Earlier this week on Wednesday, Forbes released what we would consider a bombshell report on BRICS+. The reason we believe it to be such a substantial article is because of the certainty it appears to be written with in tandem with the fact it came from such a reputable economic source. What the report dove into was BRICS+ and their mission to create a gold-backed currency to try to replace the hegemony of the United States Dollar (USD). However, what was interesting about this report was the fact it spoke about this gold-back currency future as a definite. It was no longer about hoping to create a new currency with real value, or simply just discussing the potential of such a currency if it were to be created, but rather the report spoke about this currency as something that is 100% going to come to fruition; something the world needs to prepare for.

Of course, in precious metal circles there has long been a desire to return to sound money in order to restore true wealth back to the hardworking people of the world. With that said, due to the USD having such power since 1971, gold just faded further and further into history only to be stockpiled by those with incredible foresight into what would come of this debt based system. Now there is a very real chance true value will be returning to the world stage because in preparation for this golden currency creation BRICS finished 2023 far and above the largest purchasers of physical gold bullion. Out of the astonishing net 800 tonnes of gold purchased by central banks in 2023, 14% higher than 2022, 225 tonnes of gold went to China alone with Russia slotting in as the second highest buyer, followed by India. It is also being reported that already through January 2024, China and Russia have continued their buying spree. It is hypothesized that BRICS nations are stockpiling gold at such a rapid pace, not only in preparation for their gold-backed currency, but to protect themselves from a serious U.S. recession that many believe is fast approaching.

To more deeply understand how a gold-backed currency would actually work, it is important to understand how the USD works in our current system; something the Forbes article does in a very clean and simple way. First, consider the USD as the currency of currencies. If someone in India wanted to buy wool from New Zealand, they could not make the purchase with Indian Rupees, as there is no market for that currency in New Zealand. The same way there is no market for New Zealand Dollars in India. That is where the USD gets its power because every country has a market for USDs. So, what would happen? The person from India wanting wool from New Zealand would first need to purchase USDs with Indian Rupees, and then buy the wool in USDs. This is essentially what BRICS+ is trying to create: another currency that can act as the middle ground for world currencies, but rather than being based on debt would be based on real value, gold and silver.

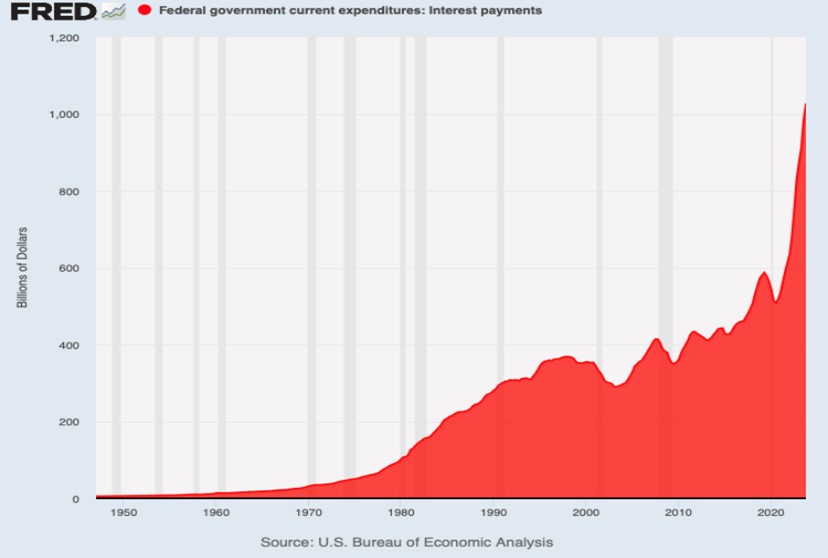

To make things even more clear the direction BRICS+ is looking to go, it was also reported that China purchased a whopping 1.39 MILLION barrels of oil every single day in December. A staggering increase from 20,000 barrels a day in November, and a clear sign that China believes something BIG is on the horizon. What is even more interesting is that China on average purchased 760,000 barrels EVERY DAY through 2023 with no purchases coming from the United States signalling China has dwindling interest in doing business with the current world super power. And really, when you consider how much trouble financially the United States has gotten not only itself into, but the world due to the spiralling debt scam they have run with the USD since 1971, 53 years ago – it becomes blatantly obvious why countries (especially BRICS+ nations) are stockpiling gold, silver, oil, rare earth minerals, food, you name it. If it is a useful commodity, BRICS+ is buying or producing it in some form. Also, the dramatic increase in oil purchases by China from 20,000 barrels a day to 1.39 million during times many believe they are going to go to war with Taiwan and subsequently the United States points to that being not only a scary scenario, but a very real outcome. Curious timing too, as the United States just surpassed $1 TRILLION A YEAR due in interest payments on their ever soaring national debt (image below). It is no wonder China is loading up on real wealth and real assets because as we have spoken about before, the only way to pay off debt in a debt based system is to print more currency over and over and over again until the people finally realize it is worthless. BRICS+ have realized this, and gold is their answer.

Looking at Canada, our situation is no better. In December, Canada sees inflation rise after record interest rate hikes that were supposed to stop inflation in its tracks. Well, they didn’t, and the Bank of Canada’s response was to leave interest rates where they are this past Wednesday. What have we been saying all along here at Au Bullion? Rock and a hard place. Central banks can either continue to raise rates and implode the world economy OR cut rates and let inflation run out of control destroying fiat currencies due to the trillions upon trillions upon trillions of dollars created since 2020.

Because of this, and with 2024 1 Oz Silver Canadian Maples coming out within weeks, we want to offer a massive blowout sale on random year 1 Oz Silver Canadian Maples while supplies last. It is imperative citizens of Canada begin to realize the seriousness of the financial situation the world is in and begin to protect themselves financially while they still can as when these economic crashes historically happen, it feels to most like they came overnight leaving no time to prepare. We know this to be untrue as the writing is on the wall LONG before any economic turmoil bubbles to the surface.

Hi,

Hi,