Gold All-Time High

Without going through everything that happened in 2023 in detail, we think one word that sums up this past year would be ‘TURBULENT’. Massive banking crashes spanning from the United States to Europe. Chinese property markets falling off a cliff. Record interest rate increases leading to a financially crippled citizen base around the world. Not even diving into geopolitical tensions rising at a rate so quick that many are speaking of World War III potentially being on the horizon. It is a year that many were hoping they could leave in the rear view but sadly 2024, 19 days in, is bringing with it more financial bad news that suggests the world is headed for a severe financial crash at worst to flush out rotten debt or a full financial reset moving toward Central Bank Digital Currencies (CBDC) at best due to the complete loss of faith in current fiat currencies, also due to rotten world debt.

The above may come across as a stretch, but if instead of looking at each of our newsletters as one off events, and rather you try to puzzle them together, placing them all on a single web, this helps paint a clearer picture of the impossibly murky waters of our world’s financial system. It is then you can at least start to see the beginnings of an avalanche, rather than getting caught up on each individual snowflake falling during the financial blizzard we find ourselves in. And to that, below we will be recapping 2024 up to this point, and it is our hope you feel the urgency this newsletter was prepared with as we feel the time for everyone to protect themselves as best they can to weather the storm is now… while waiting could be costly.

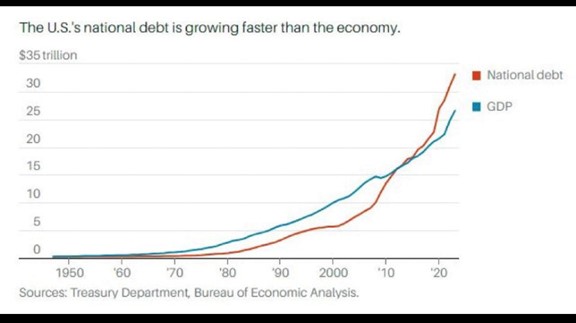

In 2008, this was the last time the world saw a large-scale financial crash that almost sucked world economies down with it. What most people do know is the Federal Reserve turned on the currency printers and bailed banks and other financial institutions out, kicking the real problem down the road for future generations to deal with. What most people don’t know is that it triggered a dangerous reversal in the United States National Debt and its Gross Domestic Product (GDP). When the currency printers were turned on, it was at that moment National Debt began to accelerate faster than GDP, and once national debt exceeds GDP, a nation is on paper, broke. This is the United States as we stand today.

U.S. National Debt has ripped past their GDP, and with $7.6 trillion USD worth of public debt being held by the Federal Reserve coming due this year (2024), which represents 31% of ALL outstanding U.S. government debt – this acceleration of debt is only going to continue as the government will need to continue to borrow more currency to pay off past debts; and the cycle of diluting our savings will continue… unless held in physical silver and gold.

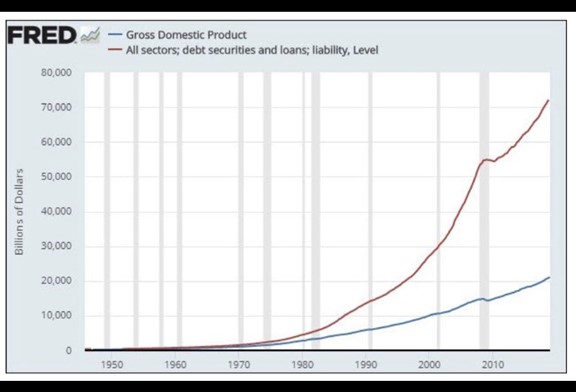

And to make this as clear as possible, looking at the zoomed in version below it becomes blatantly obvious how bad the current situation has become as the bottom blue line (GDP) is meant to pay off the red line (total debts) that as we can see above, has passed the blue and will never look back as more currency will always need to be created to pay it off.

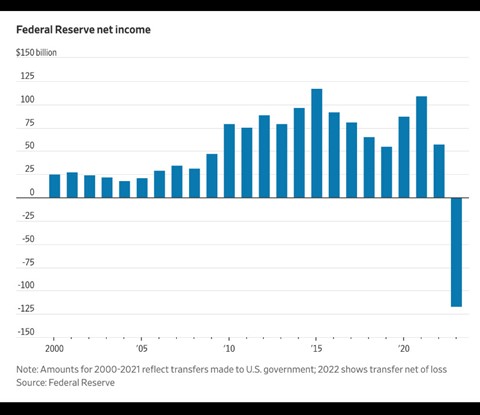

To make matters worse, it was also reported by the Federal Reserve that corporate America is currently carrying $13.7 trillion USD in debt, jumping 18.3% since 2020. This caused 153 companies to fail to make mandatory debt payments, up from 85 in 2022 – a staggering 80% increase. The unsustainable debt problem created in 1971 when the world turned away from sound money, silver and gold, is now beginning to catch up to the future generations that were left holding the bag. Shockingly, that was not the end of the bad news reported by the Federal Reserve as they also let the world know that in 2023, they faced their largest yearly loss on record. Which sounds bad, but the image is worse.

The United States is in SERIOUS trouble. The only thing that can save them now is Fort Knox, which holds the largest gold reserve in the world.

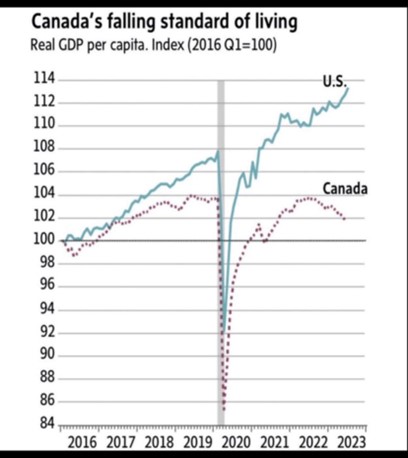

Of course, this is the United States, and we are in Canada, so why does this matter to us? While this is a fair question, it is to be understood that due to the United States holding world reserve currency status, their economy is what all others lean on, and even still, look below to see how Canada has bounced back since the closures of 2020.

Going purely off GDP, the Canadian standard of living is plummeting, and anecdotally we would venture to guess most Canadians would agree with that sentiment. This not even mentioning that in December of 2023, Canadian inflation began to rise again hitting 3.4% – squeezing Canadian wallets and savings even harder.

So what has been the result of all of this chaos? The answer in short: the world has continued to stockpile gold and silver, especially the countries in and hoping to join BRICS+, while the West + Europe are both hoping their paper currency debt scheme will last a little longer. Due to this transition sending real wealth out East while the West focuses on piling up debt, gold has continued to rise in China, actually making a fresh all-time high this week hitting 482 Yuan per gram of gold. Highlighting that Eastern markets are highly focused on the value and protection gold can provide during the turbulence that is sure to continue given the world’s current financial landscape.

Below you will find the newest addition to our Lunar Dragon offers – the stunning 1 Oz Australian Lunar Series III Year of the Dragon Silver Coin minted by Perth Mint. As well as, one of the first shipments in Canada of 2024 1 Oz Silver American Eagle Coins.

1 Oz Australian Lunar Series III Year of the Dragon Silver Coins | Perth Mint

2024 1 Oz Silver American Eagle Coins | U.S Mint

Hi,

Hi,