For thousands of years physical silver and gold have been used as money due to their elemental structure allowing for them to be utilized over say, the noble gases, that would float away whenever not enclosed. While, in today’s fiat system, it does appear the current paper currency in circulation shares characteristics with noble gases, as due to the massive debt tied up in the system, when a crisis hits like in 2008 – digital versions of paper currency and its purchasing power goes “POOF!” and seemingly vanishes from public accounts. Where as with silver and gold, due to their scarcity, it and its purchasing power cannot vanish in times of crisis due to rapid printing of more silver and gold. It is impossible to do, as the process of mining and refining these metals into coins/bars takes time and effort. This is where the term ‘intrinsic value’ comes from. This scarcity allows for the alternative to take place when a crisis hits, and silver and gold actually see their purchasing power rise rapidly to account for the loss of purchasing power of the circulating paper currency.

Once the pandemic hit, governments turned their money printers on high, which sent many people rushing toward silver and gold to protect themselves from the incoming inflation storm that was headed their way as a result. However, anyone that dared raise concerns about inflation was shutdown, with the Federal Reserve, the Biden Administration, and the U.S. Treasury, all saying that inflation was transitory, reassuring the public that their savings were not at risk of being drained away by the stealth tax of inflation. That, of course, turned out to be a giant lie, and the Federal Reserve has since acknowledged that they are nowhere close to winning their inflation fight. The result: a surge in demand for physical silver and gold, as the people that originally believed those in authority about inflation, rushed for cover as now the storm clouds were no longer just a forecast, but are sitting directly overhead in plain view.

In 2021, total demand for physical silver across all sectors sat just over one billion ounces, with total supply registering under that number at 998 million ounces. This led to a deficit of 48 million ounces, which was enough to catch many in the metals’ sector attention. With that being said, the number released for 2022 is becoming so large – those across all financial sectors are beginning to take notice. Demand averaged out across all physical silver categories was up 16% in 2022 from 2021, leading to a total demand of 1.21 billion ounces of silver, which is being driven by record demand for industrial use silver, silverware, jewellery, and physical coins/bars for investment purposes. However, the total supply for 2022 only increased to 1.017 billion ounces, a deficit of 194 million ounces, up 304% from the deficit in 2021.

As you can see laid out in the silver supply/demand chart above – physical investment and hedging demand both exceed the overall demand increase of 16%, showing that the public is beginning to take notice of the economic climate and are quickly turning to physical assets to protect themselves. What should be noted is that as physical demand has increased 16%, and deficits have increased 304%; paper spot price has dropped 16% on the year. Keeping in mind that prices move with a lag to market indicators, it appears physical silver is primed for a rapid increase in price when measured in ounces.

When it comes to silver’s shiny yellow friend, there has also been a noticeable upswing in demand. In a report put out by the Perth Mint in Australia, they stated that gold demand in October reached 183,102 ounces for coins and bars, an increase of 206.5% from this time last year. For comparison, their second largest month for gold bullion sales on record was March of 2021 when they sold 130,730 ounces – an increase of over 40% from previous monthly highs. While silver did not see as sizable an increase in demand as gold coming out of the Perth Mint, it did still jump to 1,995,350 ounces sold in October 2022, up 47.6% from this time last year.

It is clear that there is a surging demand for both precious metals that have long been referred to as the only real money we have today. Then when considering there not being enough silver and gold above ground for each person of the world to hold a single ounce of either metal, as these deficits increase, you are going to see bigger and bigger players enter the physical market to secure their piece of the sound money pie. It is inevitable that fiat currencies around the world will continue to lose their purchasing power until they have none left. As more people begin to understand this fact, the more they will rush to secure physical assets while they are still affordable for all. This is not even considering the rush by tech companies as they try to secure cheap silver that is VITAL for their operation and expansion. The pressure is on precious metals from all angles, and with a scarce supply, their value is inevitably set to reach new highs.

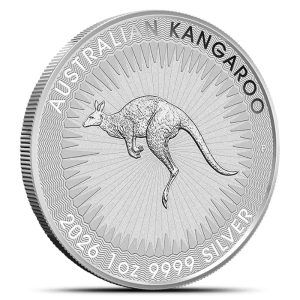

If you want to also secure physical wealth while prices are still low – look no further than our Black Friday Deals to secure silver and gold at a discounted price.

Hi,

Hi,