At this point in time it is no real secret that when a hot war breaks out, silver and gold take immediate action, jumping significantly in price on the news in order to brace itself for what the fallout may be. Once tensions come down, silver and gold often slowly start to retrace their spike once it is realized the war may either drag on or is unlikely to have a large impact on countries outside of those involved. This was seen when both the Russia/Ukraine conflict started, as well as the conflict in Gaza. However, what you do not see often is silver and gold return well below their pre-war levels until tensions have been completely removed. With all that said, the world is once again being thrust to the edge of their seat as during a meeting between President Biden and President Xi of China, it is being reported that President Xi blatantly stated to President Biden in a face-to-face meeting that China had full intentions of taking back control of Taiwan, and bluntly asserted Chinese right to rule the territory. Adding, they would prefer to take it peacefully and not have to use force, although, a forceful seizure is on the table if the United States were to intervene in the matter. Xi went as far as laying out the conditions under which China would attack with military force.

In recent speeches, Xi has also continuously poked at Taiwan, hinting at the prospect of invasion causing United States officials to becoming increasingly concerned that Xi is planning to seize control of Taiwan by any force necessary, regardless of what he may say publically. Biden has been quick to respond stating that the United States would come to the defence of Taiwan if Xi did attack. What is interesting, is the White House then released an official statement and seemed to massage Biden’s messaging changing the overall statement to an acknowledgement of China’s claim to rule Taiwan, and that the United States COULD defend Taiwan’s right to self-governance if attacked, not WOULD. What is interesting about this is the fact that the White House had to make Biden’s statement not so blunt, as originally it was a clear statement of war. If China pursued Taiwan, the United States would get involved. This is what has caused those watching economic markets to become increasingly worried. A war between Palestine and Israel is one thing, between Russia and Ukraine another, but a hot war between the two world superpowers, China and the United States is A WHOLE OTHER SCENARIO…

Both countries are in an extremely sticky situation when it comes to their economy, putting even more pressure on each side to strategically position themselves appropriately so they are set up to be the world’s number one superpower in the decades ahead. What is interesting is the way in which both countries are going about this. China continues to sell United States debt realizing it is becoming more and more worthless each moment that passes (now at a low not seen since 2009), and they are using that money to secure record amounts of gold, other strategic rare earth metals, as well as other industrial commodities that will bolster their dominance in the world economy; let alone what BRICS+ is doing as a whole regarding commodities. Something we have spoken in depth about in the past. On the other side, you have the United States, which rather than trying to gain a strategic advantage using real wealth and assets, they continue to use the U.S. Dollar (USD) to try to bully other countries, using the threat of military or financial action to keep dominance. However, countries are quickly realizing there are other payment alternatives, and quickly the USD is losing control.

This is where Taiwan comes in, and why people believe this war could be the war to end all wars, changing our world as we know it. Taiwan is the leading manufacturer in semiconductors as well as over 90% of all advanced semiconductors. Now, given that semiconductors are an essential component to all electronic devices, as we head into a more tech-based economy, these semiconductors may end up being one of the most valuable assets one country could own. Making it not hard to understand why China so desperately wants to take back control of Taiwan and ultimately gain control of the world’s semiconductor production. On the same note, it is also understandable why the United States has stated they would defend Taiwan if China attacks, because they too want to have indirect control of Taiwan and their semiconductor production as well.

Given the importance of the asset Taiwan currently controls, the incredibly tough situation both China and the U.S. find themselves in economically and historically, how much distrust these two nations carry toward each other as each battles for the spot of the world’s #1 superpower – it is clear why people are getting worried that if these two countries go to war, it may ultimately end up dragging all other countries in with them. This may also add insight into why so many countries have caught gold fever, and continue to purchase physical gold as quickly as they can. They do not want to get caught with their pants down, once the world turns its attention to REAL WEALTH and away from illusionary wealth as war breaks out with the goal of securing as much real commodity wealth as possible.

If you are looking to protect you and your family’s wealth, gold and silver are the best way to ensure when you need value in a pinch, it will reliably be there. It was reported that in 2023 homelessness in the United States surged 12% to over 653,000 people (which is likely to be understated as the odds all homeless people were surveyed is impossibly low) with the major spike being attributed to soaring food and shelter costs, along with pandemic stimulus running dry. Jeff Olivet, executive director of the U.S. Interagency Council on Homelessness, a federal agency, stated, “many Americans are living pay check to pay check and are one crisis away from homelessness”. Silver and gold ensure when crisis does strike, the savings you put away will not have been eroded by inflation, but rather could have the potential to increase for the same reason.

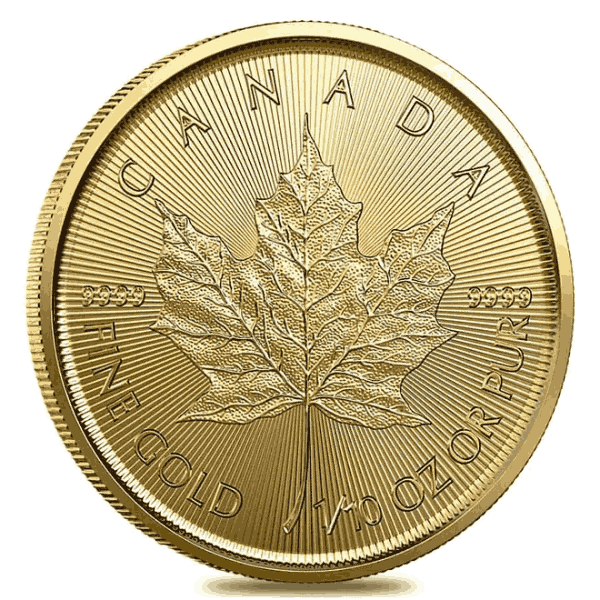

2023 1/10th Oz Gold Canadian Maple

2023 Merry Christmas 1 Oz Silver Round

Hi,

Hi,