Outside of being a defence contractor that makes boatloads of money during times of war – war is something that most people are opposed to regardless of who is involved. War rarely if ever ends positively for any nation or person involved and many would argue there must be more diplomatic ways to resolve conflicts than through bloodshed. Even winning sides, due to the sheer destruction that can take place are often left unrecognizable in some fashion. The reason we bring this up is because even if a country dominates the conflict from start to finish and sees very little if any physical destruction done to their land – war spending, due to the sheer number of currency notes that are needed to be created to fuel war efforts, leaves citizens to toil with rapidly increasing inflation years after the war has come and gone. It is no surprise that leading up to and during times of war, hard assets like food, oil, and of course, sound money, silver and gold – tend to rapidly increase in value and importance.

In addition to rising inflation that has plagued countries all around the world for much longer than central banks led people to believe it would, it was the anticipation of rising geopolitical tensions that have fuelled gold’s rise to all-time highs and silver’s push to highs unseen since 2020 lockdowns. Looking at where we stand today, some are suggesting that WWIII is closer than expected. With Iran launching nearly 300 missiles in Israel’s direction over the weekend, the world is anxiously waiting to see how involved the United States becomes. With Iran being a new member of BRICS+, many are speculating that any intervention from the United States may prompt BRICS+ superpowers, China & Russia to get involved. This would be a devastating development that many are hoping is avoided as in the midst of our current economic situation, world war or any major escalation would surely mark the end of our current paper fiat system as all countries print into oblivion to fuel their war effort.

It seems that China has been getting out long ahead of this potential outcome with the rapid increase in gold and silver purchases made by the People’s Bank of China. Not only that, but it was reported over the weekend by economist Brad Setser that China’s holdings of U.S. Financial assets as a share of its GDP is now as low as it was when China first joined the World Trade Organization in 2001. It is clear that China is reducing as much American risk as possible as it flees toward the world’s most neutral assets, gold and silver.

Continuing on with China, it appears the rush toward silver and gold is not only happening on the government level as it was reported that many of the retail gold and silver sites in China are becoming backlogged due to the sheer number of buy requests coming from the public. Remember, China’s housing market and stock market have already gone through rough patches over the past few years – this is increasing the rush citizens feel to protect the wealth they still have in physical gold and silver; something experts are predicting will make its ways to Western shores as financial insecurity spreads.

What is also interesting about China regarding silver and gold, is how they have seemingly become the market that is setting the price of these assets around the world rather than it being the United States as it has been for 50+ years. We have repeatedly brought up the price arbitrage being created due to higher prices for both silver and gold in China to try to get insight into whether or not Chinese prices being higher would ultimately lead to a Western price rise in silver and gold or would it ultimately have no impact. Looking at how prices have responded today to open the week, we are getting signals that the physical market in China is taking control from the paper silver and gold market in the United States. Prior to Western markets opening the price for silver on the Shanghai Gold Exchange sat at $31.91 USD/oz, while the COMEX price in the United States sat at $28.32 USD/oz – a massive 12.7% spread in favour of China. Similar to gold, China’s price opened at $2470.78 USD/oz, whereas the United States price sat at $2345.90 USD/oz, massive 5.05% spread. At time of writing, gold is sitting pretty well unchanged at just over $2346.00 USD/oz, however, silver continues to take its turn pushing toward new highs as it opened being shot out of a cannon currently sitting at $28.50 USD/oz – a current increase of 2.50% on the day.

Looking deeper into silver – based on where current resistance levels are at, we may be on the precipice of a large move to the upside. Fridays tamp down into the weekend after a 4% surge to start the day offers proof of this concept. The 2.5% rise this morning also adds further proof. Look below at the silver price chart for more insight:

As you can see, since early 2022, silver in USD has been battling to get through the $30 USD/oz resistance level. However, once it breaks through – only its 1980 all-time high stands in the way, which without any resistance above $50, has the potential to send silver well into triple digits per ounce. On Friday, silver shot up to $29.48 USD/oz, only to bounce off the resistance top of $30 USD/oz. The tamp down finished with silver just below the $28 USD/oz resistance bottom at $27.84 USD/oz. Immediately today, silver plunges back into the battleground between $28-30 USD/oz. At this rate, with the Chinese price sitting well above $31 USD/oz – it is only a matter of time before silver breaks through in Western prices, and truly, the sky becomes the limit for an asset that is pivotal to human advancement. At current levels, silver very well may be the cheapest asset on earth in terms of where its real value lies.

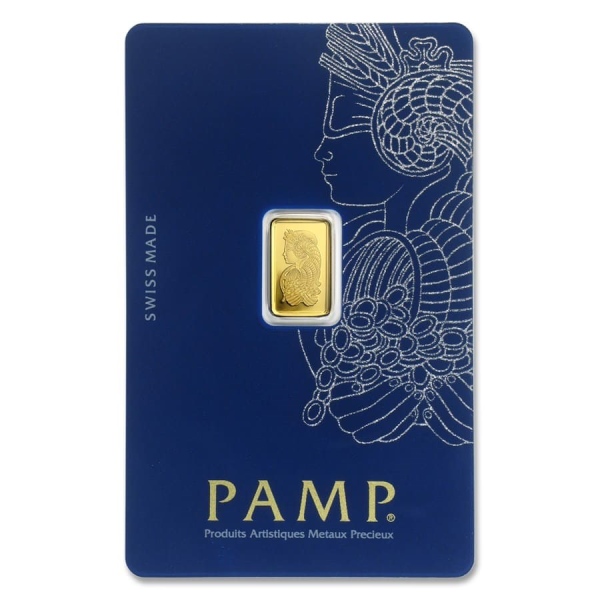

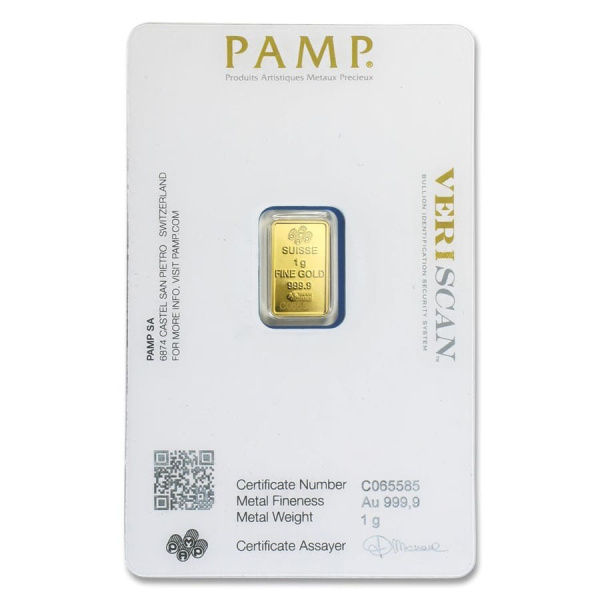

As tensions rise across the world – it is beginning to feel like we have less and less time to protect what wealth our family has earned. In situations like this, it is of detriment to ourselves to wait for firm confirmation of where price is headed in silver and gold prior to purchases. The reason for this is, as we have seen, when these assets set their sight on new highs, they move quickly to reach them and wait for no one. Below you will find our lowest premium silver rounds giving you the best bang for your buck, as well as fractional gold. As gold continues to hit all-time highs, having smaller pieces is of the utmost importance to avoid only having large pieces of high value if you choose to use your gold as money.

1 Oz Silver Bars & Rounds | Various Mints ($3 Over Spot!)

1 Gram Fortuna Gold Bar | PAMP Suisse

Hi,

Hi,