Between the start of the pandemic and the summer of 2022, the world saw what will go down as the most unprecedented currency creation period in modern history, this of course until the next crisis inevitably hits and the printers need to once again be turned back into overdrive to bail out those banks that begin to collapse as a result. This, of course, being an educated guess, however, an educated guess based on solid financial history. Each crisis that occurs continues to grow larger and larger in size due to the proverbial can being continuously kicked down the road via massive central bank bailouts. Never allowing true deflationary price discovery to happen, but instead, artificially inflating prices with mass currency creation by central banks.

As we touched on a few newsletters ago, central banks hate seeing deflation as it returns assets from their inflated price levels back closer to their real market value, benefiting savers and those who are cautious with their dollars earned, this destroying the illusionary wealth trap they have fooled the public into believing is beneficial for all. Even though, as we can see today, less and less people can afford everyday necessities due to this illusionary increase in wealth only benefiting those who are already wealthy and placing a tighter and tighter stranglehold on those in lower income tiers.

Looking deeper into the last printing cycle between 2020 and 2022, we saw nearly 80% of all United States Dollars in circulation printed, as well as a 300% increase in Canadian Dollars printed in comparison to previous years representing well over 40% of all circulating Canadian Dollars at the time. This caused inflation in the western world to rush to 40-year highs prompting a rapid increase in interest rates by central banks unseen since the years prior to the 2008 Great Financial Crisis to try to stop inflation from moving into hyperinflation territory. What then prompted the crash of 2008, was after interest rates were raised rapidly, the increasing pressure put on the economy forced equally as rapid interest rate cuts that sent a coiled inflation rate through the roof. Today, we are seeing the same phenomenon occur due to inflationary eras often moving in waves. The first wave, while often intense, is short-lived and is the smallest wave to occur, followed be a second much stronger wave of inflation, lastly followed by the third and most intense wave of inflation seen in the cycle. These cycles often last a decade plus, making the individual waves harder to see as related to one another when in the middle of these inflationary cycles. However, once the entire cycle is completed and we have data that we can look back on, you begin to see history rhyming through these inflationary periods.

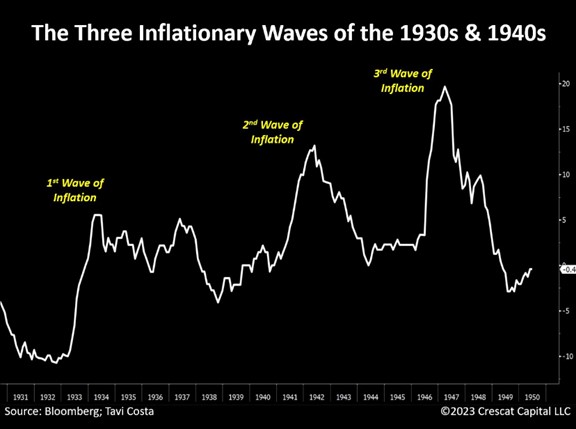

In order to get an accurate look at what may be occurring in the 2020s moving toward the 2030s, we must look back at eras that saw similar monetary policy put in place to try to defeat raging inflation in that time. Below you can see a chart that shows the inflation waves seen after The Great Depression in the 30s and 40s.

You can clearly see that while inflation is knocked back down after each wave, similar to what is happening today with inflation contracting heavily over the past 12 months, it returns with a vengeance, only to be knocked down again before reaching its peak of that era in the third wave. When looking at silver and gold, as expected, within high-inflation environments, these precious metals work overtime to store the value you worked hard to earn, often accounting for the loss in purchasing power seen in national currencies, plus some.

Between 1931 and 1951, a two-decade span of increasing waves of inflation, silver moved from $0.28 per ounce to $0.89 per ounce, a 217.86% increase in value, far greater than the 20% inflation rate seen at the peak of the 3rd wave. Gold, however, was still being used as a backing to the United States dollar so free market prices were unable to be discovered until the waves of inflation seen in the 1970s when the gold standard was ended. Even with that said, during this time, the government was forced to increase the price of gold from $20.66 per ounce up to $35 per ounce, which still represented a 69.41% increase in the value of gold over that two-decade span.

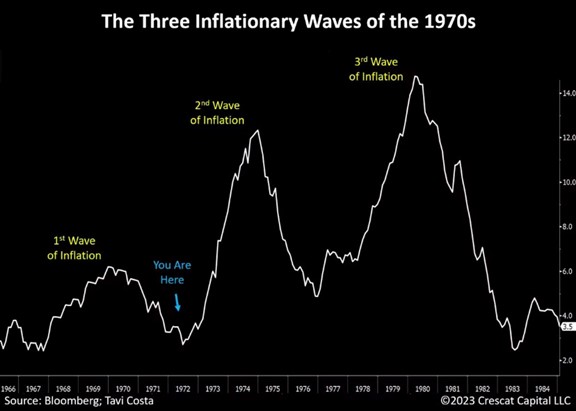

Below you can see the same chart altered to show the waves of inflation seen over the 1970s.

Similar to the 1930s and 40s, inflation from the late 1960s to early 1980s moved in a pattern of three waves. During this period of massive currency devaluation, silver and gold once again were there to protect their holders from the impact these inflationary waves had on majority of the public trained to hold savings in dollars. Between 1966 and 1980, the price per ounce of silver moved from $1.30 up to $35.75 representing a whopping 2650% increase in the value of silver, far surpassing any inflation rate seen at that time. On the side of gold, now free to find its free market value after being cut from the United States dollar, moved from $35 in 1966 to $677.97 in early 1980, a massive increase of 1837.06% in the value of gold. Again, showing that in times of severe inflationary waves, silver and gold ensure wealth for its holders are not only protected, but also increased immensely. What is interesting, is gold has continued to climb from its 1980 high, while silver sits many percentage points below its value in 1980, showing just how undervalued silver is today being the only commodity on earth currently sitting at a lower value than the 1980s high seen in many commodities.

What should be noted is that today, we saw the first wave of inflation mark 40-year highs taking us to the peak of the 1980s 3rd wave, meaning if this cycle continues as it did in the 30s/40s, as well as the 70s to 80s, the second and third wave of inflation very well may push us into a hyperinflationary environment which is incredibly bullish for silver and gold respectively based on historical moves made in these metals. It also emphasizes the importance of getting out ahead of these waves and not waiting to protect yourself until we are right in the middle, as at that point, silver and gold will have already began to move in the upward direction putting incredible amounts of attention on them as majority of the public struggles financially, prompting panic buying that will likely not leave enough silver and gold for all of those that wish to purchase them. If you want to ensure you have enough financial protection for the second and third waves of inflation we are likely to see, Au Bullion has you covered – below you will find various tubes of some of the world’s most popular silver coins, due to being highly recognized, they add a layer of insurance knowing they will be accepted all over the world.

Silver British Britannia Tubes

Silver Australian Kangaroo Tubes

Hi,

Hi,