Alan Greenspan, Federal Reserve Chair from 1987-2006 once said, “In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value.” In other words, due to fiat paper currency having the ability to be printed at will by a country’s central bank – without a stable backing to the currency such as gold, the currency will continue to leak purchasing power, in turn confiscating wealth from unsuspecting citizens. The reason we say “unsuspecting” is because most people do not have a true understanding of how inflation works simply because their bank account has not changed. If someone has $100,000 CAD in the bank before the government prints $2 trillion CAD, and then afterward still has $100,000 CAD in the bank, there is often no correlation drawn that their $100,000 has now been diluted and therefore will purchase less goods. This essentially keeps public outrage at bay due to inflation usually being kept low around 2%, and therefore, only draining purchasing power at a slow rate year over year, but mind you – it adds up quick, albeit it had previously gone largely unnoticed. However, due to inflation pushing so high during 2022 and early 2023 closing in on 10%, citizens began to notice their fiat currency was not going near as far as it did the year prior, even the month prior in many instances, and this was the beginning of gold entering the spotlight once again as public awareness began to shift.

Turning our attention back to present time, just this past Sunday, as early markets in the East opened before the Western open early Monday morning, gold came to life while citizens of the West slept and rallied nearly 4% in a flash to a new all time high of $2117.79 USD/Oz of gold. Now while this spike did not hold once Western markets opened and gold was pushed back down nearly the same percentage in which it had first spiked, it was a clear signal that gold is ready to push through price resistance and ultimately continue higher in the near-term. And to that, it is important to remember, that healthy and sustainable gains in an asset are not found when price action is vertical gaining 10%+ each and every day. It must be steady, with price drops mixed in, and strength shown by continuing to fight through those dips to make higher highs rather than lower lows. The most blatant example of this is crypto currencies. How many projects have we seen being touted as REAL MONEY because they are up multiple hundreds of per cent if not thousands? Only to come crashing down to zero just as quickly as these currencies made headlines. That said, we are not sure what investors in those crypto currencies would expect as that is the investment formula in very simple terms: quick gains lead to false price stability which then leads to equally as quick losses leaving investors dumfounded at what just happened. Where as steady gains lead to stable prices, which ultimately leads to a far slower price retraction once the assets true cycle has come to close giving people time to change their play before getting profits wiped out.

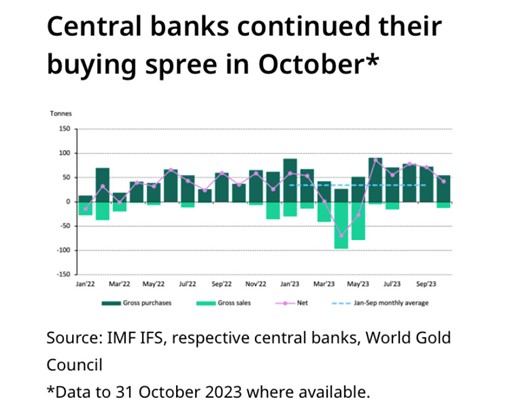

When it comes to what central banks are currently doing, they are seemingly following a similar formula to what was laid out above. Pre-pandemic, holding government debt was seen as the go to asset if you wanted to be sure you would get a handsome pay out. This continued as interest rates were raised at a record pace, sending the cost of borrowing through the roof, making government bonds even more attractive as they paid out a higher yield. However, as we reach the end of this bond cycle, you are seeing more and more central banks sell their U.S. Treasuries (U.S. Debt) and in turn buy gold. Looking at the charts below you can see central bank purchases and sales of gold each month going back to January of 2022, as well as the total accumulation since January 2023 by each country involved with gold this year.

As you can see, there has only been 3 months dating back to January of 2022 where central banks sold more gold than they purchased, with 2 months breaking even, and the remaining 17 months showing far more purchasing of gold than selling.

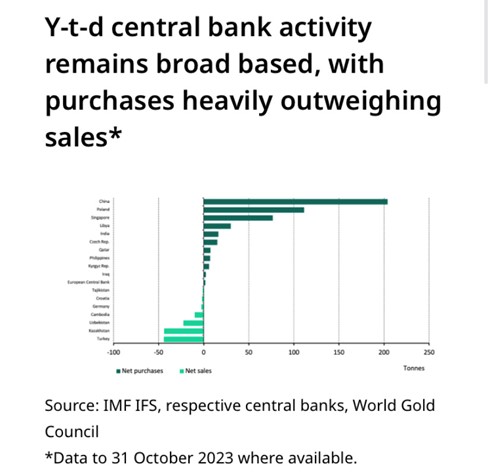

In the above year-to-date chart, you receive a strong visual outlining just how much more gold has been purchased than sold in 2023. China has been far and above the largest buyer of the year announcing another 42 tonnes of gold being purchased in October (their 12th straight month of buying), then being followed by Poland, Singapore, Libya, and India.

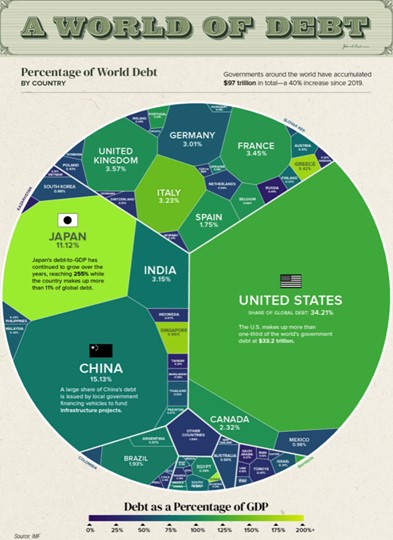

In our final chart of the day, you begin to get a better understanding of why central banks are turning away from holding other countries’ debt, and rather looking to hold gold instead.

Since 2019, governments around the world have increased their debt by 40% to an astounding $97 trillion USD, with the $100 trillion USD barrier likely to be broken by early 2024 if not before the conclusion of 2023. What is shocking about this is that the country holding the world reserve currency now holds over 1/3rd of the ENTIRE WORLD’S DEBT sitting at 34.21%, well over 125% of total U.S. GDP. Essentially, the country that has the most currency circulating worldwide is dead broke.

When trying to understand why governments and central banks are shifting toward gold and away from bonds/treasuries it is important to understand that government debt will ALWAYS be paid back. And if that is the case, why not hold their debt? The reason being, when turning on a printing press and creating money out of thin air can take care of what a country owes, the currency received back for lending to the U.S. government will be worthless, and the same can be said for each country with a central bank. With that said, this is why you are seeing a major shift toward gold, countries understand fiat paper currency has almost run its course and that a new way for monetary exchange must be implemented. This is why Central Bank Digital Currencies (CBDCs) are being created, so the public continues to use currency with no real value, while governments hoard physical gold.

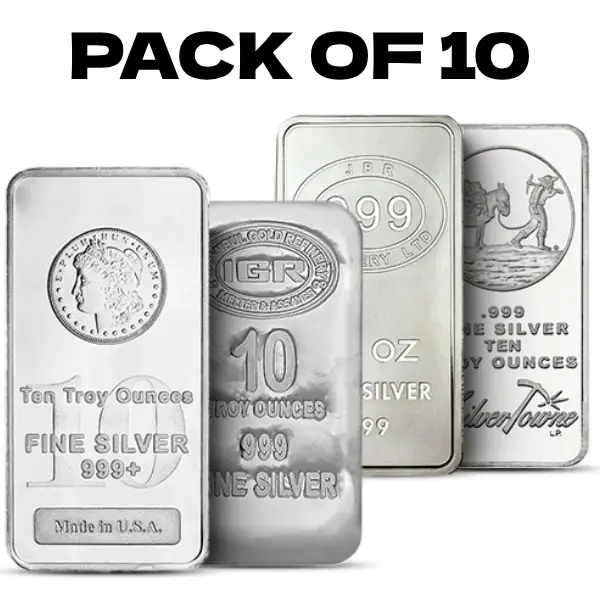

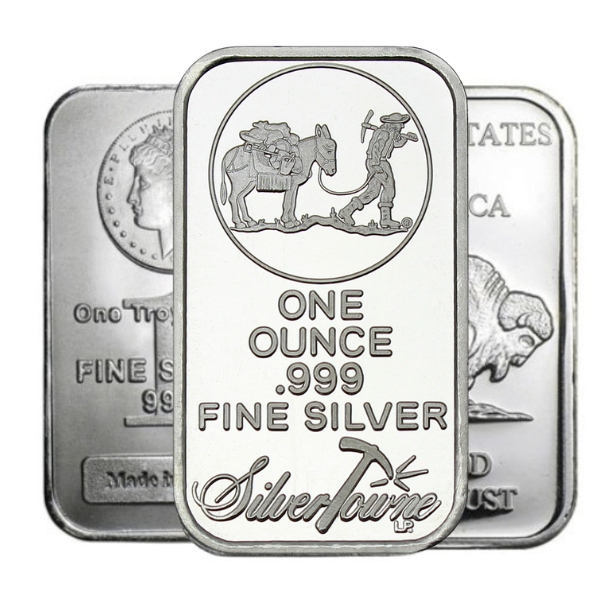

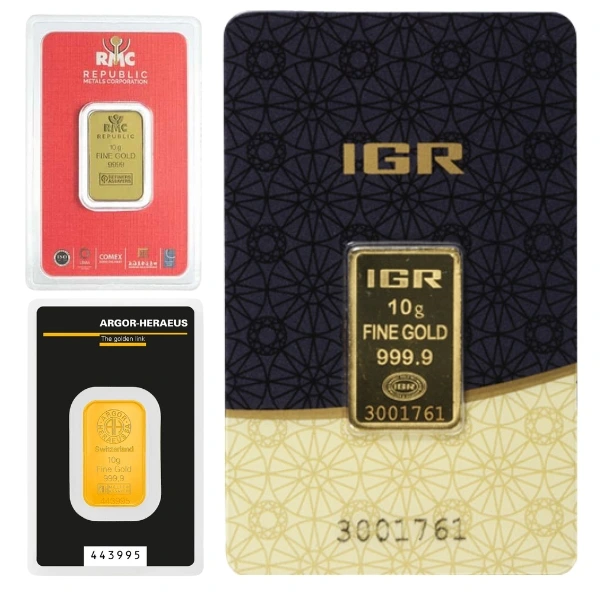

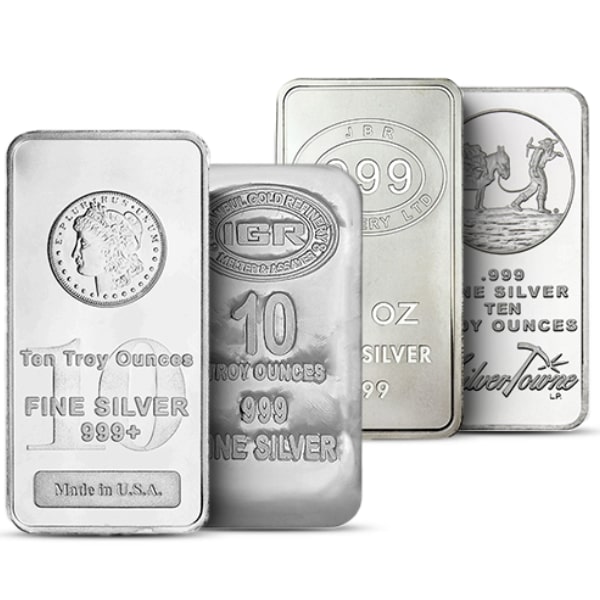

If you too want to ensure you are prepared for the economic changes coming the world’s way, look no further than Au Bullion as we are always happy to help with any of your precious metals needs, and we are always stocked with high quality, low premium products including those you see below!

1 Oz Gold Royal Canadian Mint Bar

Hi,

Hi,