In an era of economic turbulence, where markets sway under the weight of geopolitics, industrial demand, and speculative fervor, a quiet but powerful force is emerging in the world of commodities. Precious metals, long revered as bastions of value, are once again commanding attention—not through fanfare as they are largely going unnoticed, but through the undeniable arithmetic of supply, demand, and market mechanics. Today, we delve into the currents reshaping the silver market, where scarcity, industrial hunger, and speculative missteps are converging to create a moment of historic significance. This is not a pitch, but a window into a market on the cusp of major transformation.

The Anatomy of a Short Squeeze

At the heart of silver’s story lies a phenomenon known as the short squeeze—a market event where speculators betting on price declines are forced to buy back their positions as prices surge, amplifying gains in a self-reinforcing cycle. Silver, with its unique position as both a monetary and industrial asset, is primed for such an event. Analysts project a staggering deficit of over 200 million ounces in 2025, driven by unrelenting demand from solar energy, electric vehicles, and other industrial applications, in addition to investment grade bullion purchases by central banks, while global supply remains stubbornly flat. The result? Silver prices have already climbed to $39 per ounce USD ($53.33/oz CAD) and show no signs of slowing, as scarcity tightens its grip.

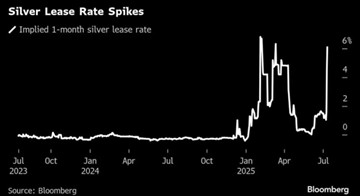

Signal 1: Lease Rates in Uncharted Territory

One of the clearest indicators of silver’s tightening market is the unprecedented surge in lease rates—the cost to borrow physical silver. Currently exceeding 6%, these rates are the highest since the 2008 financial crisis, a stark departure from the near-zero norms of calmer times. You’ll notice on the chart below; these heightened lease rates have been a major driver in silver’s gains through the entire year. This is not a subtle shift; it’s a signal of desperation, as market participants scramble for physical silver in a landscape where availability is dwindling. High lease rates reflect a market in panic mode, where borrowing costs scream scarcity louder than any headline.

Signal 2: LBMA Stocks at Historic Lows

The London Bullion Market Association (LBMA), a cornerstone of global precious metals trading as it is the largest bullion vault in the world, reports silver stocks have plummeted to approximately 23,791 tonnes—roughly 793 million ounces—the lowest in years and below a single year of global mining supply. Of course, due to the world running at a deficit in silver there is no clear path to replenishing these global vaults. This erosion of available inventory underscores a critical imbalance: demand is outstripping supply at an alarming rate. As industrial and investment needs collide, the dwindling stockpiles signal a market stretched to its limits, with little room for error.

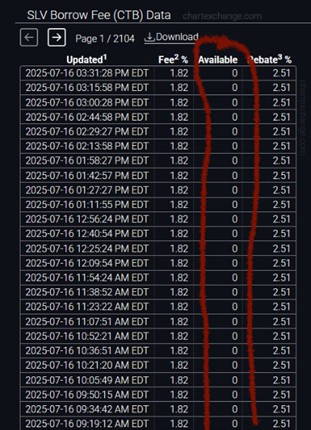

Signal 3: SLV Short Shares Evaporate

The iShares Silver Trust (SLV), a major vehicle for silver investment, tells a similar story. Shares available for shorting have dwindled to near zero, leaving speculators with little ammunition to sustain their bearish bets. The chart below shows nearly the entire trading day of July 16th, with zero shares becoming available to borrow. Compounding this, the market faces a staggering disconnect: for every physical ounce of silver, 365 paper ounces exist in trading. This imbalance cannot persist indefinitely. As investors and industries demand delivery of real, tangible silver, the pressure on paper markets could ignite a reckoning.

A Historical Parallel: The Nickel Precedent

To understand silver’s potential trajectory, consider the nickel market’s chaos in 2022. Supply shocks, triggered by geopolitical events like Russia’s invasion, sent nickel prices soaring 250% in mere days. Short sellers, caught off-guard, faced a $100 billion wipeout, with major institutions like JPMorgan reeling from the squeeze. Silver’s current dynamics mirror this setup: a massive short position—887 million ounces, exceeding a year’s worth of global mining supply—stands vulnerable to a single catalyst. With industrial demand surging and supply constraints tightening, silver could be one spark away from a similar explosion. If silver hypothetically faced a similar 250% surge through this week, its price would land at $97.50/oz USD or $133.38/oz CAD.

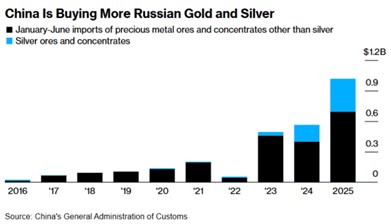

Global Shifts: The BRICS+ Factor

Beyond market mechanics, geopolitical currents are reshaping the precious metals landscape as well. China’s unprecedented purchases of gold and silver from Russia signal a deepening alliance among BRICS+ nations, who are increasingly turning to tangible assets to hedge against global uncertainties. This strategic accumulation underscores a broader trend: nations and investors alike are seeking refuge in metals that have held value through centuries of upheaval. Silver, with its dual role as an industrial necessity and a store of wealth, stands at the heart of this shift.

A Moment of Clarity

The signals are unmistakable: surging lease rates, dwindling inventories, evaporating short positions, and a historical precedent that looms large. Silver’s market is not merely tightening—it is transforming. As industrial demand accelerates and geopolitical alignments shift, the metal’s role as both a practical resource and a timeless asset comes into sharp focus. This is not about speculation, but about recognizing the forces at play: scarcity, demand, and the weight of market realities. For those watching closely, the silver market offers not just a story, but a signal—a glimmer of what’s to come in a world where value is redefined by what endures.

Hi,

Hi,