As we turned the page on October and began to try to quantify what may be coming our way regarding precious metals and the overall financial system in November, we started off by laying out multiple scenarios of what we may see in our first newsletter of this month. These scenarios covered seven periods of time going back to the early 1970s in which November seemed to mark a price low of the time and proved to be a catalyst that vaulted silver and gold higher and higher over the following months/years. With those scenarios covered, we urged our readers to keep an eye on silver and gold this November to see if there were any signs a near-term price low was in, and that higher prices were on the way.

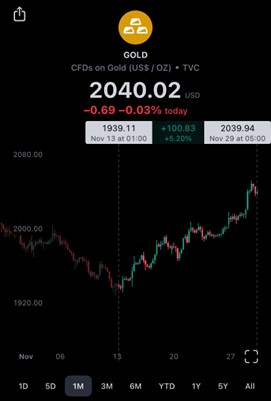

With all that said, let’s take a look at how November is finishing up as December quickly approaches and the overall economic outlook around the world continues to deteriorate. After our November outlook newsletter went out on November 2nd, 2023, gold and silver both began to dive lower, dropping 3.31% for gold and 4.76% for silver between that time and November 13th, 2023. Initially, our call of November usually signalling better times for precious metals appeared to have been wrong. However, it was November 13th, 2023, that ended up being the turning point we had been predicting might come based on historical data on both gold and silver. Since that date, gold has risen 5.20% at time of writing, and silver has taken off like a rocket sitting at a 13.45% price increase at time of writing. You can see on the charts below the dramatic turn around both of these precious assets have made over the past two plus weeks; seeing large daily jumps over 2% in each metal being mixed in throughout their climb.

As these sound money assets commonly do, you can see above that on the exact same day, both assets determined that they would begin to push their way higher. Looking at the month of November as a whole, of course, overall gains are smaller with prices dropping for the first two weeks of the month, but still we see gold sitting at a positive price increase of 1.68%, while silver has seen a price jump to the tune of 8.17% on the month.

What is important to remember is you will quite often see larger moves made in silver both to the upside and to the downside with the reason for that being that gold has historically always led price changes in the precious metals asset class with silver following aggressively. This is also why you see many investors in precious metals flocking toward silver due to it likely seeing a far more volatile move to the upside once gold begins to poke through all time high price levels as financial indicators around the world continue to worsen.

Speaking about all time high prices, as currently stands after the 5% plus run gold has made the past two weeks – the shiny yellow metal currently sits just over $30 shy of an all time high in price or just 1.49% away at time of writing. All it would take is one more good day, and gold may not only reach an all time high in price, but for the first time in history finish a month above $2000 USD/ounce if it can hold these levels through tomorrow. Due to the $2000 USD price barrier being rejected countless times at the end of previous months going back to and including August of 2022 when the current all time high was set, many in the financial sector believe that if $2000 USD can be held closing November along with an all time high in price being met, $2000 USD/ounce may never be seen again as prices continue to move higher and higher as financial conditions worsen around the world.

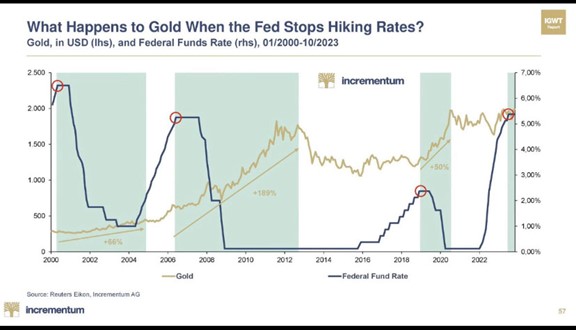

Of course, current price action in combination with closing a month at an all time high in the price of gold would surely spur further buying by central banks and the public alike putting continued upward pressure on prices. However, it is not even close to the only thing currently being viewed as incredibly bullish for gold and silver. Another being that earlier this week, Federal Reserve officials spoke, with one of their Board of Governors, Christopher Waller, stating in paraphrase that while he feels inflation is still far too high, he also feels that current interest rates are high enough to continue to slow inflation rates, and with that said, feels interest rates will not go any higher and will actually begin to be cut in 2024. What this means, is that the Federal Reserve is most worried about the rock and hard place we have repeatedly mentioned in our newsletters. With banks still continuing to fail, the Federal Reserve cannot raise rates any higher or they will break the economy, but they also cannot lower them just yet as inflation will make a dramatic turn around and race out of control again. What is interesting though, is that Waller mentions that in 2024, that is when he believes interest rates will be cut, so why don’t we take a look at what gold has done dating back to the tech bust of 1999-2000 when interest rates are cut.

Between 2000 and the end of 2004 when rates were lowered in response to the tech bust, gold rallied 66%. Between 2006 and the end of 2012 when rates were again lowered in response to the incoming and then impact of the Great Financial Crisis of 2008 that was seen coming from miles away by financial experts at the time including Michael Burry (from the now famous Big Short movie), gold rallied another 189%. Lastly, when rates were cut going into 2019 until they reached zero in 2020 in response to impending lockdowns, gold again rallied 50%. The only question now, is where does gold go in response to interest rates inevitably being cut again?

This is a question many citizens and those in the financial sector, including central banks and governments, would like to see answered while holding as much gold and silver as they possibly can. One thing is for certain, it is that while small and large banks may fail, central banks that control monetary policy often come out on top, and these are the very same institutions buying gold at record speed. If you too want to see what happens with gold prices once it reaches an all time high and we inevitably see interest rates cut, while holding gold, check out our Cyber Monday deals being offered through our website, as well as some popular gold and silver products below.

2023 – 25x1g Gold Maple Gram Sheets

2023 1 Oz Silver Canadian Maple Tubes

2024 1 Oz Lunar Dragon Silver Rounds

Hi,

Hi,