Introduction

Swiss-born and -based Credit Suisse Group AG is a leading international investment bank and provider of financial services. Financial services provider with the second-largest global investment bank Its headquarters are in Zürich, and it has offices in all the world’s major financial hubs. Swiss rail system expansion was financed by Credit Suisse when it was established in 1856.

Exploring Credit Suisse’s Response to an Unprecedented Banking Crisis

To increase its liquidity and deposit reserves, Credit Suisse AG announced on Thursday that it would lend 50 billion Swiss francs (€50.7 billion, $54 billion) from the nation’s central bank. As per the management of the bank, these measures show resolute action to strengthen Credit Suisse. investors’ fears were somewhat reduced by its efforts to support Credit Suisse’s reputation.

How this Drove Credit Suisse to Borrow $54 Billion in Record Amounts?

- On February 9, the highest annual net loss was recorded since the global financial crisis in 2008whichat was over $7.9 billion.

- The business has had financial problems for the last 2-3 years. According to Credit Suisse Customers withdrew $133 billion in 2022, mostly in the fourth quarter.

- Credit Suisse stock lost almost 25% of its value since the beginning of 2023.

- Saudi National Bank, Credit Suisse’s largest shareholder, announced that it was unable to provide any further financial assistance.

- An Analysis of What Happened During the Global Banking Crisis

Despite assurances that the bank had a robust liquidity basis with a 150% cash deposit ratio, the market, which was already on edge following the bankruptcy of two mid-size US companies Silicon Valley Bank and Signature Bank last week, continued to liquidate Credit Suisse shares.

Being one of the 30 so-called globally systemically significant banks, Credit Suisse is bound by international regulations that mandate it maintains financial buffers against losses. Thus, a banking crisis could dim the commercial prospects for providers of IT services.

Tags : Global Banking Crisis

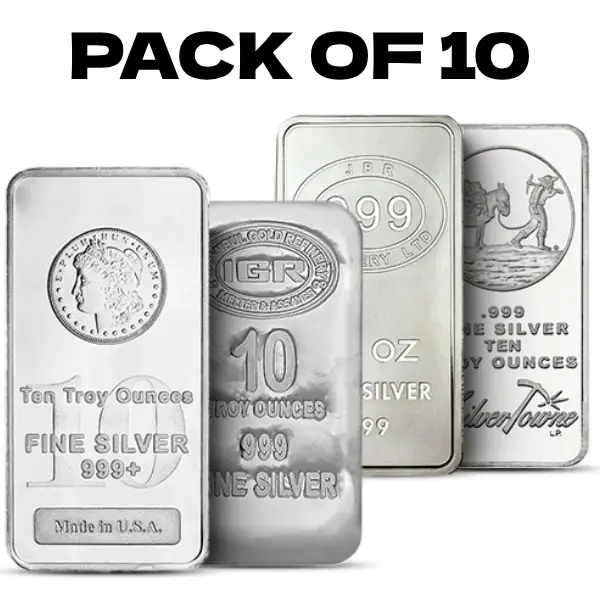

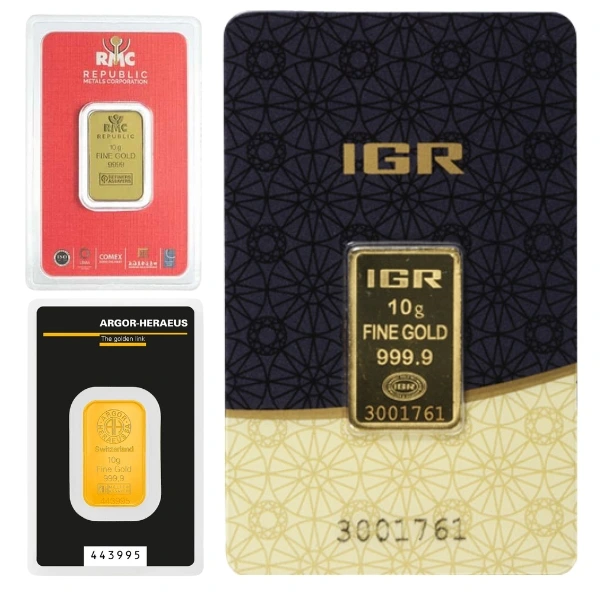

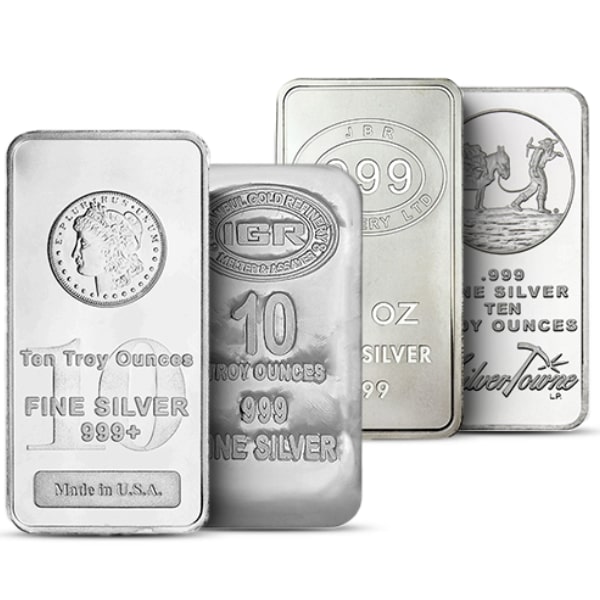

Enhance your precious metals portfolio with silver bars at low cost

Hi,

Hi,