In our previous newsletter we wrote about an arbitrage in gold and silver prices between China and the United States that had created a vacuum pulling physical metal out of the United States only to then promptly empty its golden dust bag within China’s border. Essentially, due to China’s Shanghai Gold Exchange valuing silver and gold at a higher USD price per ounce than American exchanges, accredited investors were incentivised to purchase gold and silver in the United States only to sell it to Chinese buyers within the hour for an easy profit.

We argued that overtime this would force silver and gold prices higher UNLESS the Shanghai Gold Exchange were to bring its prices back down to level with American prices. With that said, the Shanghai Gold Exchange price did not come down over the last 10 days, it has only continued to creep higher forcing American prices up along with it. Just yesterday (March 5th, 2024) gold in USD on American exchanges reached an intraday high of $2140 USD/oz pushing the all-time price higher during trading hours and ultimately putting stronger pressure on prices as the market closes. And just think, gold has continued to show such incredible strength during a time BEFORE the Federal Reserve has decided to officially cut interest rates. There are many expecting gold and silver to rally once rates are inevitably cut due to the banking crisis only picking up steam, but with such positive price action occurring beforehand, gold is giving clear foresight into the sheer strength these precious metals have been storing up.

Of course, the high praise of how gold has performed lately is not in anyway meant to downplay silver – it is actually quite the opposite. We have long stood on our position that gold will make the first strong move and will kick the door down allowing silver to ultimately sprint through it. If you are one who is in opposition to this stance, consider that gold continues to touch all-time-high prices, while silver remains more than 50% below its all-time-high of $50 USD in 1980 and is a CRITICAL industrial metal… crucial to human advancement as a society; that on top of being a monetary metal. Gold is forcing the ceiling higher and higher, while silver continues to coil and store energy for a long overdue sustained price increase.

When returning back to the price arbitrage in precious metals between China and the United States, it too points toward silver having far more upward potential than gold on a percentage basis. On February 21st, 2024, the price arbitrage between China and the United States for gold sat at 2.55% with the higher price being in China on the Shanghai Gold Exchange. That same day, silver’s arbitrage sat at 8.98% with the price again being higher in China on the Shanghai Gold Exchange. At the time of writing, the arbitrage between gold prices has shrunk while the arbitrage in silver prices has become larger as the price for silver in China continues to fly. Currently, prices for gold and silver in both countries are as follows:

GOLD

China ($2162.98 USD/oz)

US ($2132.08 USD/oz)

Variance = 1.45%

SILVER

China ($26.37 USD/oz)

US ($23.74 USD/oz)

Variance = 11.08%

As you can see, going off the Shanghai Gold Exchange, silver would be expected to see a much larger price rally in the near-term than gold; with many arguing that would be the case for the entirety of the coming bull market in precious metals.

Breaking the price variances in gold and silver between these two superpowers down further indicates that this arbitrage does put real pressure on American prices to increase to catch up to Chinese prices rather than the reverse of having Chinese prices fall. Going back to our newsletter on February 21st when we first identified this price difference, in the United States the gold price was $2018.46 USD/oz, with gold currently sitting at $2132.08 USD/oz, an increase of 5.63% in 14 days. On silver’s side, on February 21st the price in the United States was $22.95 USD/oz, while today it sits at $23.74 USD/oz, and increase of 3.44%.

It is becoming crystal clear that the immense amount of purchases of precious metals by central banks led by China is beginning to have a real world impact on prices and it is only a matter of time before European and Western nations stop trying to win this financial war with debt, and themselves begin scrambling for hard assets such as silver and gold. The reason we say that is because even United States congress member, Rep. Mooney, recently pressed Jerome Powell about how many tonnes of gold other countries had repatriated from the New York Federal Reserve vaults; a very simple question. A question that was dodged and remained unanswered, which has started to spur controversy on why Jerome Powell, Chair of the Federal Reserve, may not want the American public to know just how much the international community is valuing gold and silver at present times.

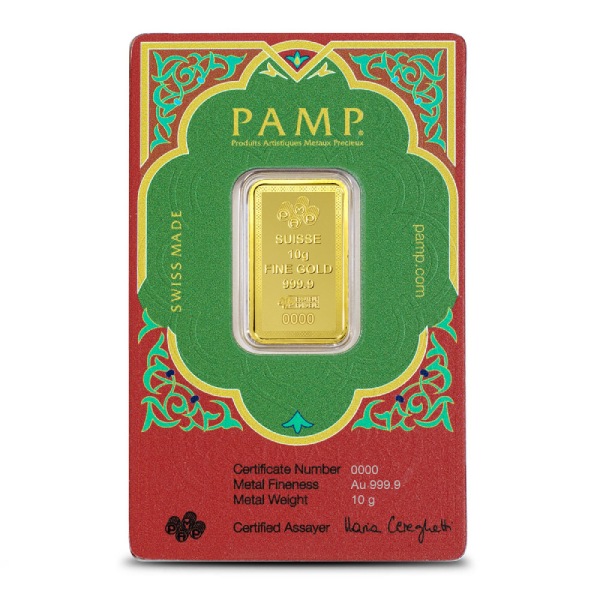

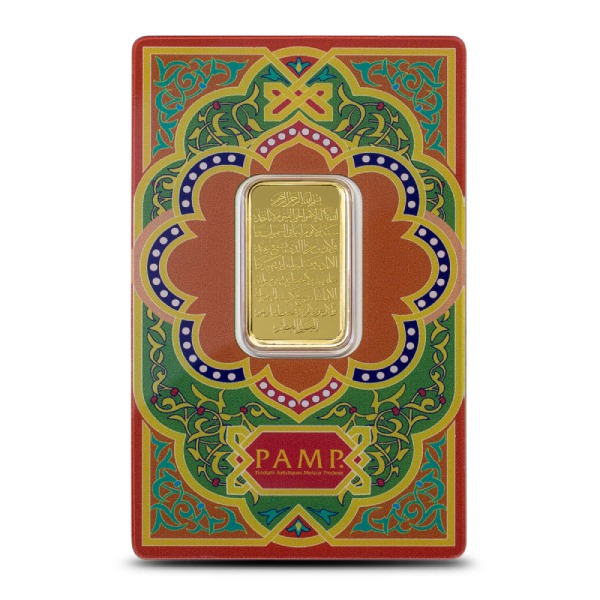

Our position has long remained the same. Silver and gold are considered precious and have been used as money for thousands of years due to their scarcity. Those with majority of the world’s wealth only ever want more and we foresee a massive transfer of wealth from those with intangible debt based assets to those with tangible real value assets like silver and gold. That is why central banks have been buying gold and silver hand over fist, while simultaneously staying tight-lipped on why they are doing so… the more citizens buy the less there is for them because like true money should be, silver and gold are in VERY LIMITED supply. If you want to ensure you have stored up enough physical wealth, Au Bullion, as you know, is always here to help you out. Below you will find our lowest premium silver and our lowest premium gold, along with the STUNNING 10 Gram Ayatul Kursi Gold Bar!

Assorted 1 Oz Silver Rounds & Bars

Circulated 1 Oz Gold Bars | Royal Canadian Mint

Hi,

Hi,