BRICS+ and other Eastern countries have been receiving mass amounts of our focus over the past few months due to the seismic shift these countries are initiating regarding the world financial system. The turn back toward gold, silver, oil, rare earth metals, and other crucial commodities to human survival has been a long time coming as more and more people are thrust into poverty due the unsustainability of the current debt-based fiat currency system. Today, that is not going to change, as for the first time since Russia pegged the Russian Ruble to a fixed amount of gold after having their United States Dollar denominated assets frozen, we saw an arbitrage in gold and silver prices moving from West to East.

This occurred on February 19th, 2024, when the United States had a banking holiday due to it being President’s Day. On these rare occurrences, China and other countries open as usual if they do not have a holiday that same day – this past Monday, China remained open for business while the United States was closed. As we have been writing about extensively, going back 15-months, China has been on a buying spree of gold bullion, putting upward pressure on Western USD/CAD prices as the Shanghai Gold Exchange price continued to push higher. On a regular business day when the United States is not on a banking holiday, you often see a high volume of future silver and gold contracts sold in the West to push prices down, while physical bullion is gobbled up out East, pushing prices up – keeping prices relatively stable. We have noted that due to future contracts being paper silver and gold, the physical purchasing of bullion by China and other Eastern countries is far more effective as it actually impacts the finite supply of precious metals left on the market over time. Selling of paper precious metals simply acts as price speculation tool that has also been proven through fines of JPMorgan to be a cog in the machine of price manipulation to make these metals look less valuable than fiat currency. In the end, it is a charade ended by the physical purchasing of the East.

That said, back to the price arbitrage that was created on Monday. Due to physical purchases of bullion continuing in China with no future contracts being sold in the United States, we saw gold on the Shanghai Gold Exchange reach $2070 USD/oz, while simultaneously it was selling for $2018.46 USD/oz in the United States. Silver was the same story reaching $25.00 USD/oz in China, while selling for $22.95 USD/oz in the United States. That is a massive price difference of 2.55% in gold and 8.98% in silver. The reason this is worth noting is because it gives incentives to investors that have the authority to do so to actually drain the West of silver and gold, and send it out East. Hastening the process of China de-dollarizing and moving toward sound money.

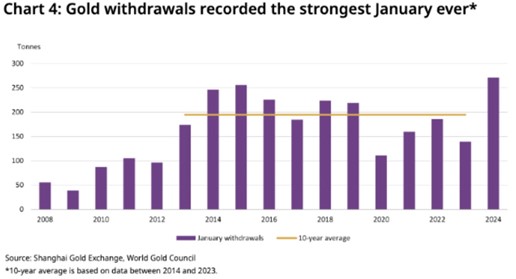

This, of course, would really be no surprise as this past January of 2024 China saw a record amount of outflows of gold from the Shanghai Gold Exchange and other ETF holdings in any single January. Simply put, Chinese citizens along with its government are speeding up the already record pace at which they are purchasing gold. The chart below speaks for itself as withdrawals of physical gold by citizens soared past the 10-year average (yellow line).

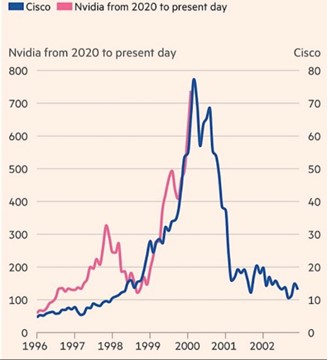

Turning our attention back to the United States, we begin to even further understand why Chinese citizens along with the Chinese government are rushing toward physical gold and silver. In case you have not been following the fiasco that is Nvidia Corporation, which in the last calendar year has seen its stock rise to the tune of 224.96%, pulling the S&P 500 with it along with investor delusion. Because, yes, while many investors are championing their current gains, as seen with past economic collapses, unless on the inside, most people do not know when to take their profit and run, and ultimately get dragged down with the system. Of course, it would be easy for people to say that we are just pushing this nonsense because we own precious metals – and that would be wrong. We love precious metals due to the protection they provide not only us, but our friends, and our family, and it gives us great fear to hear when people we love are invested in stocks with no exit strategy. Especially, when the stock market is setting up like this:

The above is a stock overlay of Cisco from 1996 to 2003 and the aforementioned Nvidia Corporation between 2020 and 2023. The rise looks almost identical and what remains to be seen is if the drop will carry the same resemblance. What people do not know is that Cisco was a company that led the rise in stocks during the 2000 dotcom crash. In 2000, Cisco was trading at over $79 per share, by 2002 the stock had plummeted to $8.96, an 88.66% crash that pulled many investors down with it.

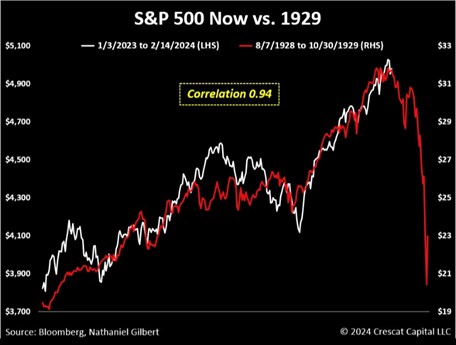

From there, we know there will still be some people shouting that this is an isolated incident and that we are cherry picking. Which is fair, it is just a comparison of 2 stocks. However, the below chart is a full S&P 500 comparison between today and the 1929 crash that led into the Great Depression:

A staggering 94% correlation between the two time periods. Again, all that is left to see is if the drop is similar.

In just this newsletter we have drawn stark comparisons between today’s stock market and the devastation that occurred during The Great Depression, along with comparisons to the 2000 dotcom crash. Going back through our past newsletters you will also find extensive correlation to 2008 (almost eerily correlated), as well as recessions seen in the 70s, 80s, and 90s. What is more baffling than how we got ourselves in this debt spiral in the first place is the fact that people actually believe this time will be different and that there won’t be any consequences to our financial recklessness indulged upon on a world scale.

It truly is only a matter of time before the cracks of this system bust wide open and an avalanche of financial destruction washes over the world. It unfortunately has to happen, as the world is far too saturated in debt to ever recover to widespread prosperity without the implementation of a new system, and we believe BRICS+ is on route to doing so. The real key is how they are doing it… with gold and silver as the base of their money. If you would also like to base your money on sound principles, here at Au Bullion we are running an extended Family Day sale where you can find assorted 1 Oz Generic Silver Rounds for only a couple dollars over melt price.

Hi,

Hi,