The United States once again finds itself in the peculiar situation of needing to raise their debt ceiling in order to continue to finance government spending congress has already agreed to, as well as future obligations such a Social Security, Medicare Benefits, Military Salaries, Veteran Benefits, Tax Refunds, Interest on National Debt, etc. While needing to raise the debt ceiling is nothing new in the United States as borrowing has been required to take place in ever increasing quantities since the conception of the private central bank that operates in the United States, the Federal Reserve, in 1913. It does beg for the question of “how long is the road this proverbial can keeps getting kicked down?” to be asked. At some point, debt will become so outrageous – simply issuing more would become redundant due to the debtor never being able to pay it down in full. However, before getting into how dire of a situation the United States finds itself in, we think it is important to revisit a chart that periodically seems to resurface, and that being the chart that tracks the purchasing power of the United States Dollar.

As you can see, in 1913 the United States Dollar was still carrying its full purchasing power as it was being successfully backed by gold. However, once the Federal Reserve stepped in, massive illegal printing took place, slashing the purchasing power of the USDs being sent to other countries that were supposed to be as good as gold, forcing these countries led by France to demand gold instead of dollars until Richard Nixon made this an impossibility in August of 1971. Today, the purchasing power sits at just 33.7 on the chart above, marking a 96.69% loss in purchasing power since the USD sat at 1017.8 on the above chart in 1913.

During the same time period, United States National Debt as moved almost completely inverse of the chart mapping the USDs purchasing power, suggesting, that as more dollars are printed into circulation their value continues to depreciate, and quickly.

At what point does any one entity or in this case a country lose the faith of those using its instrument of debt (the USD) due to the scarcity being so low, you can find them just about anywhere? Essentially, the complete opposite of what gives silver and gold their value. It is also worth bringing up the Committee on Banking, and Urban Affairs, United States Senate hearing on February 16th, 2005 that featured then Federal Reserve chairman, Alan Greenspan. He would go on to say the following when speaking toward the national debt, and servicing obligations such as Social Security payments:

I think we should maintain the principles of Social Security, but I think the existing structure is not working, and that until we can construct a system, which creates the savings that are required to build the real assets so that the retirees have real goods and services, we do not have a system that is working. We have one that basically moves cash around, and we can guarantee cash benefits as far out and at whatever size you like, but we cannot guarantee their purchasing power. This is why the issue ultimately has to be resolved in terms of do we have the material goods and services that people will need to consume, not whether or not we pass some hurdle with respect to how financing occurs, because the financing is a secondary issue, and it is the means to create the real wealth, not an end in itself.

The highlighted portions of Greenspan’s statement are worth breaking down further once you fully understand the situation the United States currently finds itself in which we will go over now.

Looking at today, Janet Yellen the U.S. Secretary of the Treasury made a statement late last week letting the public know that the United States Treasury is going to be forced to move cash around and take ‘extraordinary measures’ to ensure payments are able to be made up until June, which at that point the government will be out of money and require more to be printed for them – increasing the national debt even further. The below chart shows how likely the market believes a United States debt default is, as the below chart shows the yields on current Credit Default Swaps…

The market clearly suspects something is coming based off how violent a move the above chart made. Keeping in mind, silver and gold remain as the best hedges against currency default.

In normal circumstances, as mentioned earlier, the proverbial can usually has the ability to be kicked down the road, however, this time around, there are already so many USDs in circulation and inflation is still out of control right as the printers need to be turned back on. This is a recipe for disaster and has put the United States between a rock and a hard place: they can either increase the debt ceiling, print more money, and send inflation surging upward once again, which is highly bullish for silver and gold OR they can default, calling into question the value of USDs currently being held causing a rush out of USDs and into other tangible assets, again, highly bullish for gold and silver.

Revisiting Greenspan’s comments above, he lays it out in black and white. He stresses the system needs to create REAL wealth, so retirees have REAL goods and services. This does not come from illusionary wealth held in fiat currency, it is held in tangible assets like silver and gold. He further fuels this fire by then stating, of course, they can print and hand out cash assets in whatever quantity congress wants, he just cannot guarantee they will buy anything of real value. Again, this referring to USDs that continue to lose value, unlike real money, gold and silver, that have gone up hundreds of percentage points since Greenspan’s statement in 2005, keeping up with an ever-expanding currency supply as they always have. He then finishes it off by highlighting the importance of creating REAL wealth, and that printing endless fiat currency is not an end in itself due to those dollars inherently having NO VALUE. Their value comes from having confidence in an entity that is now on the brink of saying, “yeah, we cannot pay you back”, and with the Eastern half of the world continuing to load up on gold and silver, it is clear they suspect a major fall in the hegemony held by the United States and their dollar is on route.

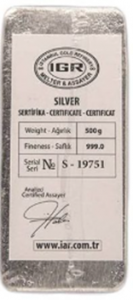

If you would like to get ahead of the approaching disaster that is marked for June of this year if the debt ceiling is or is not raised, gold and silver have historically provided that protection. When looking to secure wealth at as low a cost as possible, while also focusing on more stacking friendly quantities, we suggest you check out the 500g Silver Bar out of the Istanbul Gold Refinery. At 500g this bar is equivalent to 16.0754 troy ounces, making it a little larger than the 10-ounce bars, but also allowing it to carry a smaller premium providing you a better ‘bang for your buck’.

Hi,

Hi,