Ever since Bitcoin’s (BTC) release date on January 9th, 2009, shortly after the Great Financial Crisis of 2008, there have been a plethora of theories that have been thrown around as people began to speculate on what exactly this digital form of currency would come to be. There were some that felt it was the future of money, a digital currency that allows you to carry around your entire life savings in your pocket, but unlike today’s digital bank accounts most of us carry around on our phone, you could not create more BTC and so therefore it was argued it was the superior form of money. The obvious downside to that is if you lose your phone today, your entire life savings did not just get lost with it, as with cryptocurrencies and BTC alike, once they are on an offline hard wallet, they can only be recovered from THAT specific piece of hardware. No online app will be able to help you recover your lost wealth that may either have fallen down a sewer drain in downtown Toronto or has slipped between your couch cushions.

Another theory that was debated vigorously was that BTC was not actually released by a monetary pioneer looking to free the people under the alias of Satoshi Nakamoto but was instead created by government authorities. The theory suggests that BTC is meant to act as a conditioning tactic to allow for the public to get used to the idea of there being purely digital, non-tangible currency, so that when the 160+ countries inevitably release their Central Bank Digital Currencies (CBDC) to replace our current form of currency, there will be less pushback to the idea that cash is a thing of the past. This theory also suggests this is why cash has been slowly replaced in favour of debit and credit cards to make that transition to a cash free and digital economy even smoother. Of course, there are those who understand the capped amount of BTC at 21,000,000 does not allow for its supply to be diluted by creating more the same way a CBDC would be able to be mass produced the same way our fiat Canadian or American Dollars are today, therefore eroding their value. And it is those people with that understanding of the limited supply of BTC that will lead us to our 3rd theory that is by far the most prevalent in circles that champion BTC as the king of money.

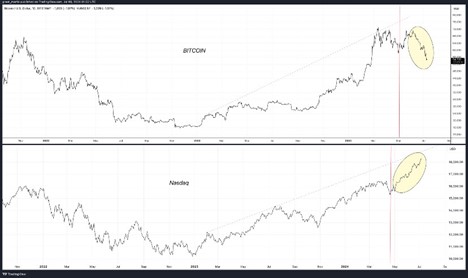

This theory is one that is spread not only to champion BTC, but also to try to slander the value of silver and gold bullion as they are BTC’s direct competition, acting as if over 5000 years of evidence to the contrary of their beliefs can simply be disregarded. The theory is that BTC is the ultimate store of value. Which, on the surface, appears to be plausible. It has a capped supply, so isn’t it natural it would store value over time? Not exactly, as that would be too simplistic. What is not told is that there are thousands of other cryptocurrencies that have been created, with a majority having a fixed supply. Sure, some have a supply that are in the 100s of billions of coins, but they are still capped at a limited supply, so why would only BTC be the ultimate store of value as many of those capped supply cryptocurrencies have returned to their innate value of zero? Also, if we investigate BTC a little further, you will see that BTC has always acted very much like a speculative tech stock, tracking the NASDAQ very closely. Which really makes perfect sense when you consider that purely digital currency and the blockchain they run on are a new form of technology. Many believe, it will survive and stick around, but with central banks creating CBDCs that are sure to be the main competition to non-government owned or controlled cryptocurrency, it is yet to be determined what will survive. One thing we know will survive and continue to be accepted as money in every country in the world is precious metals, namely, silver and gold. Look at this chart below to see how closely BTC has been correlated to the tech heavy NASDAQ since 2022 when they began to print massive amounts of currency. We will speak to the divergence that recently occurred shortly.

It is clear these two assets move in a very similar pattern, with BTC showing far more volatility in its moves than even the volatile NASDAQ.

This leads us directly into our final point on why silver and gold are the true stores of value and why BTC, while taking nothing away from it as an asset, is purely speculation and in NO WAY should be at this time considered to be a store of value. Selling it as such would be doing a disservice to whomever has purchased it under those false pretences. Just to ensure we are all on the same page, a store of value is defined as such:

A store of value is any commodity or asset that would normally retain purchasing power into the future and is the function of the asset that can be saved, retrieved and exchanged at a later time, and be predictably useful when retrieved.

The first ¾ of that statement certainly includes both BTC, as well as gold and silver. However, the very last part “and can be predictably useful when retrieved” is where BTC falls out of the game. BTC has such violent swings in value, it should not in any way be used as savings during times of economic struggles as we are seeing today. Of course, when BTC is up near $75,000 USD per coin, that is great, but then when 3 months later when it is worth $55,000 USD per coin and your savings have been eroded by nearly 20%, that is far from ideal. Especially, if you needed the savings during a time it was taking a massive dip in value. What is also interesting is that whenever you see BTC being illustrated online, it always appears as a gold bullion coin, almost as if those creating the images know gold portrays real value.

When it comes to silver and gold, while they do move up and down in value day-to-day or week to week, you would never see such violent swings in their value during tough economic times and if you did, it would be to the upside to store, secure, and preserve purchasing power over time. Which means, when you need your gold and silver bullion, you do not need to worry about it being far less useful or valuable than when you saved it for a rainy day – the definition of a store of value. A quick reminder, while BTC is tumbling, silver and gold continue to hold a year-to-date gain of over 34% for silver and 15% for gold.

To briefly close out, the divergence you are now seeing between BTC, and the NASDAQ is a curious one due to them being so correlated the past 2 years. There are theories being discussed on why this may be, but the most spoken about one is that BTC is giving an indication that speculative assets like stocks are about to take a major downturn. Of course, this is impossible to confirm until stocks follow BTC downward or BTC pops back up ending speculation. What we do know for sure is that silver and gold have always been and will continue to be far and away the most superior forms of a store of value. Those who choose to turn a cheek to their illustrious history, instead moving toward speculation when it comes to their hard earned wealth are making unnecessary gambles with money they hope to be there long into the future.

Hi,

Hi,