For many hardened silver and gold advocates there is a deep understanding that gold and silver are in fact REAL money; often referred to within the community as ‘sound money’. However, the over-arching public opinion is that once Richard Nixon took the United States, and subsequently the world, off the last remaining reminisce of the traditional gold standard – gold and silver no longer served any financial purpose. This controversial opinion has since been fed through the central banker, politician, and mainstream media mega horns driving home to the public the idea that paper currency and created credit are the only forms of money. Learn more about Gold vs. United States Currency Supply.

The most glaring example of this was when Ben Bernanke testified to congress that central banks continued to store gold out of “tradition” and not for any monetary benefit. As someone without any formal financial education (which is the position most world citizens find themselves in), who are we to question one of the most powerful central bankers at the time? Well, if you are one questioning what Bernanke said, you would be right to do so, and the following charts breaking down the correlation between the value of gold and the U.S. currency supply show exactly why that is:

From 1900 up until the creation of the Federal Reserve in 1913 – base money (currency) in the Unites States was equal to the value of gold. This time period is also noted as having incredible price stability.

In 1914, the Federal Reserve cranked up the money printers in order to fund other countries fighting WW1. This was when the U.S. first started becoming a major super power as the dollars being shipped out of country returned as gold to be held in Fort Knox. You can also see this massive printing spree flung the currency supply significantly higher than the value of gold that was supposed to be backing each of the dollars printed. Bank runs started in the early 1930s due to this discrepancy as citizens began to realize U.S. dollars were not “as good as gold”. This forced Franklin D. Roosevelt to confiscate gold and revalue it in 1934. The following was the result:

Gold quickly accounted for EVERY SINGLE dollar that was in circulation. Those that continued to hold gold rather than turning it into the government a year earlier saw their purchasing power drastically increase. Those holding USDs saw the inverse happen. On the federal side, this newfound value at the U.S. Treasury sparked another printing spree and the fraud of printing too many dollars than gold held in reserve began again.

Once again, the currency supply leapfrogged the value of gold held in reserve, however, this time world governments were on to the con. Led by the then President of France, Charles de Gaulle, the world began to demand repatriation of its gold. No longer trusting that the U.S. was only printing enough dollars as they had gold in reserves to back them. This, of course, was an accurate assumption.

The result was that from between 1959 and 1971 when Nixon terminated the convertibility of USDs to gold – the United States lost 50% of the gold held in reserve. However, due to the gold standard being ended – many theorized gold’s value would plummet as it no longer served any financial purpose. Those who are up-to-date on their monetary history know what happened next…

Credit was introduced to help create the illusion of wealth, while real wealth was funnelled into fewer and fewer hands. One of the main methods for accomplishing this was the demonization of gold after its removal from the monetary system in 1971. However, if you went against this narrative and even suggested gold would go to $100 per ounce, you were ridiculed. What happened next?

Not only did gold account for the paper currency supply, but also in 1980 for a couple weeks gold actually accounted for all the outstanding credit currently in circulation. Once again revaluing itself to account for all currency in circulation at the time, and again, those choosing to hold gold over paper USDs saw their purchasing power touch the sky.

After the 2008 Great Recession the money printers were turned to overdrive to bail out the debt based system that had began to show signs of failure. In 2015, for gold to make the same accounting move it has done throughout the last 100+ years – a value of over $47,000 per ounce gold would have equated for the currency supply plus the same overshoot it did in 1980. These numbers have only been blown out even more as since 2020 the money printers found a gear above overdrive, pumping 80% of all USDs in existence into the system. For gold to make the same accounting move now you are looking at a gold value incomprehensible to most people.

One thing is for certain, the financial landscape is shifting dramatically and a new monetary system that the world operates within is in the conception phase. Once again, those championing gold and silver are being ridiculed for their optimism – however, history shows, those on the side of precious metals will preserve their purchasing power long after each fiat currency passes on in place of another.

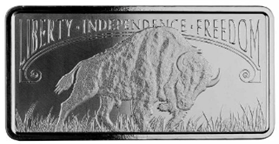

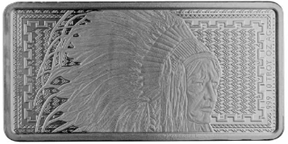

Silver and gold not only provide their holders with a sense of self-empowerment – these metals allow for each individual to reclaim their liberty, independence, and freedom. If you want a bar to mark this critical moment in history, there is no better way to do it than with the Scottsdale Mint 10oz Silver Buffalo Bar below.

Hi,

Hi,