Gold is one of the oldest investment commodities in the world. When investing for the future, it’s important to know about gold. Gold is a very popular store of value that has been used for centuries as money. There are many benefits to owning gold, several of which make it stand out from other forms of investment.

Section: Why Invest in Gold?

Gold is a smart asset for investors. Gold bullion is a reliable store of wealth. Still, with an average annual return of 9.7% from 2000 to 2020, gold investors have made a killing over the past two decades. Analysts have been cautious about the outlook for the gold market in recent months due to high inflation and geopolitical unrest. Even so, gold is regarded as a secure investment and serves as a safety net in choppy markets.

Section: How to Invest in Gold?

There are many ways of investing in gold, depending on your personal situation. Let’s look at some of them:

Section: You can invest in physical gold.

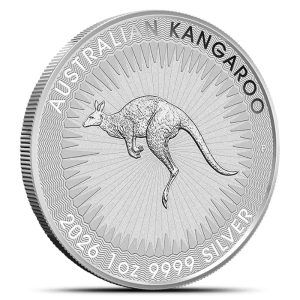

Gold coins, bars, and jewellery these are traditionally the most popular way of investing in metals Investors in Canada can purchase gold bars online from CIBC Precious Metals or in-person at a CIBC branch.

The Royal Canadian Mint issues the Canadian Gold Maple Leaf every year as a gold coin. The gold coin has a face value of $50 Canadian and is valid currency.

The government of Canada does not tax gold bullion, bars, and coins at all qualifying as precious metal, defined as 99.5% pure gold. This means that you can buy physical gold without paying any taxes on the sale or purchase.

In addition to bullion, you can purchase gold jewellery. Jewellery can have artistic or sentimental value, unlike coins or bullion, making it a more practical investment than just a financial one.

Section: You can profit from gold by investing in gold exchange-traded funds (ETFs).

The exchange-traded fund (ETF) – an ETF is an investment fund that tracks an index or commodity such as oil, aluminium, or corn (which used to be known as “futures”). The best way to buy ETFs is to open a discount brokerage account, which will allow you to easily track your investments and save money on commission and trading costs.

Canada’s first commission-free trading platform is Wealthsimple Trade.

A great way to increase your exposure to the precious metal while lowering your risk is to invest in a Canadian gold ETF.

What gold exchange-traded fund (ETF) is the best in Canada for 2022?

o iShares Gold Bullion ETF: The closest thing investors can get to owning physical gold without having to buy, hold, and store it is the iShares Gold, Bullion ETF.

o iShares S&P Global Gold Index ETF: With $922 million in assets and a current unit price of $15.10, it is one of the most liquid gold ETFs in Canada. The fund also pays out a meagre 1.7% quarterly distribution.

o BMO Junior Gold Index ETF: The junior gold exploration, development, and mining stocks are included in the index. The fund has a MER ratio of 0.61%, $59 million in assets, and a $54 share price as of August 2022.

o Horizons Gold Yield ETF: uses a covered call strategy to offer investors tax-efficient distributions and exposure to gold that is hedged against changes in the Canadian dollar.

Section: You can make money on gold by investing in gold stocks.

The fifth-largest country in terms of gold production was Canada. The country’s production of gold increased by 78% from 2010 levels in 2020, making it the most valuable mined commodity.

You need a full-service broker or can open an account on an online trading platform to purchase gold stocks.

Here are just a few gold stocks that are top performers that you might want to think about.

| Gold Stock | Market Cap | Stock Price | Dividend Yield | Description |

| Barrick Gold Corporation (TSX:ABX) | $35.28 billion | $19.60 | 0.0183 | One of the largest gold mining companies in the world with operations in 18 countries |

| Agnico Eagle Mines (TSX:AEM) | $25.88 billion | $55.51 | 0.0375 | Large gold mining company with cost-efficient operations |

| Franco-Nevada Corporation (TSX:FNV) | $30.6 billion | $157.08 | 0.0107 | Gold-focused streaming and royalty company with a hefty dividend |

Section: The Benefits and Drawbacks of Gold Investing

| Benefits | Drawbacks |

| Great Hedge Against Inflation | It’s A Great Challenge Storing the Physical Gold |

| Diversify Your Investment Portfolio | It Doesn’t Earn Passive Income |

| It’s A Great Store of Value | |

| Easy To Buy |

Section: When should you make gold investments?

You may have heard that you should invest in gold when there is uncertainty in the stock market, or when the value of the dollar is declining. However, these are not the only factors to consider.

The price of gold is affected by many factors, including political and economic conditions, as well as supply and demand. When these factors are favourable, the price of gold may increase. However, there is no guarantee that the price will continue to rise.

If you are considering investing in gold, you should do your research and consult with a financial advisor to determine if now is the right time for you.

Takeaway: These are some of the ways to invest in gold and it’s a smart financial decision.

One of the most popular investment options for Canadians is to buy gold. Gold is a reliable and relatively safe way to invest for the long term. It is also a good choice for diversifying your investment portfolio. No matter what the economic climate, there are always opportunities for gold to appreciate.

Gold is a great way to increase your retirement savings, but it is also an excellent option for long-term investment, especially when combined with other forms and precious metals. Gold is an excellent way to hedge against rising inflation and help protect your wealth and savings against future potential devaluation of the dollar or other currencies.

However, gold is a very volatile investment that can fluctuate dramatically in value. It’s important to do some research and make sure you buy gold at the right time.

Hi,

Hi,