Slowly, then all at once. This is a phrase we want you to keep in mind as you traverse the economic landscape of this world. A financial landscape that has been intentionally made so convoluted it becomes difficult for many who don’t have the time to really look into how it works to understand. However, with our initial phrase in mind: “Slowly, then all at once” — you will begin to notice how many red flags are already waving, and also how steadily they keep popping up all over the world. Even if these red flags are not enough to harm the world economy in a systematic way, you begin to more clearly understand that when lumped together, these red flags become far more dangerous. It is like the big bucket at a water park. Kids and parents alike standing under it, anxiously waiting for the bucket to tip over and release a tidal wave of water. This visual is identical to our global financial system. Slowly, then all at once. At some point in time, a flag will pop up, and it will fill the bucket of financial calamity to the top, and in a flash, the system so riddled with debt, will implode on itself. Slowly, then all at once.

The goal is to be well prepared before the “slowly” phase has fully passed, as many financial experts are predicting the “all at once” phase will be far greater then both the Great Financial Crisis of 2008, and even the Great Depression. Governments and central banks around the world have created the perfect storm of financial disaster with how reckless they have been with the practice of printing currency, and effectively creating value out of thin air.

The reason we want to highlight the above now, and do our best to ensure that you have it engrained in your mind is because of how gold and silver reacted to the most recent statements made by Jerome Powell, Chair of the Federal Reserve, this past Wednesday. Over the past 2 years, the Federal Reserve has been incredibly aggressive in its fight against inflation, raising interest rates 11 times to 5.5%. However, what those holding silver and gold have been waiting for is word that interest rates will be cut due to massive economic weakness and the need for a looser monetary policy. That being because as yields fall, holding debt that has already become a toxic asset becomes even less attractive. This also is usually followed by more currency being injected into the system as interest rates coming down make it easier for families and business alike to get loans. In turn, sending silver and gold upward as they again begin to track the losses in fiat currency. Which, is exactly what they did following Jerome Powell stating interest rates will likely be cut in 2024…

(Image taken Wed, Dec 13th, 2023)

(Image taken Wed, Dec 13th, 2023)

As you can see, immediately as the words came out of Jerome Powell’s mouth around 2:30pm that rates were likely to be cut in 2024, silver spiked vertically 4.59% closing closer to a 5% gain on the day, while gold spiked vertically 2.31% closing around the same gain on the day. Now, even though silver and gold have since traded sideways up until the time of writing today (December 18th, 2023), this pattern aligns perfectly with our introduction phrase, “slowly, then all at once”. It is unlikely silver and gold reach the price points many financial experts are predicting until interest rates are actually cut, and the USD once again begins to lose strength. That being said, the fact silver and gold jumped so significantly on the news itself, has many anxiously anticipating what these assets will do once interest rates are officially brought down.

To finish off, we want to bring to our reader’s attention another major red flag that has emerged signaling the importance silver and gold have already played, even before any major calamity has taken place. What is even more shocking is that holders of these precious metals likely haven’t even taken notice due to the inflation numbers being presented to us by the Federal Reserve. To make this clear, we will use an example that had gone viral using Home Alone, a holiday movie classic. Kevin McCallister in 1990 went on a shopping spree while left home alone, spending $19.83, he did use a $1 coupon, and so in reality the price was $20.83 USD. His list consist of a half-gallon of milk, half-gallon of orange juice, a TV dinner, a loaf of WonderBread, frozen mac and cheese, liquid detergent, saran wrap, a bag of toy soldiers, Snuggle dryer sheets, and toilet paper. If we go off the government numbers by the Bureau of Labour Statistics, the same $19.83 he paid after the $1 off coupon would cost $45.60 in October of 2023, a 130% increase since 1990. However, a user on TikTok went viral after replicating Kevin’s shopping list, spending $68.99 – far higher than CPI estimates given to us, and highlights a 248% increase since 1990. This story gained so much media attention, USA Today and Fox News copied the experiment in an attempt to debunk the TikTok user. USA Today reported a cost of $53.94 (172% increase) and Fox News came in at $72.28 (264% increase), both well higher than official CPI numbers released to the public. This shows that our dollars are losing nearly, if not, double the purchasing power than we are being led to believe. With all that said, in December of 1990, gold was about $380/oz and silver was $4.24/oz. Today, at $2024.26/oz for gold, and $23.87/oz for silver – gold has increased 432.7% and silver has increased 462.97%, not only preserving the loss of purchasing power since 1990, but actually increasing it significantly!

If history has shown us one thing, it is that silver and gold have always held their value and protected their holders. With so many financial red flags popping up each and every day, it is only a matter of time before a system built on false wealth and debt, will begin to crumble under the weight of itself; thrusting real wealth, silver and gold back into the spotlight. This Christmas, consider gifting your family and friends silver or gold, items that will not only glimmer before their eyes, but protect them long into the future; the definition of a gift that keeps on giving.

2023 1 Oz Merry Christmas Silver Round | Asahi Refining

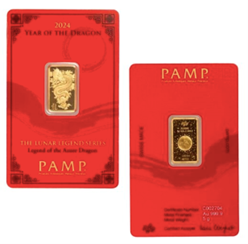

2024 5 Gram Lunar Dragon Gold Bar | PAMP Suisse

2024 1/10th Oz Lunar Dragon Gold Coin | Perth Mint

Hi,

Hi,