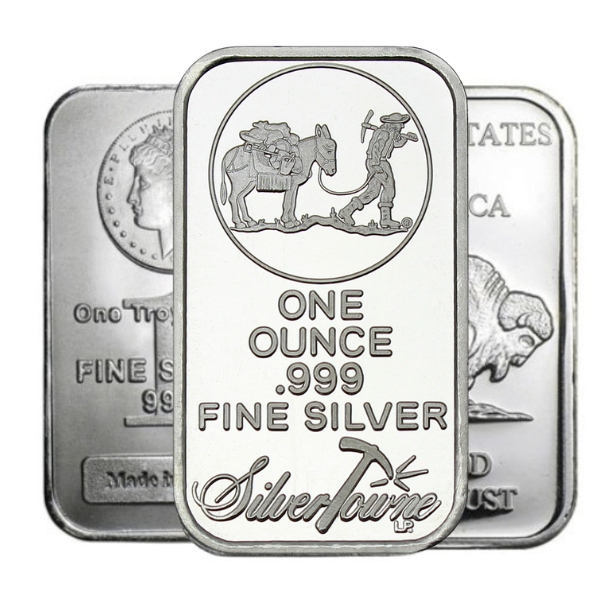

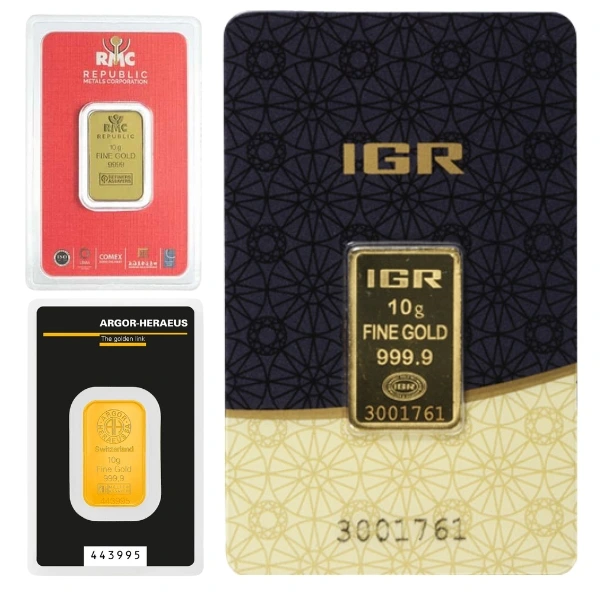

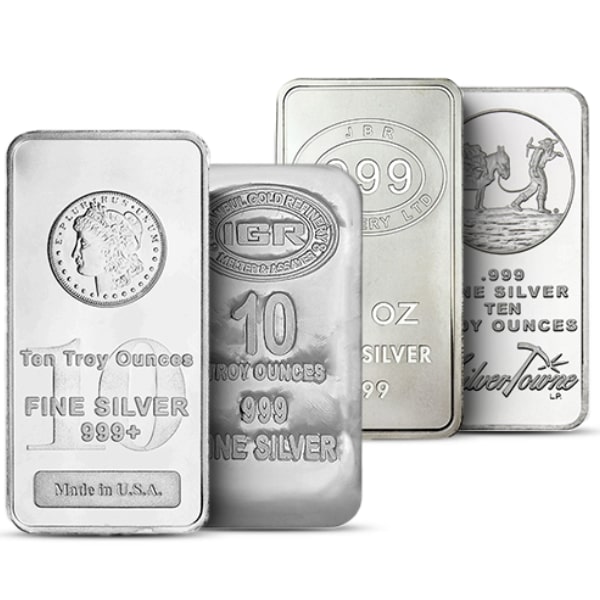

Silver has been among the world’s most precious metals since the dawn of time. Similar to gold, silver has been seen as a symbol of wealth. Throughout history, this precious metal has had several important roles in our society. Silver has been used in jewellery, currency, trading, and much more. It has proven itself highly valuable and useful in countless industries. One of silver’s most common and popular uses in modern times is as an investment.

Investing in silver bars and coins is an incredibly efficient and reliable method for investors to preserve and grow their wealth. Economists have proven that silver bullion has a high ROI making it an even more desirable commodity. Investing in silver bullion through bars and coins is the most favoured method to invest in.

What is a Spot Price?

The spot price for a commodity is essentially the physical value of the investment at the exact moment. The spot price for silver is used in bullion transactions and trading. Bullion purchased on the spot market is intended for immediate delivery. This differentiates it from the futures market, which has a delivery date in the future. Because of this predicted date, the silver is purchased with a predetermined price, known as the futures price. Futures prices are typically higher than spot prices. The futures market prices are calculated through current interest and dividend rates along with the date of the contract.

How is Silver’s Spot Price Determined?

Like all commodities, several factors influence the price of silver greatly. One of the biggest influences on silver’s spot price is its supply and demand. Additionally, trends in the market, economic crises, and inflation also play a major role in the silver price. Similar to other precious metals, silver’s spot price is determined by over-the-counter trading along with other economical factors. It is essentially an average value of the estimated future price, based on traded futures and the next month. Most prices in the world markets are based on LBMA prices for physical bullion. The London Bullion Market Association, LBMA, is known for having the largest markets in the world. Most sites typically have a high and low value for the spot price that represents the highest asking price and lowest bid for the day.

Specialists and analysts record data throughout silver’s history as an investment to calculate and predict its future. Studying these trends and calculating them gives us accurate predictions for the market and economy.

Hi,

Hi,