Investing in precious metals is an attractive option to many investors looking to hedge against soaring global inflation due to the rapid currency printing taking place across the world. The right type of bullion and size of piece can maximize your investment potential and ensure that you get the best return on your money, while also preserving flexibility in how your precious metals can be spent in the future. It’s important to understand the different types of bullion available and how they can influence your purchase decisions. Let’s look at some of the factors that may help you decide which type of bullion is best for you.

The Gold/Silver Ratio

The gold/silver ratio is an important factor when it comes to investing in precious metals. This ratio compares the price of one ounce of gold to the price of one ounce of silver, and it can help determine which metal is most cost-effective for any given purchase. When speaking toward the mining aspect, silver and gold come out of the ground anywhere between 7:1 and 12:1, meaning for every 7-12 ounces of silver mined, there will be one ounce of gold. Historically, silver and gold look to be priced around 20:1 when allowed to find their free market value. Generally, if the ratio is higher than 50:1, it’s more advantageous to buy silver; if it’s lower than 40:1, then it may be more advantageous to look at gold. In other words, if gold is more expensive than silver relative to its historical average, it may be wise to invest in silver instead, and vice versa if gold is cheaper than historical averages.

Size Matters

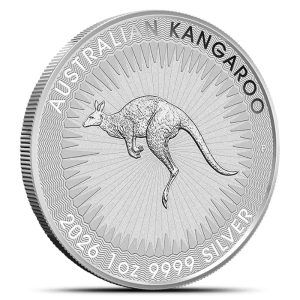

Bullion comes in various shapes and sizes—from coins and bars to rounds and ingots— with each type/size having its own benefits. For example, coins tend to be easier to trade because they are more widely accepted by dealers around the world due to them coming from sovereign mints in most cases; however, they also tend to have higher premiums due to their collectible value. Bars tend to have much lower premiums but they may require extra fees when trading them with third parties (e.g., banks). Rounds come in similar sizes and weights as coins but do not typically have collectible value due to them being minted by any refiner melting precious metal and not necessarily a recognized sovereign mint; this makes them attractive for investors on a budget who want maximum returns for their investments. Finally, ingots come in various sizes from very small (called “grain”) all the way up to 1 kilogram bars; these are ideal for larger investments since their large size makes them cost less per ounce than smaller items like coins or rounds. All that said it is also important to consider the size of each piece, as sometimes an ounce of gold can cost too much for investors on smaller budgets. That is where fractional gold or silver comes into play. These pieces allow for investors to get smaller pieces, which also grants them more purchasing flexibility if prices rise higher, as trading a 100 ounce bar for a weeks worth of food at the grocery store may prove to be difficult due to its high value.

Tax Considerations

In addition to considering which type of bullion is best for you financially, you should also consider any tax implications associated with buying or selling bullion items. For example, if you’re buying or selling over $2,000 worth of silver or gold coins from certain countries (like Canada), then you must pay taxes on those transactions; this applies even if those coins have no numismatic value (i.e., are not collectible). Tax laws should always be taken into account when investing in precious metals so that investors don’t incur any unexpected costs down the line.

Investing in precious metals requires careful consideration of several factors such as the gold/silver ratio and tax implications before making a purchase decision. Knowing what type and size of bullion will fit your needs will also help ensure that your investment pays off down the road! With careful research and analysis, savvy investors can make smart decisions about which type of bullion will give them maximum returns on their investments while minimizing risk exposure along the way. Here at Au Bullion, we are committed to helping you satisfy your precious metal needs, whatever they may be!

Tags: Sovereign Mints

Hi,

Hi,