Silver, often referred to as the ‘little brother’ of gold, has been a valuable commodity for centuries. In modern times, Its diverse applications, from jewellery to industrial use, make it a highly sought-after precious metal. For a new by investor diving into the realm of precious metals, understanding the dynamics of the spot silver price can be crucial.

-

What is the Spot Silver Price?

The spot silver price is the current silver price at which a single ounce of silver can be traded. Unlike futures prices which refer to a contractual agreement to buy or sell silver at a future date, the spot price is all about the here and now. The price is dictated by the global market, adjusting every few seconds during market hours based on various factors.

-

How is the Spot Silver Price Determined?

Several factors play into the spot price of silver:

Supply and Demand: The basic economic principle. If silver demand rises and supply falls, the price typically goes up and vice versa.

Global Economic Conditions: Another factor affecting Silver prices often rise during Global economic downturns. During these times, investors flock to precious metals as a safe-haven asset to protect their wealth.

Currency Strength: Another major factor that affects Silver Spot Price is the US dollar. This is because precious metals, whether it is Gold, Silver or Platinum, are all typically traded against the US Dollar. Thus, then the dollar is strong, silver prices typically drop and vice versa.

Interest Rates: Generally, when rates rise, precious metals tend to perform well and increase in value.

-

Why Invest in Silver?

Apart from diversifying one’s portfolio, silver has:

Industrial Demand: Unlike gold, silver is used extensively in various industries like electronics, medicine, and solar energy. This guarantees some level of demand.

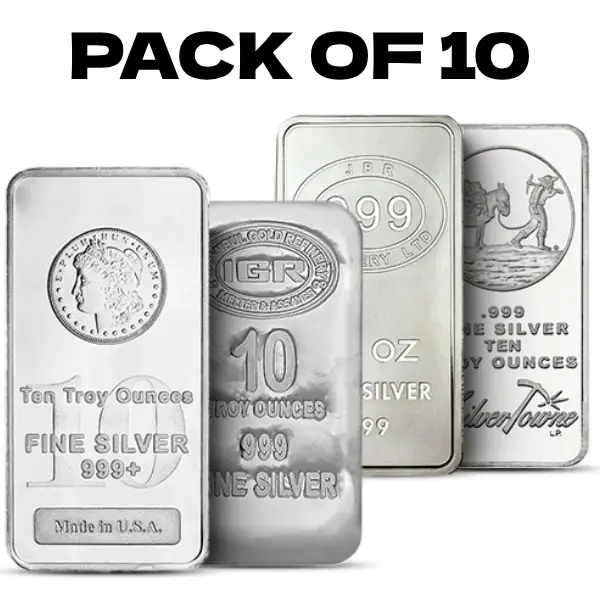

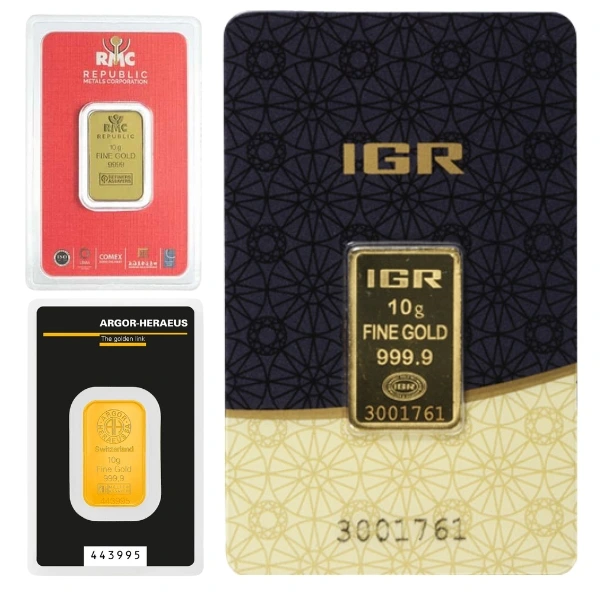

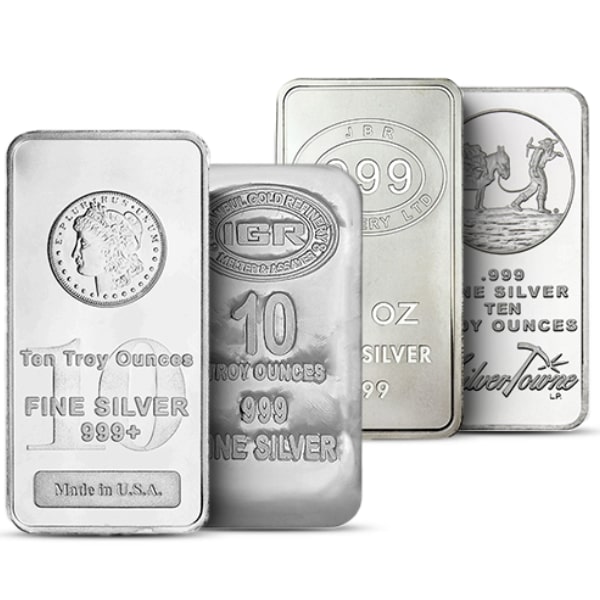

Affordability: Compared to gold, silver is more accessible to the average investor looking to build a portfolio.

Growth Potential: With increasing technological applications, the demand for silver might surge, offering a potential upside.

-

How to Keep Track of Spot Silver Price?

You can check out our Silver Price Page to keep up to date with Spot Silver Prices. It’s also beneficial to follow news platforms and forums dedicated to precious metals. Before making any investment decision, ensure you’re consulting reliable and up-to-date sources.

-

Risks and Considerations

While silver can be a great addition to an investment portfolio, it’s crucial to be aware of the risks:

Volatility: Silver prices can be volatile. Ensure you’re comfortable with this before diving in. Remember that is in an investment you are making and that all investments carry risk associated with them.

Storage: Physical silver needs to be stored securely. Having a large portfolio, you may need to consider safe storage options, which can cost money at times.

Market Research: Make sure you are up to date with current precious metals updates. The precious metal market can be affected by a range of unforeseen global events., so it’s always a good idea to stay informed.

With due diligence, investing in silver can be a rewarding experience. Silver Spot Price is an important topic for newby investors to understand. Like any investment, it’s crucial to do your research, understand the market dynamics, and consider your risk tolerance!

Hi,

Hi,