Much of the world’s focus has been directed toward the Federal Reserve and how their policy decisions are going to impact not only the American economy but also that of the entire world. The only reason the Federal Reserve gets so much attention is due to the USD holding status as the world reserve currency, and therefore, the policy put forth by the Federal Reserve has large implications on all other countries. However, there have been news stories coming out of the East to start 2023 that are gaining very little Western media attention, yet, each story continues to beg for the question to be asked: “how long can the USD hold onto world reserve status?”

The first story is a continuation of what surprised global markets in late December of 2022. That being the Bank of Japan increasing their yield cap on their 10-year government bonds to 0.50% from 0.25%. While this caused a massive shock in the market due to the Japanese yen surging to multi-year highs against the USD; what has caused an even more severe shock is the potential for that cap to be lifted higher once again as yields on the 10-year government bond in Japan surged past the 0.50% cap again today. This coming AFTER the Bank of Japan stated in December after the first cap increase that they would be spending 9 trillion yen ($69.02 billion USD) per month in Q1 2023 to support the cap. On January 12th, 2023, they spent 4.6 trillion yen ($35.28 billion USD) in ONE DAY and the 10-year yield still did this:

What most people are missing is that Japan is the largest creditor nation in the world holding over $3 trillion dollars in foreign assets, of which, over 50% are held in the United States alone. According to reports out of Bloomberg, expressed as a percentage of the GDP of the country in which Japanese assets are invested, Japanese stock and bond holdings break down to 7.3% of America, 7.5% of France, 8.3% of Australia and 9.5% of the Netherlands. What is going to happen if suddenly Japanese yen denominated rates become more attractive and are no longer artificially held down being allowed to rise? Well, much of that capital will be repatriated back to Japan meaning USDs, Euros, and other currencies will be shed in favour of the rising Japanese yen putting added inflationary pressure on those countries that are seeing their currency return home. With Japan being the largest creditor nation in the world for the past 31 years, they have A LOT of foreign currency to sell off, so if they start shedding foreign debt at a rate quicker than they already are, a change of such magnitude could shock the entire global system. It is safe to say this policy decision (to be made by the end of the week by the Bank of Japan) has not been getting near enough attention as it serves to dog pile onto the already ever-increasing mountain of risks in paper assets, additionally adding to the safe haven attraction held by gold, silver and other physical commodities.

Bank of Japan continues to increase the pace at which it sheds foreign debt holdings.

Flow of capital into foreign bonds out of Japan has been net negative since late 2021.

Another story that continues to develop that has stark implications for the USD is the talks coming out of Saudi Arabia to price their oil and take settlements in currencies and assets other than the USD. This began to catch coverage after Xi Jinping visited Saudi Arabia and left confirming that the China and Saudi Arabia were discussing settlements of Saudi oil for Chinese yuan for the first time in over 50 years. Yesterday, Saudi doubled down on this idea stating in Davos that they would be open to pricing oil in a multitude of currencies including their own Saudi riyal. It bears repeating that the only reason the USD has such high demand around the world is because the world’s largest oil producer, Saudi Arabia, agreed to price their oil in no other currency but the USD. It is a forced demand, not real demand. If this ends, and with each day it appears that day is getting closer, not only will Japan be shedding the USD but the world will also. This again, will cause unseen volatility in paper assets similar to the situation developing in Japan. It should come as no surprise to people that commodities (assets with real tangible value) are projected to do so well in 2023 by most major financial institutions while many world governments restructure their financial systems.

The final blow to the dollar being reported this week, is the advancing talks between two resource rich countries, Russia and Iran, who are both also looking to shed reliance on the USD. It was announced just this week that the two countries would in tandem be developing a digital currency backed by gold to “replace the dollar, ruble, and rial for foreign trade settlements.” While there would need to be far more transparency than there is now and than there was in the past with any currency being gold-backed – you can see a continued shift toward tangible assets taking place on a global scale.

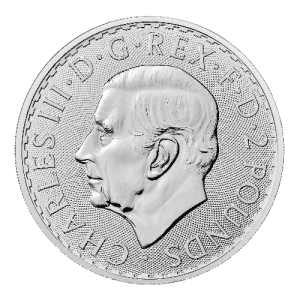

If you too want to shift some of your wealth from paper assets into physical commodities with real value, while also being one of the first to get your hands on physical bullion with King Charles on the obverse – check out the new 2023 1oz Silver Britannia now available for pre-order.

Hi,

Hi,