Within precious metals circles it is likely well understood that precious metals were a mixed bag this year. Gold and silver performed outstandingly, while platinum and palladium finished the year in the red. However, what is likely far less understood is just how well gold and silver performed in comparison to other traditional investment classes that most citizens would find themselves in. Which, of course, is a great benchmark to use when evaluating how your investments did during the year. Understanding that gold and silver are traditionally long-term investments, and their performance is not solely based on a single 12-month cycle, it is still important to understand how each investment is trending to ensure you are still optimizing your buying and selling. With that said, let’s dive right in.

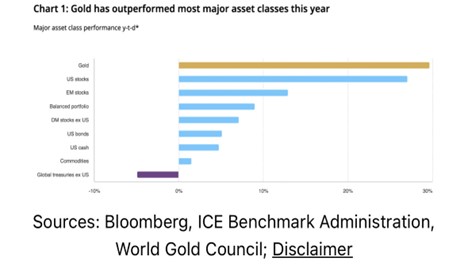

Your most common asset classes that citizens find themselves in are the following:

- United States Stocks

- Emerging Market Stocks

- Developed Market Stocks (excluding the United States)

- A Balanced Portfolio of Cash, Bonds, and Stocks

- United States Bonds

- United States Dollars (Cash)

- Commodities

- Global Bonds (excluding the United States) and

- Gold

What is left out on the chart below is silver as a standalone asset class, however, we will bring that into the comparison.

With that said, what you are seeing above is that through January to December of 2024, gold was the best performing asset class in the world edging out United States stocks when it comes to the most common investments made worldwide. This is during a time where United States stocks are in an incredible bull market with many calling for a 2000 or 2008 style crash sometime in Trump’s second term as President. On the contrary, high inflation estimates into 2025 are fueling gold and subsequently silver giving them sustained strength moving forward.

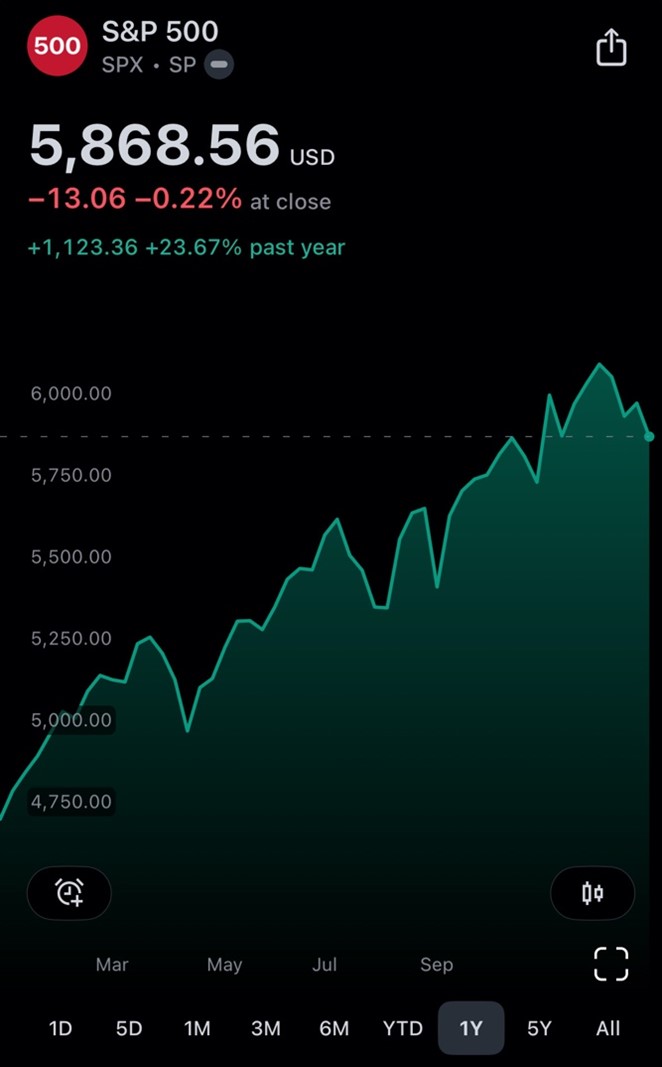

Breaking the United States stock section into the four largest indexes, this is how they stacked up against gold and silver in 2024.

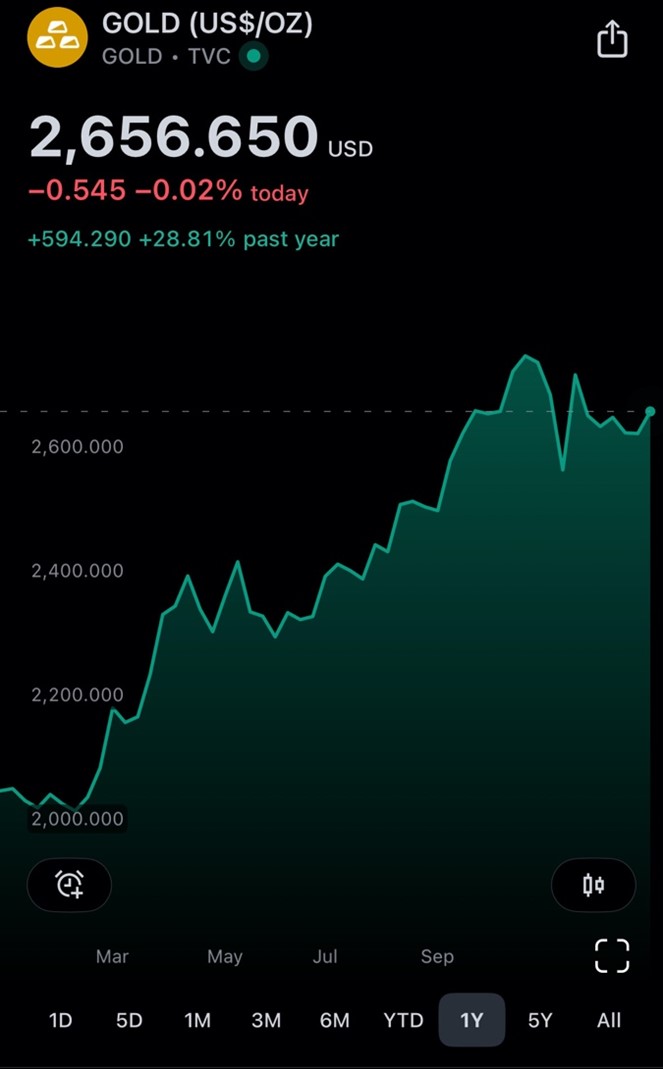

#1 – GOLD

28.81% Increase in 2024

#2 – NASDAQ

25.85% Increase in 2024

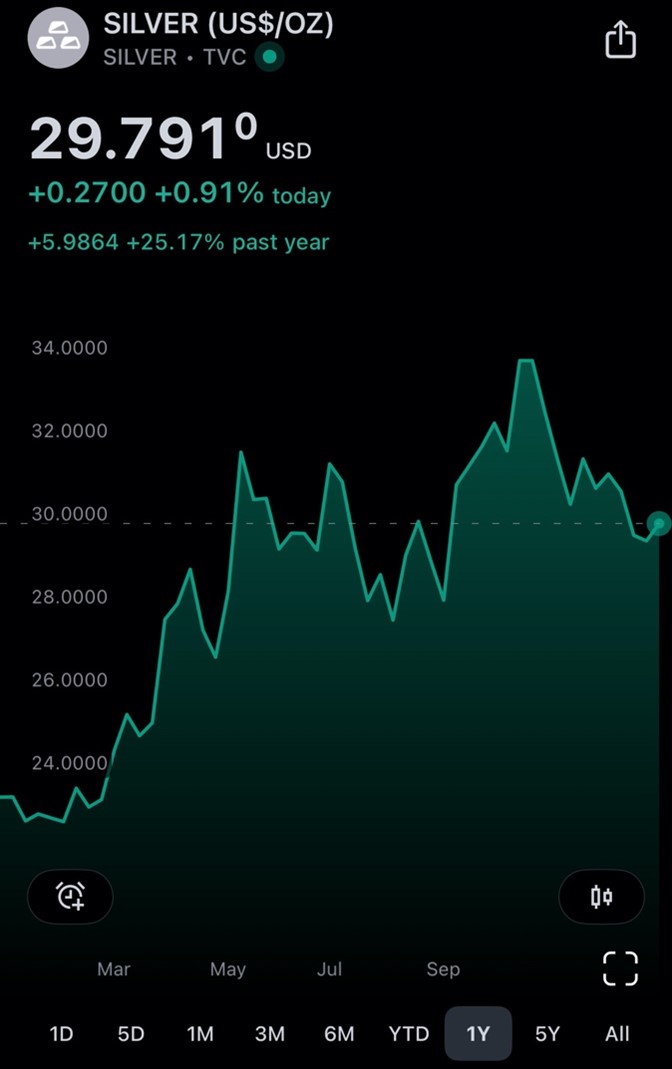

#3 – Silver

25.17% Increase in 2024

#4 – SP & 500

23.67% Increase in 2024

#5 – Dow Jones Industrial Average

12.85% Increase in 2024

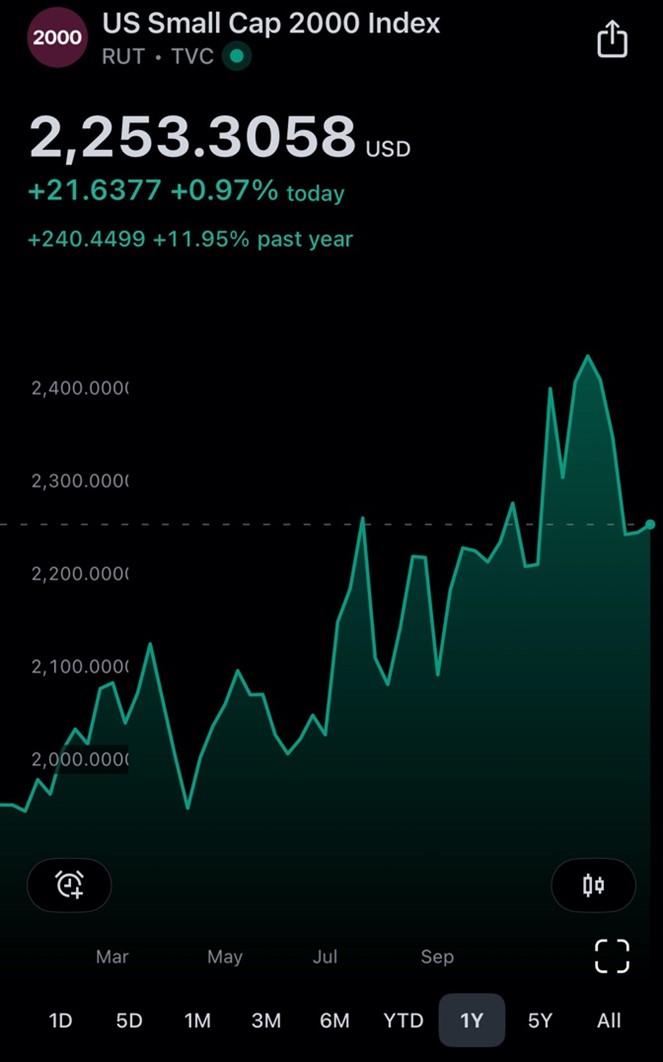

#6 – Russell 2000

11.95% Increase in 2024

What is truly remarkable is that during such an unprecedented stock market rally due to the creation of so much new currency over the past 4 years, gold outperformed all major indexes with silver solely falling short to the volatile tech heavy NASDAQ. However, even with that said, the NASDAQ itself is comprised of over 3,300 companies with five heavily outweighing the remaining 3,295 when it comes to how heavily their performance impacts the NASDAQ itself.

Apple is 11.7% of the NASDAQ. Nvidia is 11.1%. Microsoft is 10.3%. Amazon is 7.2%. and Alphabet (or Google) is 6.8%. Making for a total of 47.1% of the entire index. Noting that, and understanding the entire composite performed to a tune of 25.85%, when you see that these five companies far outperformed the rest of the index you see that the NASDAQ as a whole really did not perform all too well, and those companies that are leading the charge are heavily reliant on silver for their products and business operations making silver a vital investment for each of those tech behemoths.

SILVER

Focusing more closely on silver and the year it had, we turn to simple supply and demand. Silver’s physical demand is estimated to reach 1.21 billion ounces to finish 2024, with supply rising just 1% leaving the physical deficit at a staggering 184 MILLION TROY OUNCES of silver. Also note, industrial demand alone, as mentioned in our previous paragraph regarding tech companies, ticked up 7% and is projected to surpass 700 million troy ounces for the first time in history and represents a jaw-dropping 68.2% of total supply.

Need we remind you that India from January to April of 2024 alone imported 134,132,915 troy ounces of physical silver, over 13% of total yearly supply for the world in just 4 months. That being more than their entire 2023, which at 116,546,456 troy ounces of silver imported was a yearly record. In comparison, during the same 4-month span in 2023 India imported only (and we say only simply due to the staggering 2024 numbers) 14,628,589.7 troy ounces of physical silver. India has a clear understanding that physical silver is vital to human advancement and for a country and citizen alike to prosper and therefore has taken it upon themselves to continue to purchase record amounts of silver through 2024.

GOLD

When turning our attention to gold, you see a similar story. In 2022, central banks set the record for yearly net gold imports purchasing 34,787,107.8 troy ounces of physical gold. They then followed this up closely by purchasing another 33,340,324.2 troy ounces in 2023. Through the first 9-months of 2024, central banks have accumulated 21,525,889.4 troy ounces of physical gold. If they were to keep a consistent pace their final count for 2024 gold bullion purchases would come to 28,701,185.9: shy of the 2022-23 mark. However, through January-March of 2024 central banks set a new Q1 record purchasing 7,392,421.16 troy ounces of gold. If they were to set a Q4 record, they may set a new yearly record along with it.

While central bank purchases were down in 2024 in comparison to 2023, it is important to remember that the years of 2022 and 2023 saw record amounts of gold being purchased and should in no way take away from the amount they continued to purchase in 2024. 2024, barring a massive uptick in Q4 being reported in January of 2025, will go down in history as the 3rd largest buying year in history by central banks of gold bullion. That would mean, the last 3 years has represented the largest gold buying spree the world has seen in modern history. To suggest inflation will disappear and that the world economy that is riddle with debt will magically fix itself in 2025 is appearing more and more like a pipe dream with each passing day. With the reality pointing toward gold and silver becoming the bedrock of a future financial system to provide much needed stability. The only question that remains for 2025 is, “will the banks have all the physical gold and silver, or will citizens begin to buy in record amounts in the same fashion as central banks, inevitably becoming their own bank, securing their wealth in the process?”

Hi,

Hi,