Before jumping into the main topic of this newsletter we feel it is important to touch on the actions the Bank of Canada took earlier this week. They became the first central bank in the G7 to cut interest rates, dropping current rates by .25%. While a quarter of a percentage point may not seem like a lot, what must be understood is that even prior to interest rates being dropped, inflation was already beginning to creep higher after bouncing off the 3% level, still 50% higher than where the Bank of Canada would like inflation; showing interest rates were in fact not high enough. Now that they are easing monetary policy due to what the Bank of Canada will feel is a sufficient economic slowdown, will release the pressure valve ever so slightly allowing for inflation to begin to creep higher, faster. Creating the stagflation environment in which gold and silver become incredibly important due to persistent high inflation, an economic slowdown, and an increase in unemployment arising simultaneously.

Many believe silver and gold have long been in a bear market up until recently when both have been shot out of a cannon to start 2024. Prior to this year, if you took to social media, you would see swarms of those who have long owned gold complaining of its performance. What is interesting is that out of all the major stock indexes going back to late 2000, gold has outperformed each one by a wide margin, providing not only the greatest wealth protection, but the greatest wealth gains. Yet, you rarely hear gold or silver spoken about in the media positively, and the S&P 500, NASDAQ, and Dow Jones are all raved about due to their consistent performance. Below you will see a number of charts showing you the comparison, and it is clear, through what has been a decade of booms and busts, physical silver and gold together provide their owners the greatest protection due to their appreciation and lack of counterparty risk. And don’t take our word for it, check out the charts below from lowest gains to highest and let these precious metals speak for themselves. As a disclaimer, all charts are from June 2nd, 2024, however, gains or losses have remained steady and so percentages are within a few points up or down of current trading prices.

Dow Jones Industrial Average Index

Out of all major stock indexes, gold, and silver the Dow Jones has posted the lowest gains over the past 24 years. Between October 31st, 2000, and June 2nd, 2024, the Dow Jones has gained 254.59%, and average of 10.61% each year.

S&P 500 Index

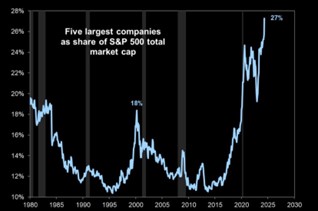

When preparing this newsletter, this was the most shocking result we found. As we move toward a more tech-based society, we figured the Dow Jones would have been at the bottom, but the S&P 500 is made up of the 500 largest market cap companies in the New York Stock Exchange (NYSE). How could this index that is given so much attention and love have performed so low on the list posting gains of 301.67% between November 30th, 2000, and June 2nd, 2024? An average of 12.57% per year. Then we found this, a chart that showed the S&P 500, especially prior to economic collapses, is carried by only a handful of companies. Currently, 5 companies represent a record 27% of the entire S&P 500, a bad sign for the index overall:

U.S. Small Cap (Russell) 2000 Index

What is better known as the Russell 2000, which is made up 2000 small cap companies in the overall stock market between November 30th, 2000, and June 2nd, 2024, made gains of 356.10%. Which is a yearly average gain of 14.84%, placing it 3rd lowest on the list.

Silver is by far the most intriguing asset on this list. The reason being is it still slots in as having the 3rd highest gains on this list over the last 24 years, which given how low the price currently is in relation to its all-time high says a lot. You will notice, each chart expect for silver shows a slow a steady progression up and to the right, steady gains after steady gains, nudging against all-time highs. Silver has been far more volatile as it desperately tries to find its rightful place at new all-time highs appropriately adjusted for inflation as it has been recently trying to achieve. All that said, between December 31st, 2000, and June 2nd, 2024, silver posted gains of 540.87%, for a yearly average of 22.54%. Buying and holding physical silver has long surpassed how quickly inflation would have eroded your purchasing power, doing its job as advertised, not only protecting, but increasing your wealth over time.

NASDAQ 100 Index

The NASDAQ is by far the most susceptible to booms and busts due to the volatile nature of tech stocks. You can see on the chart below, the quick rise led to a dramatic fall in 2000-01. After that point, it saw steady sustainable gains. The last 4 years, the NASDAQ has entered another swift increase calling into question the sustainability, with many suggesting the NASDAQ may be in large part what causes the next financial downturn. Nonetheless, it has still posted an impressive 626.81% gains between November 30th, 2000, and June 2nd, 2024. An average gain of 26.12%.

Out of all the powerhouse assets and indexes listed, gold shines the brightest and continues to protect its holder’s wealth through what has been 3 crashes through 24 years, with a 4th very well on its way. Between November 30th, 2000, and June 2nd, 2024, gold has posted a staggering gain of 771.67%. Even the volatile tech stocks of the NASDAQ are no match for the monetary power gold possess as fiat currently continues to be diluted due to reckless currency creation, shifting value toward real assets. This gives gold a yearly average gain of 32.15%, far exceeding yearly inflation.

As economic conditions continue to erode in every country, physical assets with no counterparty risk have been and will continue to be the best way to not only protect current wealth, but to help increase wealth through economic turmoil. It was last being reported that over 60 banks in the United States are at risk of failure due to the unprecedented level of unrealized losses they are currently facing. Any wealth held inside the financial system is at risk as you are a creditor of the bank that could fail in the blink of an eye. Physical gold and silver are yours and will be there when you need them most.

Hi,

Hi,