By now you have likely been made aware that this past holiday Monday saw the worst stock market selloff since Black Monday in 1987. While this did happen 5 days ago, we wanted to wait to write about it until more information had come out and we had clearer insights into what exactly caused this massive financial tremor. The reason we are calling it a tremor and not a full-on financial earthquake is because markets, while trading has cooled off immensely due to the overarching fear this tremor created as it exposed major risks in global markets, stocks still did make a nice rebound to finish off the week, albeit Friday has just begun at time of writing. However, many still believe the worst is yet to come, as the selloff seen Monday did NOTHING to impact how inflated markets are today or how much risk is embedded in the current system and we intend to break that down for you in this newsletter.

To start, we want to look at what exactly led to this financial tremor as it will clearly highlight where the risk remains in the system as we stand today.

If you begin to dive into what occurred Monday, you will constantly be led back to what is being called a Japanese Yen Carry Trade. What this is, is investors buy up cheap Japanese Yen, and we mean CHEAP, as interest rates in Japan have been NEGATIVE since before 2018. From there, they use the cheap Japanese Yen to buy U.S. Equities (stocks) that have a far higher yield than the Japanese Yen itself. Most recently, much of this Yen has been poured into high return tech stocks which is why you are seeing companies like Nvidia continue to defy all odds. It is being propped up by cheap Japanese Yen. Where this becomes scary is it is not just U.S. investors taking advantage of this carry trade, but investors all around the world meaning the risks of this trade are worldwide. The chart below shows just how much buying of U.S. Equities with Japanese Yen has been taking place.

At the peak, and even still today allocation of U.S. Equities within foreign portfolios has nearly eclipsed 60% and is firmly above the 2000 Tech Bubble. Not only that, but the sheer weight of the top 1-10 stocks in the United States is so far out of balance with the rest of the market, the only other time this has ever been seen in modern financial history is 1929 just prior to the worst depression the United States has ever seen. The chart below clearly highlights the sheer danger of this market today given where investors currently have their money.

To drive home what you are looking at above, the solid blue line represents the market cap of the largest stock in the market relative to a stock in the 75th percentile, so one with a more average size. You can see that the concentration into so few stocks that are now obviously propping up the entire market pales in comparison to all other recession years outside of The Great Depression, which even now has been passed. Even going back to our last chart where foreign holdings of U.S. Equities near 60% was seen back in 2000, comparatively looking at this chart you can see that the 60% of stock holdings in 2000 was far more diversified whereas today most investors are piled into 10 stocks. A recipe for disaster.

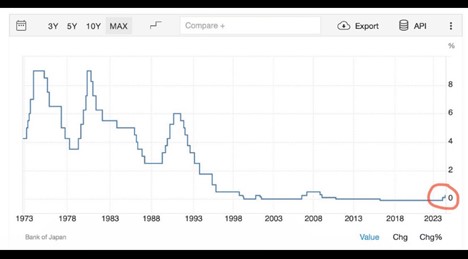

Now that the risk has been identified, we want to turn our attention to what the catalyst was. What caused the above the unfold so swiftly? To answer that, we must return to where we began. The Japanese Yen. Going back to the beginning of the year, the Japanese Yen stood at 140:1 with the USD. Meaning, for every $1 USD you would receive 140 JPY. Before last week, the Yen had weakened to 160:1 to the USD, which is fantastic for the Japanese Yen Carry Trade we broke down above. The cheaper Yen can be acquired the better. However, with the Yen weakening by over 14%, that is great for those taking advantage of the carry trade, yet horrible for the Japanese themselves and because of this the Bank of Japan raised interest rates to try to defend the Yen. However, this had catastrophic consequences as a more expensive Yen immediately started to unwind the carry trade meaning investors needed to sell off assets to cover what was now turning into losses in their initial Yen purchase. To calm the waters, the Bank of Japan came out and said they will not raise interest rates further while markets are unstable. Which, may sound great, but look how much of an interest rate increase it took to nearly bring down global markets:

The smallest of increases, a mere 0.25% nearly put markets into a tailspin. A single quarter of a percent. If markets are so unstable they could not handle Japan raising interest rates by so little, the market is clearly unstable as is whether the Bank of Japan continues raising rates or not. To support that statement, look at the VIX (Volatility Index) below that looks to put investor sentiment into a number. Monday, the VIX spiked over 60, which has been unseen since 2020. Even still, the index sits 84% higher than where it started the year, indicating investors in no way believe that worst was avoided.

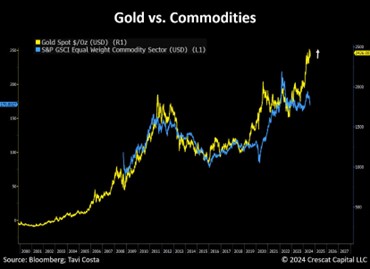

Across the ocean, it is now being heavily debated whether or not the Federal Reserve will cut United States interest rates by more than 0.25% in September or even have an early emergency meeting as markets are obviously suffering. However, this is what we have spoken about previously, as markets crumble under the weight of elevated interest rates gold will continue to hold strong as underlying inflation is still well higher than expected putting us in a stagflation environment. Great for gold. If the Federal Reserve begins cutting while inflation is still where it is, this will act as if they poured gasoline on fire – inflation will begin to run out of control. Again, fantastic for those who own gold. As you can see below, gold has by far been the strongest commodity as it continues to show strength, which is ultimately bullish for other commodities, especially the more volatile precious metals, like silver.

To finish off, we wanted to highlight what may have been the scariest part of the entire financial tremor that occurred on Monday, and that was the “surprise” or “inconvenient” timing for stockbrokers to have major outages. The largest brokers to have outages occur were Charles Schwab, Fidelity, and the largest of all, Vanguard. Which, whether intentional or not on the side of these brokers, still poses a MAJOR threat for those that own stocks. As investors woke up and checked markets Monday morning, greeted with flashes of red, they also became aware that they had been locked out of their trading accounts. Unable to sell to avoid further losses, or even unable to buy if they felt this was only a quick correction. They were stuck in their positions for better or for worse. Either way, this should strike fear in the hearts of investors as if this turned into a full-on market collapse, investors would have been helpless as they watched their wealth bleed away before their eyes. This remains a strong reason to own silver and gold bullion as in these situations, bullion shops stay open. We will be buying and selling to help support our clients. No cyber outage to render debit/credit cards useless and ATMs worthless. No stockbroker outage to remove your ability to manage your online assets. Your wealth remains in the palm of your hand, putting and keeping you in control.

Hi,

Hi,