At Au Bullion, we are focused on supplying the highest quality bullion products from the most reputable mints to our supportive clients for as low a premium as possible, educating our clients on precious metals themselves, as well as working to keep our clients up to date on all the latest news that impacts this sector, and ultimately, your precious metals investment. Although, as we have stated before, while owning precious metals such as gold, silver, platinum, palladium and/or rhodium is technically an investment as you have turned Canadian Dollars into bullion with the potential for gains or losses, precious metals are more accurately categorized as SOUND MONEY. To reiterate, Canadian Dollars, United States Dollars, Australian Dollars, Indian Rupees, Chinese Yuan – all fiat, is a debt instrument. They do not fit into the definition of money. Precious metals, most namely, silver and gold, do fit the definition. Which is why you are seeing so many smart countries and citizens alike swap their worthless fiat debt instruments for real wealth in the form of silver and gold, especially as the devaluation of fiat currencies is becoming far more apparent as cost-of-living skyrockets across the world.

What is commonly circulated as the definition of money is the following:

Money is any object that is generally accepted as payment for goods and services and repayment of debts in a given country or socio-economic context.

Based on the above, fiat currency would fit the definition of money. However, when you add the core functions of money to the definition, completing the definition in full – the following immediately removes fiat currency as a viable option for REAL MONEY.

The main functions of money are distinguished as: a medium of exchange; a unit of account; it is divisible; it is portable; it is fungible; it is durable; AND it is a store of value.

Let’s evaluate the above criteria for gold, silver and fiat currency since the time of the Federal Reserve was founded in 1913. The picture becomes very clear as to why silver and gold are a far superior form of money, simply because THEY ARE MONEY, and fiat currency simply is not. For these comparisons, we will use the USD, as it is the strongest fiat currency relative to all others.

Medium of Exchange

USD – Yes. United States Dollars are accepted around the world for goods/services.

GOLD – Yes. Gold is accepted around the world for goods/services.

SILVER – Yes. Silver is accepted around the world for goods/services.

Unit of Account

USD – Yes. United States Dollars can be used to keep an accurate tally of wealth.

GOLD – Yes. Gold can be used to keep an accurate tally of wealth.

SILVER – Yes. Silver can be used to keep an accurate tally of wealth.

Divisible

USD – Yes. I can break your $100 USD bill in multiple ways with smaller bills/coinage to make change.

GOLD – Yes. Larger quantities of gold such as a kilo can have change made in a transaction using smaller denominations such as 1 oz coins or 10 oz bars. Even smaller pieces like a 1 oz gold coin can have change made with smaller fractional pieces: ¼ oz, ½ oz, etc.

SILVER – Yes. Similar to gold, larger pieces of silver can be broken down to make change with smaller pieces down to as small as 1g.

Portable

USD – Yes. United States Dollars can be easily travelled with. Especially, in digital form.

GOLD – Yes. Gold is transported around the world, and in record amounts recently proving it is portable. Citizens have also been known to travel with gold as it is recognized and accepted regardless of where you find yourself in the world.

SILVER – Yes. Silver, again, similar to gold has been purchased and moved worldwide in record amounts in recent years. Especially, to India and China.

Fungible

USD – Yes. Our $10 USD bill is equivalent to your $10 USD bill. They buy the same number of goods/services.

GOLD – Yes. Our 1 oz gold coin is equivalent to your 1 oz gold coin. Even if you get into purities of coins/bars, the value of 1 pure golden gram in each piece once refined is the same.

SILVER – Yes. Again, silver is equivalent to gold. Our ounce of silver is worth the same as yours.

Durable

USD – Yes. Although, not as durable as gold and silver, United States Dollars are made to withstand wear and tear over decades. They are not paper as many believe, the common joke “but money does grow on trees!” while clever, is untrue. USDs are made of 25% linen and 75% cotton.

GOLD – Yes. The same gold mined thousands of years ago has not been destroyed and is still circulated today.

SILVER – Yes. While silver has been lost in massive quantities compared to gold due to all the electronics thrown in junkyards that hold small amounts of silver in each, the silver itself has not been destroyed.

Store of Value

Now this is where the rubber meets the road for our comparison. The USD was meticulously designed to copycat real money as accurately as it could. Which, as seen above has been done well, almost too well, to the point most of society has been lulled to sleep by its convenience of use, and have completely missed the below, which, is the most important aspect of REAL MONEY.

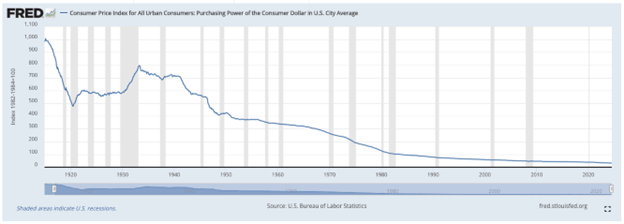

USD – No. Shortly after the Federal Reserve Act was signed and the Federal Reserve was conceived, a chart was created to indicate the purchasing power of the United States Dollar. In 1915, it stood at just under the near perfect score of 1,000 at 994.2. Today, it stands at just 31.8 an astonishing loss of purchasing power of 96.80%. Meaning, if you had $100,000 in your bank account in 1915, today it is worth just $3200 in today’s purchasing power. A truly mind-altering number as most people around the world outside of a few intelligent citizen bases have been taught to save in fiat currency. A debt instrument that was designed to leak your family’s wealth over time. The chart below highlights this value loss.

GOLD – Yes. Since the same time in 1915, gold has not only kept pace with the loss in purchasing power seen in the United States Dollar, but it has also seen its holders increase their purchasing power 100s of times over. Since 1915, gold bullion has gained 11,902.22%. Using the same comparison, $100,000 held in gold bullion in 1915 today would be worth $11,902,220. It is clear, gold is the ultimate store of value, making it far superior to any fiat currency.

SILVER – Yes. Silver, while it remains below its 1980 all-time-high, has still far surpassed what the United States Dollar attempted to do as real money. Again, if you held $100,000 in silver in 1915, today it would be worth $5,454,710 as it has gained a massive 5454.71% since the Federal Reserve began tracking the purchasing power of the United States Dollar.

As countries begin to see the writing on the wall with their fiat currencies demise being imminent as world debt has climbed well past $300 trillion USD… a truly unfathomable number… Gold and silver are being thrust back into the spotlight, and for good reason, as if the world wishes to fix its monetary problems, sound money is the only way to achieve it. Even still, if the world chooses to not fix its problems, the holders of silver and gold will continue to benefit from the inevitability of future loses in purchasing power in all fiat currencies.

Hi,

Hi,