Ever since the 2020 stimulus printing spree that governments went on to avoid a complete economic shutdown after the world was effectively locked down – financial experts began warning that such rapid currency creation would ultimately act as a band-aid for our then current problems, but essentially cause the systems demise down the road, which we are seeing today. It was hard to comprehend initially because the world had never seen such rapid creation of currency notes, as even the bailout response to the Great Financial Crisis in 2008 paled in comparison, however as we have progressed citizens are beginning to feel the pain. We were initially met with near 10% inflation, followed by a historic rise in interest rates that never even came close to 10%, meaning real rates were always negative, and that inflation while it may slow down, would not go away. Due to this dichotomy, the Federal Reserve was sent hurtling toward its worst nightmare unseen since the 1970s, a period of stagflation marked by a severe economic slowdown alongside high inflation, and higher unemployment.

Even though many financial market watchers were warning of this outcome, the Federal Reserve continued to promise the economy was strong and inflation was ceasing – this in an attempt to calm market participants and citizens alike as stagflation is good for no one. Well, no one except those that hold silver and gold.

Last month through March we got word that inflation had begun to tick upwards again after it had leveled out and the Federal Reserve struggled to get inflation back below 3%. This week we got word that the economy in the United States grew by just 1.6% in Q1 of 2024, a MASSIVE miss of the 2.5% growth that was predicted signalling the economy is grinding to a halt much quicker than the Federal Reserve had anticipated which is why they chose not to cut rates earlier in the year to try to alleviate some pressure. Due to this starting to look a lot like the stagflation period of the 1970s which was marked by a massive rise in inflation as well as interest rates being raised above 20%, we thought it would be fitting to go back and visit how silver and gold performed during that time to highlight why it is so prudent to own both silver and gold, even if just a small piece of each during times like this.

At the turn of the decade as we entered 1970, silver and gold were still the bedrock of the global financial system, with gold acting as the fiat value anchor at this point in history, actually giving real value to the paper we know as cash. Due to this, as we began to see a deterioration of trust in fiat currency due to overprinting, a run on gold in Fort Knox took place which, as many of us know, led former President Richard Nixon to end the gold standard on August 15th, 1971. Prior to this on December 31st, 1969, to evaluate just how gold and silver performed through the stagflation period of 1970-80, we saw gold sitting at $35.40 USD/oz, with silver being valued at $1.84 USD/oz. By January 21st, 1980, gold had hit its then high of $850 USD/oz – a staggering 2301.13% increase in value in just a decade. On the other hand, silver by January 18th, 1980, had also hit its then high of $49.45 USD/oz – an incredible increase in value of 2587.50% through the decade. It is not far-fetched to expect we see similar moves as we enter another period of stagflation with an even more debt-ridden global economy and far more losses of purchasing power in fiat currency that needs to be absorbed.

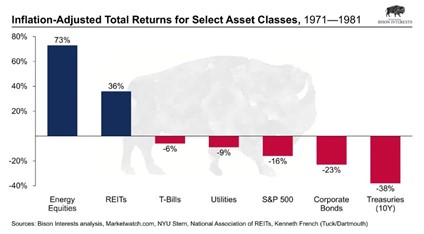

As a comparative, through the same period the following major assets performed as followed:

You can clearly see that it was Energy Stocks, as well as Real Estate Investments that far outperformed non-tangible assets such as government/corporate bonds, or the S&P 500 – however, both of those classes of assets did not even sniff the gains that both gold and silver produced over the same decade of stagflation.

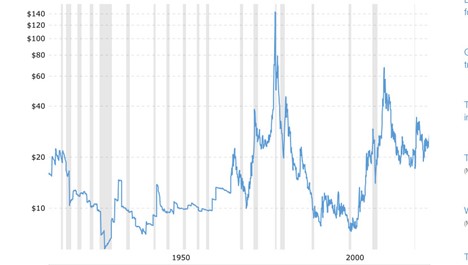

When you consider the above, it should really come as no surprise why BRICS+ Nations along with many other countries have been stockpiling silver and gold as rapidly as possible while prices are still low. And what do we mean by low? Did gold not surpass all-time-high prices? Technically, yes. However, when you adjust previous all-time-high prices from 1980 in both silver and gold for inflation, you begin to see that neither silver or gold has even started their large run up. Yes, we also understand that at time of writing silver is up 15.88% year-to-date, and gold is up 13.66% year-to-date, but when you look at the charts below you begin to realize that these two assets have yet to even wake up:

SILVER CHART ADJUSTED FOR INFLATION

SILVER CHART ADJUSTED FOR INFLATION

You can see that when adjusting for the massive losses of purchasing power we have seen in all fiat currencies, the true inflation adjusted high for silver exceeds $140 USD/oz. Meaning, that just to achieve the 1980 high in silver, from the current price of $27.60 USD/oz, silver would need to run 407.25% just to get back to that same level. After that point once silver looks to achieve new highs, the sky is the limit due to how much additional debt has been accumulated in the world over the past 50 years.

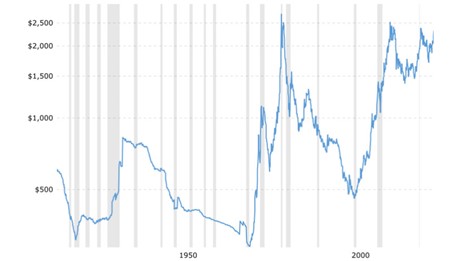

GOLD CHART ADJUSTED FOR INFLATION

GOLD CHART ADJUSTED FOR INFLATION

Similarly to silver, gold’s true all-time-high still remains in 1980 when adjusted for inflation. The true all-time-high is closer to $2600 USD/oz, 10.86% higher than current prices of $2345.33 USD/oz.

While this suggests gold is still undervalued by a large margin, it does point to silver still being the most historically undervalued asset class when looking at asset values today. That said, China’s investment demand for gold rose nearly 6% this year from last, so even if silver is viewed as having more potential gains, gold still is held in the highest regard around the world. Even still, with gains of over 2300% posted through the 1970s by both precious metals, and the fact there is not enough of each for every person in the world to have a single ounce – holding even a small amount of either metal can have a significant impact on the preservation of your wealth.

Below you will find the cheapest 5g and 10g gold bars on the market today. While we understand the true value of these metals is far higher, we also understand our duty as a recognized dealer – that being to get these assets in the hand of our customers for as low premium as possible. You will also find assorted 1 oz silver rounds/bars that will also be some of the cheapest silver you find on the market.

5 Gram Gold Bars | Various Mints

10 Gram Gold Bars | Various Mints

Hi,

Hi,