China is once again leading financial news cycles as in the midst of a property market collapse due to massive debt defaults by property giant Evergrande, their stock market has now once again began to slide downwards – now reaching total losses of $7 trillion USD since 2021 peaks. Many are saying these losses and debt defaults will leak into the West as many large European, American, and Canadian companies hold Evergrande debt that just went belly up; and we are talking billions and billions of dollars in debt going bad. Not only that, but because the global financial system is so interwoven when stocks begin to crash in a developed country like China at such a rapid speed it forces companies around the world to liquidate other unrelated assets to pay off bets that are now going bad. This chain reaction can pull in sectors of the economy not remotely involved in the initial crash, which in 2008 would have ended up swallowing the entire world financial system if banks were not bailed out by the Federal Reserve magically creating new currency and the problem being kicked down the road until, well, today…

As proof of the above concept regarding localized financial crashes turning into financial contagion we turn to a report put out by Boston University’s Global Development Policy Center. In the midst of financial stress in the United States and an environment of rapidly rising interest rates that has caused even the more affluent countries citizens to struggle immensely, it was reported this has pushed 62 developing countries into full-blown debt crisis. Furthermore, these global financial stresses have pushed a near record number of countries into spending over 20% of government revenue on servicing interest being generated by their current national debt. Reminder, the United States just surpassed $1 TRILLION PER YEAR in interest payments on their national debt that has now soared passed $34 trillion USD, soon to be $35 trillion USD at the pace it has been growing.

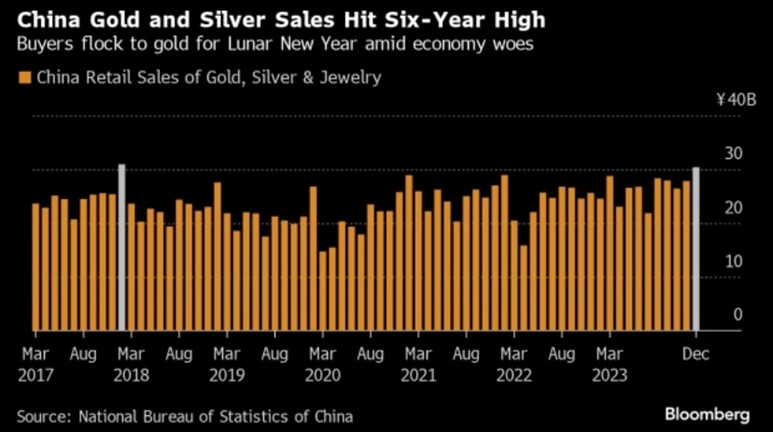

Again, it should come as no surprise whatsoever that even though China’s economy has manifested crashes before the West, citizens had been long prepared for this moment. With data only being available up to the end of December 2023, which should be noted is before word got out about full-blown property meltdown or a major stock market slide, it is being shown that citizens of China gold and silver purchases reached a six-year high.

Further to that point, all data is pointing toward China’s central bank also adding gold once again in January which would be a 15th consecutive month of central bank gold buying. With China’s monetary authority rapidly stockpiling gold, wise citizens began doing the same. Unfortunately in Western countries, central banks are hoping the perpetual debt cycle that enriched them in the first place can continue and citizens en masse have so far failed to recognize the unsustainable path we find ourselves on, and therefore, have mostly failed to protect themselves with physical assets like silver and gold. It was also reported that China’s retail purchases of silver and gold officially surpassed India, and that is in no way a knock on India, but rather to highlight that it is BRICS nation citizens that appear to be doing majority of silver and gold purchases to ensure they are prepared for when financial contagion does appear.

All that said, on Sunday, Federal Reserve Chair Jerome Powell did an interview on 60 minutes. It, of course, would take quite some time to break down the entire interview in one newsletter, so rather, we will focus on the part that has significant relevance to what we have written about above regarding the world being on an unsustainable path of spiralling debt.

At one point, Scott Pelley, the 60 Minutes correspondent who conducted the interview of Jerome Powell, stated that in 30 years the United States national debt is projected to be a jaw-dropping “$144 TRILLION USD or $1 MILLION USD per household.” Pelley then goes on to ask Powell if the national debt is a danger to the economy, in which Powell answers, “In the long run, the United States is on an unsustainable fiscal path, the United States Federal Government is on an unsustainable fiscal path and that just means the debt is growing faster than the economy.” Which, off the hop, sounds horrible in itself… as an individual, if your debt is growing faster than your income, you are bankrupt, yet, we are to be convinced the United States is in fact incredibly wealthy (not including any gold reserves, which may or may not be in Fort Knox). Anyhow, Pelley responds that he gets a sense that the statement Powell just made about financial unsustainability worries him (Powell) very much. To which Powell shoots back a classic central bank line, “Over the long run, of course it does. You know, we’re effectively borrowing from future generations…” And there it is. The cat is out of the bag… But how many people actually caught it?

First, Powell outlines the unsustainable path the United States and so the world is currently on. Then makes sure to emphasize that this is only a serious problem down the road in order to not cause any immediate panic, because well, it’ll be your grandchildren’s problem. What Powell has failed to let the viewer know is that we, today, are the grandchildren because the Federal Reserve began walking on this road on August 15th, 1971, when Nixon removed gold from our money, establishing the system of debt rather than real value. Down the road is today. There is no more down the road. All that remains is for the people to catch on that their fiat currency has no value, and either demand government returns value to the money OR act to protect themselves and their family before this admittedly unsustainable path begins to crumble beneath our feet.

To many it has been clear for quite some time now that when we are told we are borrowing from future generations, what central bankers really mean is we are robbing them, as when has any of this wealth ever been returned? In this current system, it is an impossibility. Due to this, we must act to protect ourselves. To help make that possible, Au Bullion is offering assorted 1 Oz Gold Bars from various mints at a low premium to help individual citizens prepare without having to pay massive premium fees to do it.

Hi,

Hi,