Gold and Silver Investing

People often think that investing in gold and silver is a safer option than investing in stocks and shares. When opposed to investing in stocks and shares, purchasing precious metals like gold and silver is sometimes seen as a more secure alternative. Making your first investment could not come at a better moment than right now.

In this blog, we explore the reasons why gold and silver are regarded as secure investments, as well as the information that is necessary for you to have before making such investments.

-

Gold and silver continue to be valuable assets

It is essential to emphasize that there is an element of risk involved in each investment. Even though precious metals are often regarded to be secure investments, their value may both grow and decline over time. However, in comparison to equity-based investments, they tend to have a higher potential for value retention. Not only is it reasonable to predict that they would maintain their prices, but they are also two of the most widely held stocks in the whole globe. This is due to the fact that their worth is unaffected by economic and political volatility to a relatively large extent. Instability is one of the things that the financial markets despise more than anything else.

When investors see signs of instability in the market, they often rush to acquire precious metals. Investing in gold and silver is considered to be a secure choice, regardless of whether a currency is experiencing a decline in value, or a government is through a time of instability. You need to take into consideration the fact that the price of gold and silver fluctuates over time since it is something you should plan for. Because their values might be influenced by a variety of factors, it is necessary to have a holistic perspective on the situation.

As a scenario, if a large amount of silver is mined in a given year, the mining businesses may end up with an excess supply., there may be more than enough to satisfy the demand, which would leave the mining corporations in possession of a surplus. This would have the effect of bringing the price of silver down on the market.

Or, if there isn’t a lot of silver mined, the lack of supply will cause prices to rise. You may attempt to schedule your purchase so that it falls within a period in which there is a surplus, but as no one can accurately anticipate the future, it might be difficult to tell when the optimal moment is to make a purchase. Precious metals may be the ideal investment choice for less experienced investors who have a low tolerance for risk and cash that is sitting in a bank account collecting no interest.

-

What Specific Forms of Gold and Silver Should You Invest In?

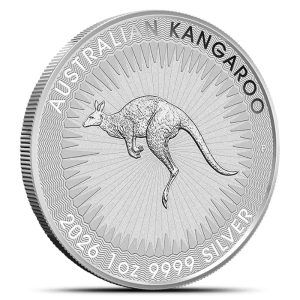

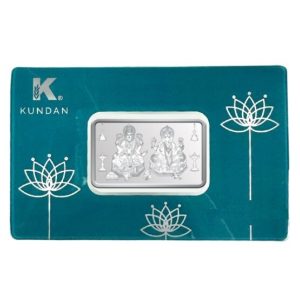

Buying gold or silver may be a lucrative long-term investment, and there are a variety of forms of these metals available. There are a wide variety of nations that produce coins, and these coins may be found in a wide variety of patterns.

Additionally, there is availability to bars. The typical size is referred to as a “Good Delivery bar,” and it has a weight of 400 ounces. In addition to this, it adheres to a wide variety of other quality criteria that you can count on aubullion.ca . This is something that is done all over the world.

It is not easy to provide a simple answer to the topic of what you need to get. Coins are handy. Because of their size and portability, they might be ideal for a person interested in investing on a more modest scale. Nevertheless, there are several varieties of coins to choose from. Some are determined to contain exactly one troy ounce of gold and one ounce of silver after being weighed. On the other side, there are antiquarian coins, which are essentially artefacts that collectors want to acquire. They do have the potential to have a very high value on occasion, especially if the imprints in question are exceptionally rare.

Although the Good Delivery bar standards are used for trading purposes, in reality, gold and silver bars come in a variety of weights, ranging from the heaviest in the world (a 250 kg gold bar produced by the Mitsubishi Materials Corporation) all the way down to 1 g.

-

One of the few asset classes you physically control

The sphere of personal finance is home to hundreds of different financial products, which can make things quite puzzling for an investor. However, if you are aware of the asset class to which each product belongs, you will find that the entire realm of personal finance is much simpler to comprehend. One way to conceptualize asset classes is as a large basket in which all of the financial items that belong to a certain asset class have qualities in common. Similarities may be seen between things like risk, returns, liquidity, and a variety of other characteristics.

Gold and silver have traditionally been regarded as precious metals and have enjoyed high levels of demand as a result of this perception. Even in this day and age, precious metals continue to find a home in the investment portfolios of shrewd individuals. Gold and silver are distinct from other asset classes since they belong to a category that may be owned and transacted with freely and boasts a price that is used as a benchmark on a global scale. There are a wide variety of tangible investments, such as real estate, for reference. But you can’t just walk away from a piece of property if you put it in your pocket and pretend it’s not there. At the end of the day, all you own is a piece of paper that certifies that you are the owner of that property, and you have to put your faith in the government that issued the document to ensure that the property remains in your possession.

People still think of cash as a tangible asset class when they look at their amount on their account statement. People aren’t aware of the obstacles that their banks would provide them with if they ever tried to take physical possession of their money, and they don’t realise how tough it would be to do so.

Diamonds are a kind of asset that, like gold and silver, are completely under your control physically. On the other hand, the substantial buy-and-sell spreads and the lack of price stability make diamonds a less appealing option for long-term wealth preservation.

-

What are the steps involved in investing in precious metals like gold and silver?

Gold and silver investments may be a good alternative investment, particularly during economic downturns. During the previous 5,000 years, several nations, kingdoms, and empires have come and gone, taking their own currencies with them when they left. But despite all of these changes, gold has maintained its role both as a means of commerce and as a store of wealth. Along the way, silver has served as a complementary precious metal, earning the reputation of being the “poor man’s gold” owing to the significant price disparity between gold and silver. The use of conventional paper and electronic currencies in the modern era is a norm. Governments have officially recognised them as money, and individuals have no problem acknowledging them in that capacity. They do not, however, have any worth that can be derived from the items themselves.

The primary criticisms levelled against gold as an investment are that 1) it does not provide income in the form of interest or dividends, and 2) it is not an all-weather investment, meaning that its value does not remain stable regardless of the market conditions.These are all valid issues; yet, they fail to address what could be the most important issue. Gold is an asset that, for the most part, performs the best when economic conditions and the condition of the financial markets are at their worst. Since of this, investing in gold is considered to be a real counter-cyclical strategy because gold is often the only asset that puts in a positive performance while other assets, such as paper assets, are decreasing.Since the end of World War II, the United States has been through two significant periods of economic instability, both of which were times when gold comfortably outperformed the financial markets.

Gold and silver, on the other hand, are examples of actual physical commodities. They are valuable not only due to the fact that they are uncommon but also due to the fact that they have a variety of different uses. Both are put to use, for instance, in the production of jewellery as well as in certain industrial applications.

Buying your initial coins is all it takes to start your investment portfolio in precious metals like gold and silver. Because we are an authorised distributor and an official partner with the many different nations, you will be able to purchase your very first coins right here at aubullion.ca

If you’ve made up your mind that you’d rather put your money into bars, we also have them.The next thing you need to do is give some thought for the investments you want to make.

-

Gold and silver may be stored in a variety of ways.

If a thief is able to get their hands on your gold and silver, it is safe to assume that you will never see it again. This is something that goes without saying. When it comes to putting away precious metals, you need to give this matter a lot of serious thought. You may choose to store it yourself, which is likely the method with the highest degree of danger. If you lose it, there is no way to get it back; no one will be able to replace it for you!

Rather of doing that, you might think about putting it in a safe deposit box. You may want to discuss this matter with a financial institution. However, in today’s day and age, the vast majority of banks are not especially interested in keeping precious metals since these transactions are now conducted online.

On the other hand, there are still services available, such as ours, which are dedicated to the safe and secure storage of precious metals. Before any service can keep your gold for you, they need that you have a certain minimum quantity of gold or silver in your account, although these requirements are maintained to a reasonable minimum.

Talk to one of our representatives now to learn more about the ways in which we can store your precious metals in a safe environment while providing you with complete insurance coverage from aubullion.ca.

Hi,

Hi,