By now, you have likely heard about the collapse of Silicon Valley Bank (SVB) and may even have your eyes pasted to the news cycle to find out what this means for your personal bank (if you use one). However, the most alarming part of this story is one that is seemingly getting brushed under the rug and not gaining much traction in the news. The reason we believe it is arguably the most important piece of what happened is because it outlines how our warning systems failed, leading to more damage being done than necessary. And if it failed once, what is stopping our warning system from failing again?

Yes, the signs for a banking system failure have been there since 2020 and many financial experts have been warning everyone of the impending crisis. However, major Credit Rating Agencies are supposed to be on watch, letting investors and depositors know when banks are becoming unwell financially so they can prepare or move their assets accordingly. Going back in time about a week, days before SVB collapsed, on March 8th, one of the two major Credit Rating Agencies, Moody’s still had SVB rated as A3 – a very respectable investment-grade rating! Later that evening, cracks began to show, and SVB announced they needed to sell bonds in an emergency rush to raise liquidity in order to stay financially stable. On those sales, they suffered a $1.8 billion loss. Moody’s barely flinched, downgrading SVB just one small notch down to Baaa1, still 3 notches into investment-grade signalling the bank was still in good health. By March 10th, SVB was in full blown collapse, causing Moody’s to finally acknowledge the situation was worse than they had anticipated, moving to downgrade SVB 13 notches in one swoop, all the way through junk territory to its lowest rating, C, which equates to default. As bad as that may be, they were not alone. The other of the two major Credit Rating Agencies, Standard & Poor’s, on March 9th, also thought that SVB was still worthy of public investment, rating SVB at BBB-, investment-grade. Similarly on March 10th, once the world already knew what was happening, Standard & Poor’s downgraded SVB 10 notches down to D, default, its lowest rating.

Within 2 days, the two agencies that are supposed to be warning the public about bad companies from an investment perspective swiftly changed their mind from SVB being a great investment, to SVB being worthless. Due to them acting so late, the damage done to those that invest in SVB is irreversible, as they will lose everything. What is interesting, is that these agencies must have told someone within the bank what was coming, as just 2 weeks before the collapse of SVB, their CEO sold $3.6 million in SVB stock, cashing out before the stock ultimately went to zero last week.

What should be most alarming to those that put faith in these agencies to tell them what is happening rather than trying to find out for themselves, is that this collapse came seemingly out of no where if you ask those in charge. Those in the Biden Administration, as well as financial experts within government like Janet Yellen, have been telling the public that there is no impending liquidity crisis, that inflation is going away, and ultimately, that we need to have continued faith in the system, with the Rating Agencies backing up these statements with investment-grade ratings being put on banks. Right up until these banks fail.

In fact, the collapse of Silicon Valley Bank is currently the second largest bank failure in U.S. history with the largest coming during 2008, and seemingly no one saw it coming. With the economy still struggling due to historic interest rate hikes that are still behind inflation, you can bet SVB is not alone. Look at the chart below that shows all the bank failures and their size in the U.S.:

In just 3 days, two of the three largest bank failures have occurred in the Unites States, yet the public is told everything is fine and there is nothing to worry about. Yes, the FDIC and Federal Reserve have pledged to backstop all deposits at SVB even though over 85% were uninsured being over $250,000. Furthermore, the current U.S. banking system holds over $22 trillion, the FDIC has a balance sheet of $125 billion + a $100 billion line of credit. Even at that rate, Silicon Valley Bank and Signature Bank have combined assets of $319 billion, the FDIC is already short almost $100 billion and there is more trouble looming.

On cue, as panic set in and people realized how fragile the system was and if they need their currency out of the bank, it may not be there for them to retrieve, silver and gold did their job. Since March 7th, silver is up 11.13% where as gold is up 6.3% — showing the public where true value is held during times of chaos. The only question becomes whether you believe the contagion is contained or if it is due to start spreading? It should be considered that in a 24-hour span over $42 billion was removed from Silicon Valley Bank during the initial bank run. $42 BILLION. Highlighting the importance of securing wealth outside the system ahead of time, so you do not need to take part in the mad dash when banks start imploding, and implode they may continue to do. In the two years prior to 2007, zero banks had failed, after which point 468 banks failed between 2007-2012. Going back two years, 2021 and 2022 saw zero bank failures; we just had our first two. Are the dominos starting to fall?

The value of the banks failing would suggest more is on route, as in 2008, the 25 banks that failed had a value of $373 billion, where as the two that failed last week are valued at $319 billion just themselves. We are dealing with much larger numbers today, and due to that, any fallout is not nearly as easy to print away with more currency.

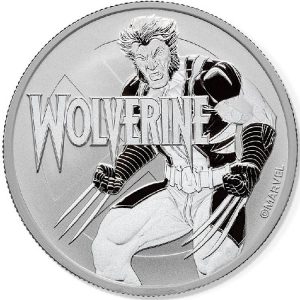

At our shop, we are seeing an unprecedented number of purchases in response to the recent bank failures with other major distributors of precious metals reporting the same. This highlights the fact that people will only move to protect themselves once a crisis has hit, causing a mad dash to protect their assets. Smart money protects themselves ahead of time while prices are lower, putting them in a much more advantageous position than someone that waited right up until the last second because they believed banks were impenetrable. This week, check out Marvel’s Venom and Wolverine 1-ounce silver coins out of the Perth Mint – the time is now to secure your wealth. Want to know more about Banking System Failure , please go through this article here.

Tags: Banking System Failure

1oz Marvel Wolverine Silver Coin

Hi,

Hi,