The global economy is undergoing a seismic shift, as outlined in the International Monetary Fund’s (IMF) recent blog post, “The Global Economy Enters a New Era.” Which knowing what we know about where our financial system is heading is an awful eery headline as we know any real change to the global economy will come with severe growing pains. Since late January 2025, a barrage of U.S. tariff announcements targeting Canada, China, Mexico, and over 50 other countries has pushed global trade into uncharted territory. The U.S. effective tariff rate has surpassed levels seen during the Great Depression, with counter-tariffs from trading partners further inflating the global rate. The IMF’s reference forecast now projects global growth at a sluggish 2.8% for 2025, a sharp downgrade of almost a full percentage point from January. Remember, down 3% growth to 2% doesn’t appear like much due to the numbers being small, but this represents a 33% decline in global growth, a far starker warning.

This “epistemic uncertainty,” as the IMF calls it, is wreaking havoc. Supply chains, already strained from pandemic-era disruptions that never fully recovered, face new pressures as tariffs disrupt intermediate goods flows, amplifying economic shocks in all regions of the world. In the U.S., growth is expected to limp along at 1.8%, with inflation ticking up by 1 percentage point due to tariff-induced price hikes. China’s growth forecast has been slashed to 4%, and emerging markets are bracing for significant slowdowns. The ripple effects are clear: businesses are pausing investments, financial institutions are tightening lending, and oil prices are sliding as confidence wanes.

Adding fuel to the fire, Japan, the largest foreign holder of U.S. Treasuries at $1.13 trillion, is hinting at leveraging its holdings as a bargaining chip in tariff negotiations with the Trump administration, according to the Associated Press. Finance Minister Katsunobu Kato’s remarks suggest Japan could sell off Treasuries to pressure the U.S. into favorable trade terms—an unprecedented move that could destabilize the U.S. bond market, long considered a bedrock of global finance. China, the second-largest holder, faces similar incentives as trade tensions escalate, raising fears of a broader sell-off that could erode the perceived safety of U.S. government debt, which would have devastating effects for countries and citizens alike without financial protection via precious metals and other tangible goods.

The Gold Rush: China’s Strategic Pivot

Amid this chaos, gold is emerging as a beacon of stability. The South China Morning Post reports that Chinese investors poured a record 16.7 billion yuan ($2.3 billion) into gold exchange-traded funds (ETFs) in Q1 2025, boosting holdings by 23 tonnes—the highest quarterly net inflow ever recorded by the World Gold Council. This surge drove China’s gold ETF assets to 101 billion yuan and 138 tonnes of gold, both all-time highs emphasizing just how much Chinese citizens and investors are valuing gold at present during times of financial turbulence. Meanwhile, Chinese purchases of gold bars and coins reached 124 tonnes, accounting for 38% of global demand, a massive percentage of overall gold consumption, while Chinese ETF purchases made up another 10% of the 226-tonne global total.

This isn’t just retail enthusiasm. The People’s Bank of China has been stockpiling gold for 16 consecutive years, holding 2,292 tonnes by March 2025 (which is likely far understated)—6.5% of its foreign-exchange reserves, a historic peak. Analysts point to fears of yuan depreciation, fueled by U.S. tariffs of up to 245% on Chinese goods and a record low for China’s offshore currency at 7.4290 yuan per U.S. dollar. “When global financial markets face uncertainties… China is likely to reduce its holdings of U.S. Treasuries in favor of gold, the most reliable alternative,” said Anderson Cheung of Best Profit Capital.

This pivot reflects a broader trend. Global central banks are on a gold-buying spree, with prices hitting another 20 record highs in Q1 2025 alone after nearly 40 all-time highs in 2024. As U.S. Treasuries lose their safe-haven status amid tariff-induced yield spikes and potential sell-offs, gold’s allure as a non-debt-based asset grows. Silver, often overshadowed, is also gaining traction as a more affordable hedge, with industrial demand bolstering its value in an era of supply chain disruptions.

Banking Woes and Systemic Risks

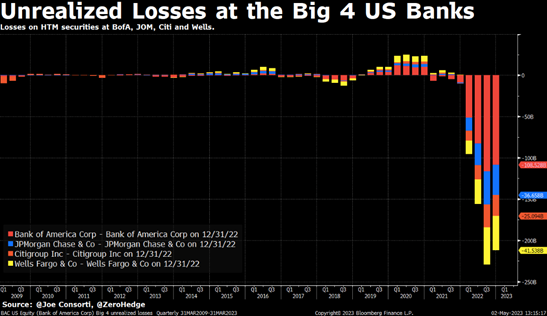

The fragility of the financial system is further exposed by developments in the U.S. banking sector. The Wall Street Journal reports that the Federal Reserve (Fed) is reviewing its confidential ratings for large banks, with two-thirds deemed unsatisfactory in 2024. These poor ratings restrict banks’ ability to pursue deals and therefore increase profits/overall bank health, exacerbating liquidity concerns at a time when economic growth is faltering. Really though, while this came as a shock to many that two-thirds of all large banks had bad internal Fed ratings, major banks with poor confidential ratings should be nothing that surprises anyone who reads our newsletters. It is worth reminding you that major banks are currently facing unprecedented levels of unrealized losses. The moment they become realized losses could throw the financial system into pure pandemonium. Just look at the chart below… truly jaw-dropping data.

Meanwhile, a power outage that lasted nearly 24 hours in Spain and Portugal, reported by many media outlets, left card users stranded, exposing the vulnerability of digital payment systems. Hospitals, ATMs, and point-of-sale terminals were crippled, underscoring the risks of over-reliance on electronic infrastructure in a crisis-prone world. Such events amplify the appeal of tangible assets like gold and silver, which require no power grid or central authority to retain value or to be used as a means of exchange.

The Case for Precious Metals

The current economic landscape is a minefield of risks: soaring tariffs, currency volatility, banking instability, and infrastructure vulnerabilities. Gold and silver offer a hedge against these threats. Unlike fiat currencies, which can be devalued by policy shifts or geopolitical strife, precious metals are finite and universally recognized. Their value doesn’t hinge on the stability of any single government or financial system, making them a bulwark against the erosion of wealth in turbulent times.

China’s aggressive gold accumulation, both at the state and individual level, sets a precedent. Other nations, wary of U.S. dollar dominance and Treasury market risks, are likely to follow suit. Recently, as gold has pulled back from $3500 USD/oz, all you seem to hear is that gold is finished or that gold has been underperforming. This is recency bias at its peak. This is how gold has performed the last 365 days:

Gold Today (May 5th, 2025, pre-12:00pm)

+2.20%

Gold Past Month

+9.14%

Gold Since January

+26.40%

Gold Past 365 Days

+43.81%

As always, gold speaks for itself.

Hi,

Hi,