Over the last couple months it has been gold that has stolen the spotlight, and not just in comparison to other precious metals or commodities, but also when comparing to stocks/bonds as those investors who mainly stick to paper assets are being forced to take notice of the warnings physical gold is sending. A warning that massive monetary change is on the horizon.

Going back to October of 2023 the gold price per ounce in Canadian Dollars sat at $2507.43 after a late year slide. However, since that moment gold has come back to life surging to new all time highs seemingly every week as we enter April of 2024. At time of writing, gold sits at $3110.17 CAD/oz, a substantial increase of 24.04% in the last 6 months and exactly what precious metals investors were hoping for as we entered 2024; a sustained run for gold into unseen price territory that ultimately holds due to the strength of the asset and does not flutter due to false strength. The reason for this is because over the last couple years as gold has worked its way near the all time high resistance level, it has fallen back down and failed to achieve a sustained high. That said, the most recent runs for gold have taken on a different look – a look that has investors around the world keeping close tabs on what gold is beginning to signal. Take a look at the chart below. It begins to become more clear why investors are excited about this most recent breakout:

The resistance level created by the 2011 high in gold prices has been hit, only to repel gold downward three different times as we approached and crossed 2020. Only this most recent run in gold has been able to not only pierce through the 2011 resistance level, but sustain price gains above it as it appears gold has secured $2200 USD/oz and is now eyeing $2300 USD/oz and beyond. With the resistance level behind gold and fiat currencies continuing to weaken around the world – the sky’s the limit for gold.

As a reminder, we have long held the belief here at Au Bullion that gold will make the first strong move to “kick the door down” on higher prices, and that due to silver being so historically cheap, the price of silver would run through the open door knocked down by gold to achieve far higher gains than seen in gold. Now that gold has achieved record highs for multiple weeks and the door to higher prices has been officially kicked down, it is time to turn our attention to silver to see if it awakens as we have long predicted. For starters, the same chart above for gold, can be seen for silver below. As you can see, the same resistance level created in 2011 has also been surpassed for silver, opening the door for a sustainable run higher.

It was right around $26.00 USD/oz where silver had a strong resistance line that you can see on the above chart. You can also see that the price per ounce pressed right up against that line without breaking through for YEARS, until finally breaking through this week after a monumental start to April with silver surging over 7% in a matter of days. Opening the door for silver to take a run at its all time high, still set back in 1980.

One country that seems to agree with the premise that silver is about to become far more valuable is India. The reason we say that is because India posted a HISTORIC February when it comes to how much silver was imported. For context, in 2023, India imported an astounding 3,625 tonnes of silver, while in February of 2024 alone, they posted a record import amount of 2200 tonnes. Well over half of India’s consumption in 2023, imported in just a single month. To put that into context further, that is around 70.7 million ounces of silver and equivalent to more 1 ounce American Silver Eagles the US Mint produced in 2021, 2022, and 2023 combined!! It is clear that whether India plans to use all this silver for future industrial production or as a monetary asset – they believe silver is going to become far more expensive and are getting out ahead to secure as much as they can at historically cheap prices.

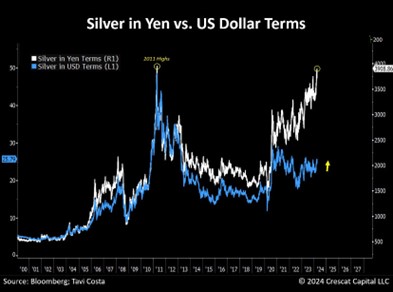

Lending further support to the thesis that silver is about to go on a massive run of its own, we turn to Japan. The Japanese Yen has had a tough year to say the least, which can be said for pretty well every world currency that is losing value in comparison to the USD due to increased American interest rates. However, similar to gold, looking at the chart below, it is clear that as currencies lose value – silver will also be there along with gold to absorb the lost purchasing power.

You can see that going back to pre-2000, the price of silver measured in Japanese Yen, as well as the price in silver measured in United States Dollars has been closely correlated until recently. Silver has been surging in relation to the Yen as it continues to lose value rapidly and the price growth appears to be slower in USD. However, what this chart hides is that silver is up over 20% in the last 6-months when measured in USD. It is simply explained by the fact that other world currencies are losing value at a much quicker pace, which is also why you see the world stocking up on silver and gold while western citizens still hold belief their currency is different and will survive, when it is not and it won’t. With gold surging to record highs in all major currencies, it is clear all currencies are weakening, just some are dying quicker than others, while ultimately still heading to the same fate.

Looking further at silver and the strength it is seeing around the world – we return our attention to the Shanghai Gold Exchange (SGE) that has been pricing silver and gold at a premium. On April 3rd, silver on the SGE was selling for an incredible $29.15 USD/oz – a staggering 9.18% premium from western prices which currently sit at $26.70 USD/oz.

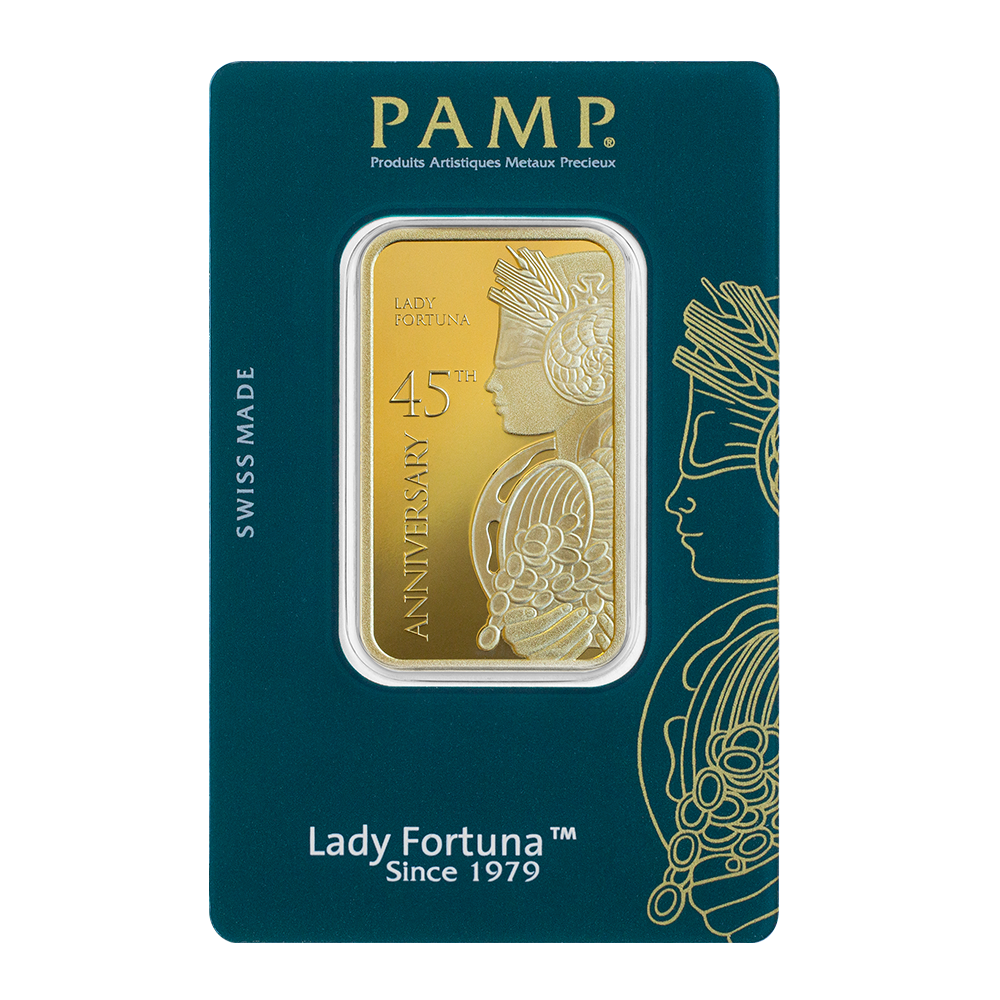

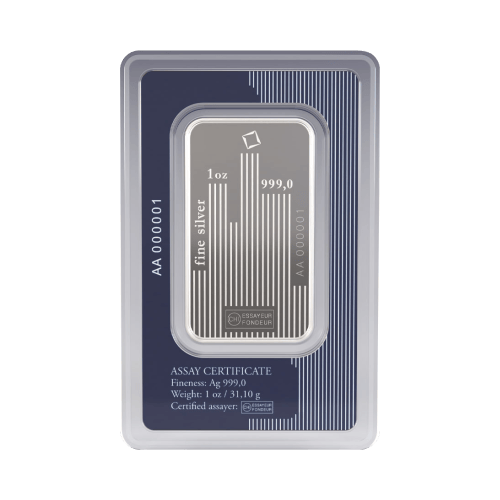

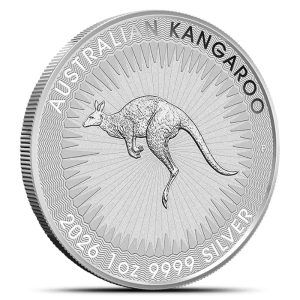

With gold continuing to surge to record highs and silver being purchased in massive amounts by countries to get ahead of this vital asset surging in price itself – there is truly no better time to get in on the action than now before these precious metals reach what many are calling “unobtainum”. Predicting these precious metals will soon become so valuable that the general public will not be able to afford them the same way they can now at current prices. If you want to take advantage of prices before any further rise is seen below you will find the beautiful 1 oz Lady Fortuna Gold Bar from PAMP Suisse to celebrate their 45th Anniversary, as well as the stunning 1 oz Skyline Silver Bar minted by Valcambi Suisse.

1 oz Lady Fortuna 45th Anniversary Gold Bar | PAMP Suisse

1 oz Skyline Silver Bar | Valcambi Suisse

Hi,

Hi,