Before we dive into the main topic of our weekly newsletter, we wanted to give an update on which Central Banks reported purchasing gold bullion through July, with August reports beginning to trickle out through September we can report on August releases in October. That said, the ultimate reason we wanted to highlight which Central Banks reported purchasing gold bullion each month is two-fold:

- After record setting Central Bank gold purchases through the last handful of years, the hype and coverage of their record buying seemed to die down. This would lead someone to believe purchases have stopped, which is far from the case as purchase reports continue to roll out across the world. Due to this to the lack of mainstream chatter regarding these Central Bank gold purchases, many we speak to daily are unaware that Central Banks have continued to purchase huge quantities of gold even after lockdowns were lifted a few years ago and the public was promised a recovered economy. Due to this, we feel it is important to begin updating our readers on what gets reported each month emphasizing how vital governments feel this asset is during these times.

- Secondly, we wanted to shine light on which Central Banks were reporting these purchases as it clearly shows that large and small countries alike are accumulating as much as possible within their budgetary constraints. Of course, a country such as Poland with a large reserve of gold already and a relatively high GDP has the capacity to purchase far more gold each month than say Mongolia, a country with a GDP which is only a fraction of even Poland. With the data being released you can see, regardless of how wealthy a country is, they are prioritizing gold bullion reserves held inside their own country.

COUNTRIES WHO PURCHASED GOLD IN JULY

August 7th, 2024

Poland reports purchasing over 14 tonnes of gold bullion in July – largest monthly increase since November of 2023. They have now purchased 33 tonnes on the year, with 392 tonnes in reserve.

Uzbekistan shows data that indicates a purchase of nearly 10 tonnes in July – their second consecutive monthly purchase takes their total gold reserve to 375 tonnes.

August 8th, 2024

The State Oil Fund of Azerbaijan announced they purchased 10.3 tonnes of gold bullion between April-June. This marks the largest quarterly increase since Q2’19 bringing their total reserve up to 114.9 tonnes.

Czech National Bank (CNB) also announced they purchased 2 tonnes of gold bullion in July, lifting their reserves to 43 tonnes. The CNB have now purchased gold bullion for 22 consecutive months.

August 9th, 2024

Reserve Bank of India continues their gold buying spree adding 5 tonnes in July. India has now purchased gold every month of 2024 bringing their total reserve to 846 tonnes.

August 20th, 2024

Qatar also indicated their Central Bank purchased 2 tonnes of gold bullion in July, lifting total reserves to 109 tonnes.

August 30th, 2024

Central Bank of Jordan data shows that they have purchased gold bullion for the 3rd consecutive month, increasing reserves by over 4 tonnes in July. This lifts Jordan’s gold reserves to 74 tonnes.

To finish off this portion of the newsletter, we want to finish with a couple countries that have indicated an increase in gold purchases moving forward through the remainder of this year.

The Deputy Governor of the Bank of Uganda put out a statement that the bank would begin purchases of domestically produced gold to ensure they can continue to boost their gold reserve. Another African country, rich in gold, that is beginning to prioritize their own countries financial health.

From there, it was Russia that announced they would be increasing their daily purchases of gold bullion and other foreign currencies from 1.12 billion Rubles to 8.2 billion Rubles, a staggering increase of 632.143%. It should really go without saying at this point that Central Banks are prioritizing gold bullion to ensure they can weather whatever economic storm presents itself, with China even going as far as to push citizens to do the same leading to a massive discrepancy between China’s production and consumption of gold. In late July, it was reported that China’s gold output for the first half of 2024 was 179.634 tonnes, however, gold consumption within the country reached a massive 523.753 tonnes.

To finish off this newsletter, we want to cover what was hinted at in the title of this newsletter. A silver battery that not only has the potential to revolutionize the automobile industry but also increase demand of silver immensely putting massive upward pressure on the price of silver bullion.

It was reported by Samsung that they were in the process of creating a new solid-state silver battery technology that looks to improve an electric vehicle’s (EV) drive range, charge time, battery life and overall safety. Kevin Bambrough, the former president of Sprott gave more details based on what he had seen so far, while much is still speculation as the technology is incomplete. He forecasted that Samsung’s solid-state silver battery would have a 600-mile range, which is nearly 1000 kms on a single charge, and that each battery would have a lifespan of 20 years, cutting down on battery waste that is nearly impossible to dispose of safely or in a place it doesn’t just sit forever. Bambrough estimated that there could be as high as 5 grams of silver bullion per battery cell, which at a standard 200 cell battery, would mean there is nearly a kilogram of silver bullion in EVERY electric vehicle. With global car production sitting at around 80 million cars per year, even if only 20% are EVs and they all used the solid-state silver battery technology, that would account for 16,000 metric tonnes of silver, which represents a massive portion of the approximately 25,000 metric tonnes of silver produced annually. Bambrough finishes by stating, “[the silver market will become tighter and] the price of silver may take a run at its all-time inflation adjusted high [of] $200 USD/oz.”

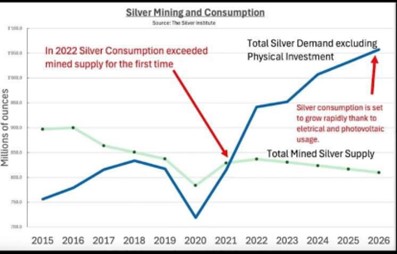

Even though this technology is still developing, it is clear the potential it has to put incredible pressure on an industry that is already running a large deficit in silver. Reminder, in 2023 silver ran at a 142.2-million-ounce deficit. In 2024, we are projected to finish the year with a whopping 265.3-million-ounce deficit. Looking at the chart below, it is CLEAR why silver is massively undervalued at today’s price, and we are guessing that years from now, many will be kicking themselves that they didn’t even take time to purchase a single ounce similar to how gold is viewed now.

You can see, that after demand blew through total mined supply in 2022, it never looked back. Adding to that, indicated in the chart above, it highlights that the above deficit does not include physical investment silver, which is a huge portion of yearly demand.

Again, we firmly believe that based on all analysis we have seen and done ourselves that silver is by far the most undervalued commodity on earth today, remaining the only commodity that remains below 1980 highs presenting an incredible opportunity for those in the know to purchase before prices really take off.

Hi,

Hi,