in 5 decades. Going even further, even if you wanted to lump those two impressive years for gold back into the mix, 2024 is on pace for gold to do something unprecedented.

In 2007, gold increased 31.59%, while in 1979 gold increased an astounding 131.86%. At time of writing, gold has increased 28% in 2024 with 3 months remaining, and due to the United States Election upcoming in early November and other economic indicators pointing toward an economic collapse coming toward every country of the world due to mass currency dilution, there is reason for strong belief that gold is only just getting started.

And to that point, it is fair to ask even with 3 months remaining in the year for gold to accumulate more gains, if gold has previously performed better in 2007 and in 1979, what would make 2024 an unprecedented year? The answer to that comes down to the timing in which this gold bull market is taking place as never before has a gold bull market happened in the midst of interest rates being their highest of that specific hiking cycle. The reason for this is as interest rates rise, this also raises yields on government bonds and in turn draws investors away from gold as it is an asset with no yield. Once rates begin their cutting cycle, gold has pressure released and re-establishes growth. This is what occurred in 2007. Rates began to be cut in October of 2007 and it shot gold out of a cannon. What is also interesting is gold still has those same months remaining this year in which gold saw tremendous rallies in 2007. In 1979, the situation was slightly different. The United States saw immense inflation due to the United States Dollar having its peg removed from gold in 1971. That caused massive moves in gold, peaking with the over 130% increase in 1979. However, in 1980, Paul Volcker raised interest rates to 20%, effectively stomping out gold’s bull market with gold posting a 32.15% loss in 1981, a 14.84% loss in 1983, and a 19.19% loss in 1984. In this case, gold was being fuelled by inflation being higher than interest rates, effectively raising interest rates 7% higher than inflation was successful in stopping the inflation problem from seeping into the 80s.

The reason 2024 has been such a special year for gold bullion is because gold has not only increased almost 30% on the year in an environment where interest rates were at their peak of 5.25% to 5.50% for the entire year. The opposite of 2007, where gold waited until the Federal Reserve indicated interest rates were going to begin dropping with a cut before it made its strongest moves. Gold has at the same time, accumulated a near 30% gain even BEFORE rate cuts were even made. Think about it within the context of why bonds become a hotter asset in times of high interest rates. Gold has made these gains in a time when bond yields are at their highest. Countries continue to sell U.S. bonds and buy gold. This simply does not happen and is a massive statement. Even further, 1979 was a clear indicator of the power held within interest rates, yet in defiance to high rates, gold has pushed onward in 2024. For that reason alone, we strongly believe that the bull market in gold, and therefore also in silver, is just getting started. Look at how silver and gold both reacted down to the second Jerome Powell, Federal Reserve Chair, announced that the Federal Reserve would be cutting rates by 50 bps.

Gold now currently sits above $2600 USD/oz for the first time in history, with silver reclaiming the $31 USD/oz level.

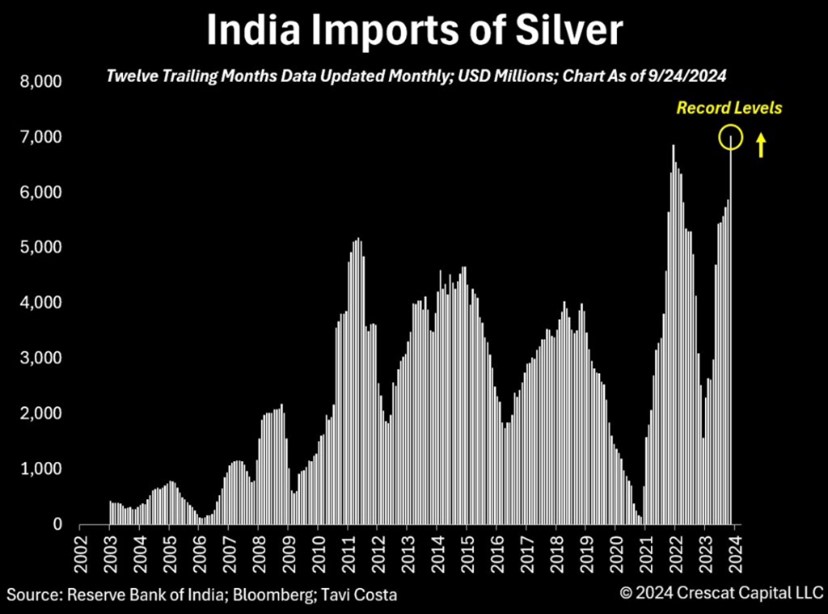

A signal was clearly being sent by both metals and it was a signal that India was not going to sit around to wait to find out what it was alluding to as they went out and increased their year-over-year purchases of silver bullion in August by 641% adding 1,421 tonnes in a single month. This brings their year-to-date total to a jaw-dropping 6,148 tonnes of silver. India clearly agrees, that while gold is pulling the cart, silver is keen to take over as the lead horse once this market truly gets started and rates are brought event lower alleviating more downside pressure.

These last few months are ones that everyone in the precious metals sector should be watching closely as with a nearly 30% gain year-to-date many would consider the bull market to be nearing its conclusion when in reality it is just getting started. It would be our estimation that 2025 ends up being a far superior year to 2024 for silver and gold and may even challenge the 131.86% gold gained in 1979 if rate cuts are accelerated due to a deteriorating economy. Coupled with increased inflation causing a stagflation environment, as we have written about previously, the gasoline is about to be poured on the gold and silver fire. No one could possibly own enough precious metals for what is about to occur.

Hi,

Hi,