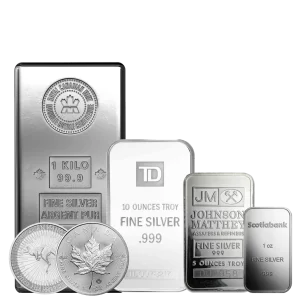

Silver has been cherished for centuries, whether showcased in jewelry, used within industries, or minted into coins. Today, we’re navigating the world of silver coins – both collectible and bullion – and exploring how silver prices influence their value. Collectible Coins & Bullion Defined To unravel the relationship between silver prices and coin value,…

Category: Silver

The Correlation Between Silver Price and Industrial Demand

Silver, often overshadowed by its yellow counterpart Gold in the world of precious metals, has a unique standing in the global market. It’s not just a metal sought after for its shine and investment value. Silver is extensively used in various industries due to its exceptional conductive and reflective properties. Today, we’ll delve deep into…

A World Buried in Debt

In previous newsletters we have been sounding the alarm on the steady transition taking place out East from illusionary intangible wealth to real tangible wealth. This transition is taking eastern countries from debt based financial assets over to physical commodities in all forms – silver and gold being a large part of that transition….

The Waves of Inflation

Between the start of the pandemic and the summer of 2022, the world saw what will go down as the most unprecedented currency creation period in modern history, this of course until the next crisis inevitably hits and the printers need to once again be turned back into overdrive to bail out those banks that…

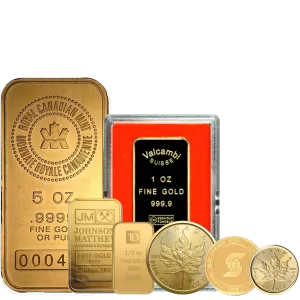

Top 5 Mistakes to Avoid When Buying Gold Bullion in Toronto

Investing in gold bullion is a great longterm strategy for safeguarding wealth, especially during times of economic crisis. If you’re located in Toronto or anywhere else in the world, this universal currency can offer a hedge against inflation and currency fluctuations. However, navigating the bullion market can be challenging, particularly for first-time investors. Even a…

Hi,

Hi,